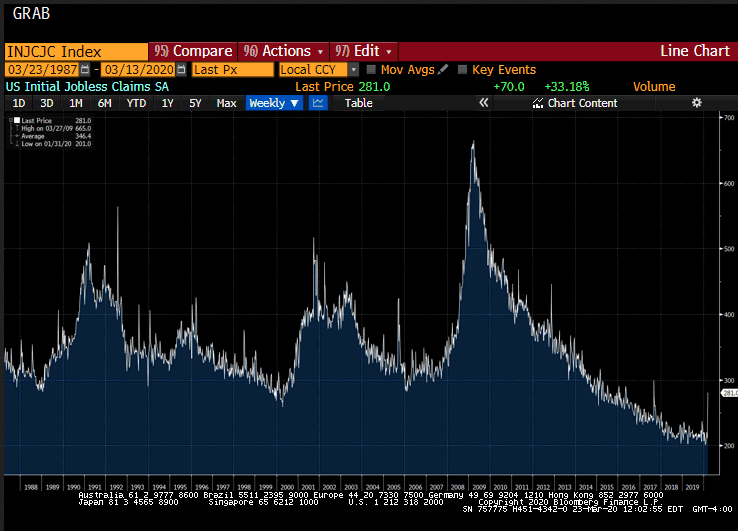

Here is the link for the replay of the conference call I hosted earlier today. I shared two ways in which this crisis is different from what we have seen in the last generation. Unlike the Great Financial Crisis, the tech bubble, and the S&L Crisis, the current crisis did not begin in the financial sector, but the real economy. Also, what follows from that is that this crisis is about liquidity, while the GFC was about counter-party risk. In the call, I covered five main topics: The economic hit like we have never experienced as significant parts of the economy are shutdown. Flash March PMIs tomorrow will give an inkling and the weekly jobless claims, which surged by a third in last week’s, are forecast to jump five-fold (~1.45 mln) in this Thursday’s report and

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, economy, Featured, Federal Reserve, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Here is the link for the replay of the conference call I hosted earlier today. I shared two ways in which this crisis is different from what we have seen in the last generation. Unlike the Great Financial Crisis, the tech bubble, and the S&L Crisis, the current crisis did not begin in the financial sector, but the real economy. Also, what follows from that is that this crisis is about liquidity, while the GFC was about counter-party risk.

In the call, I covered five main topics:

|

US Initial Jobless Claims SA, 1988-2019 |

Tags: #USD,economy,Featured,federal-reserve,newsletter