Die erste Leizins-Erhöhung seit 15 Jahren im Juni bezeichnet SNB-Direktoriumsmitglied Andréa Maechler als historischen Moment. Die Schweizerische Nationalbank (SNB) hat mit der Rückkehr der Inflation auch den Leitzins wieder in den positiven Bereich angehoben. Mit dem Übergang ins Positivzinsumfeld hat die Notenbank allerdings auch einen neuen Ansatz zur Umsetzung ihrer Geldpolitik am Geldmarkt wählen müssen, erklärten SNB-Direktoriumsmitglied Andréa Maechler...

Read More »The Dollar Comes Back Better Bid

Overview: Animal spirits are retreating today. Asia Pacific and European equities are lower, and US futures are narrowly mixed. US 2- and 10-year yields are edging higher, while European benchmark 10-year yields are mostly softer. Italy and the UK are notable exceptions. Gilt yields are firming ahead of the budget statement. The dollar is trading higher against the G10 currencies. It still appears to be in a consolidative mode, but we continue to see risk of a more...

Read More »Government firms up plans in case of gas outage

Dialling back: households would be called on to reduce the heat, if necessary. © Keystone / Martial Trezzini In case of a shortage, households and businesses which heat with piped gas would be asked to lower temperatures to 20°C, the government has said. The contingency scenario agreed by ministers is a slightly modified version of a four-stage plan announced in August, which has since gone through a consultation process involving cantonal authorities and other...

Read More »World War I: The Great War Was also the Great Enabler of Progressive Governance

Commentaries about World War I frequently discuss causes and consequences but almost never mention the enablers. At best, they might mention them approvingly, as if we were fortunate to have had the Fed and the income tax, along with the ingenuity of the liberty bond programs, to finance our glorious role in that bloodbath. Economist Benjamin Anderson, whose Economics and the Public Welfare has contributed greatly to our understanding of the period 1914–46 and is a...

Read More »The IRS Will Tax Less of an Estate in 2023

In 2012, the American Taxpayer Relief Act (ATRA) established, for the first time, a permanent estate tax and gift tax exemption. The exemption is the amount an individual can pass on at death without paying estate taxes. The legislation set the exemption at $5 million per person, indexed for inflation. Five years later, Congress decided the exemption was not large enough and passed the Tax Cuts and Jobs Act of 2017 (TCJA), which increased the lifetime exemption...

Read More »Sam Bankman-Fried FTX’ed Up

You can listen to the audio version of this article here. Last week the cryptocurrency exchange FTX, which was recently valued at $32 billion, imploded. While the tragedy continues to play out, let’s summarize what has happened so far: FTX is a cryptocurrency exchange, co-founded by Sam “SBF” Bankman-Fried. FTX enables customers to make leveraged bets (as high as 20 to 1) on cryptocurrencies. More often than not, it takes loans to make loans. FTX would make these...

Read More »Markets are Less on Edge as the Darkest Scenarios seem Less Likely

Overview: The situation in central Europe is still intense but it appears top US, European and Polish officials are more reluctant than some market participants to attribute the darkest of intentions and paint extreme narratives. The Polish zloty has recovered around 1.3% today and other central European currencies are also trading firmer to lead the emerging market currencies. The US dollar is broadly weaker against the G10 currencies. The large Asia Pacific bourses...

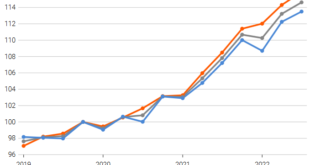

Read More »Residential property prices increased by 1.2% in 3rd quarter 2022

15.11.2022 – The Swiss residential property price index (IMPI) rose in the 3rd quarter 2022 compared with the previous quarter by 1.2% and reached 114.6 points (4th quarter 2019 = 100). Compared with the same quarter of the previous year, inflation was 6.3%. These are the results from the Federal Statistical Office (FSO). In the 3rd quarter 2022, in comparison with the previous quarter across Switzerland both the prices of sin-gle-family houses (+1.4%) and those of...

Read More »Why “Greedflation” Isn’t Real

Even as price inflation slows and we move past June’s peak, progressives continue to push the concept of “greedflation”—that this year’s price inflation is caused by corporate greed and price gouging. This is inaccurate, based on bad economics, and it blames a consequence of the problem rather than the problem itself. If we want to address the real issues in the economy and avoid similar pain in the future, we need to get serious and drop “greedflation” from the...

Read More »Barclays forecasts EURCHF trading around parity for the next few quarters

This is via the folks at eFX. For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here. Barclays Research discusses CHF outlook and targets EUR/CHF around 0.97, 0.97, 0.98, and 1.00 by end of Q1, Q2, Q3, and Q4 of next year respectively. “We expect CHF to remain at the higher end of its historical range, with EURCHF trading around parity for the next few quarters. CHF...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org