Given that the debt-ceiling debate is likely to continue for a few months, examining the Constitution provides us with the reasons our nation has been plunged into this monetary morass. Federal officials have now run up the federal government’s debt to more than $31.5 trillion. That’s a lot of money. And it’s also a lot of interest payments. Too much debt is not a good thing, either for a family or a government. Even the big-spending members of Congress...

Read More »The Elusive International Order

The liberal international order was a screen and a sham. But this does not mean that liberalism is lost. The following longform piece was an essay submitted in May 2022 to the Mont Pelerin Society for the Hayek Essay Contest on the topic of international order. Although rejected, the subject is important and of interest for our readers. An international authority which effectively limits the powers of the state over the individual will be one of the best safeguards...

Read More »Central Banks Turn to Gold as Losses Mount

In 2022, central banks will have purchased the largest amount of gold in recent history. According to the World Gold Council, central bank purchases of gold have reached a level not seen since 1967. The world’s central banks bought 673 metric tons in one month, and in the third quarter, the figure reached 400 metric tons. This is interesting because the flow from central banks since 2020 had been eminently net sales. Why are global central banks adding gold to their...

Read More »Swiss medicine sales to Russia hit 30-year high

Pharmaceutical exports in nominal terms increased by 40% since the Ukraine war began. However, export volume increased only slightly. © Keystone / Christian Beutler Swiss exports of pharmaceuticals to Russia, which are not subject to sanctions, reached a 30-year record last year, buoyed by high prices. Roche, Novartis and the other Swiss pharma companies brought in CHF2.1 billion ($2.3 billion) from the export of pharmaceuticals to Russia in 2022. In 2021 the Swiss...

Read More »Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Jeff Snider, Headmaster of Eurodollar University, joins the podcast to talk about the perverse complexities of the Eurodollar system. What even is a Eurodollar? Why was the system created? Keith and Jeff discuss the Eurodollar market and then give their hot takes in a hilarious lightning round. We hope you enjoy this insightful, whirlwind of an episode! Follow Jeff on Twitter and his website. Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner...

Read More »Why can’t the Swiss National Bank go bankrupt?

Reuters The Swiss National Bank (SNB) will make a loss of CHF132 billion in 2022, and distribution of profits to the confederation and the cantons will be suspended. What does this mean for the stability of the SNB and what would happen if it faces another large loss? The SNB still has money. However, not quite as much as at the beginning of last year. Because of last year’s loss, its equity capital has fallen from CHF198 billion to CHF66 billion. In the event of...

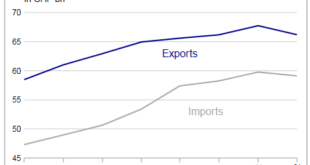

Read More »2022: Price-driven increase in foreign trade

Driven by rising prices, Swiss foreign trade increased significantly in nominal terms in 2022. Although exports rose by 7.2%, they stagnated in price-adjusted terms. Meanwhile, imports grew by 16.8% in nominal terms and edged up slightly in real terms. Trade declined in both directions in the fourth quarter. The year ended with a trade surplus of CHF 43.5 billion. In brief: ⇑ Exports: watches and jewellery set new records ⇑ Exports to Slovenia and Italy soared...

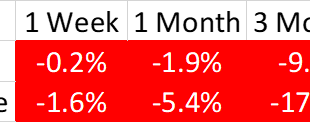

Read More »Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months. Real disposable income is up 0.8% in the last six months but was down...

Read More »Euro Pokes Above $1.09. Will it be Sustained?

Overview: The Lunar New Year holiday has shut many centers in Asia until the middle of the week, though China's mainland is on holiday all week. The signaling of a downshift in the pace of Fed tightening by some notable hawks helped lift risk appetites ahead of the weekend and saw the S&P 500 snap a four-day decline. Ahead of the weekend the NASDAQ posted its single biggest advance since last November. The downtrend line drawn of January 2022 highs in the...

Read More »China-Switzerland flights struggle to resume after three years

The return of Chinese tourists to Switzerland is not expected just yet. Keystone / Mark R. Cristino Geneva airport was expected to see the return of direct flights from China next week, but the scheduled Air China flights of January 26 and February 2 have been cancelled due to lack of passengers, reports Swiss public broadcaster RTS. China reopened its borders on January 8 after three years of tough pandemic restrictions. However, there were not enough bookings to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org