According to the Austrian Business Cycle Theory (ABCT), the artificial increase in the money supply via central bank expansionary monetary policy lowers the market interest rate. This, in turn, causes the market interest rate to deviate from the natural rate, determined by the market. Consequently, this leads to the boom-bust cycle. Understanding this, on the gold standard, where money is gold and—assuming that there is no central bank—an increase in the supply of...

Read More »Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Overview: The selection of Scott Bessent, the hedge fund manager as next US Treasury Secretary was greeted euphorically in the capital markets: one of their own and, arguably, like many of new economics team could have been picked in any Republican administration. Risk appetites have been animated. Still, we suspect market positioning may have led to an exaggerated response. The dollar has been sold. Stocks have bought. The euro is leading the G10 currencies...

Read More »Climate Anxiety: A Regime-Created “Illness”

A quick internet search for “climate anxiety,” which is also often referred to as “eco-anxiety,” “eco-grief,” or “climate doom,” produces numerous links to the psychological and psychiatric literature on the topic. The Program on Climate Change Communication within the Yale School of the Environment appears to be a major contributor to this research. Mental health professionals and mass trauma researchers report seeing more patients with symptoms of this anxiety, but...

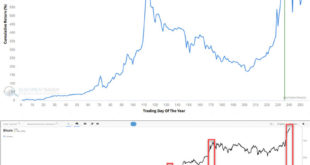

Read More »Bitcoin Is Entering Volatility Season

Since the election, Bitcoin has risen nearly 50%. While Bitcoin investors are licking their chops, believing the magnificent rally will continue, they need to realize that Bitcoin is entering a period of pronounced seasonal volatility. The graph below from Sentimentrader shows that the recent performance has tracked the typical performance for the time of year. However, as they highlight with the green line, the recent gains may fade, and volatility in Bitcoin may...

Read More »How the poorest country in Europe is integrating 120,000 Ukrainian refugees

No country has taken in as many Ukrainian refugees relative to its population as the Republic of Moldova. International organisations play an important role in supporting Ukrainians there. SWI swissinfo.ch visited a Swiss Red Cross partner project in the north of the country. This content was published on November 25, 2024 - 09:00 Vera...

Read More »Liberty Squandered: The English Tradition from Magna Carta to Empire

The identity of a people often shapes the nature and trajectory of their government. In England, a deep-rooted belief in individual liberty has profoundly influenced the nation’s legal and cultural institutions, shaping English society from the early Middle Ages through the Industrial Revolution. This identity—forged through centuries of struggle and self-definition—established a legacy of individual rights, due process, and a balanced approach to law and order. The...

Read More »Gold Is the Answer to Prohibition

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Disparate Impact Is a Legal Trick

One of the most destructive fallacies of critical race theory is its insistence that racial disparities are caused by discrimination. The CRT premise is that any gap in racial attainment calls for an explanation, and—in the absence of any convincing explanation—they are compelled to conclude that such gaps are caused by discrimination.Many readers will be familiar with Thomas Sowell’s refutation of that argument. In arguing that disparities do not prove...

Read More »Clarifying Economists’ Arguments About International Trade

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Swiss to vote on healthcare funding rule changes

The rising cost of Switzerland’s compulsory health insurance is a major political issue. The government has hatched a plan aimed at improving incentives in the hope it will reduce the seemingly never ending rise in health insurance premiums. However, a number of people sceptical of the plan’s ability to deliver the saving have organised a vote against it, which takes place this weekend. Photo by Harald Hechler on Pexels.comThe plan is focused on how various...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org