Henry Hazlitt said that to cure inflation, stop inflating, but surprisingly, most economists and politicians don’t want a cure. They believe a little inflation is not only good, but necessary. According to this view the real boogeyman is deflation—“a general decline in prices,” per Ben Bernanke—and government’s monopoly money-manager is dedicated to doing everything possible to keep prices forever rising.Not everyone cherishes having their money driven into the abyss...

Read More »Mercury found in all Tuna tested in Switzerland

Over recent weeks, mercury found in the tinned tuna sold across Europe has sparked a debate about the product. This week, RTS revealed the mercury levels of much of the tinned tuna sold in Switzerland. Photo by Towfiqu barbhuiya on Pexels.comRecent tests across Europe revealed that all of the nearly 150 brands of tuna tested contained mercury, with around 10% containing more than the legal limit of 1mg per kilogram. Tests conducted by RTS in Switzerland also...

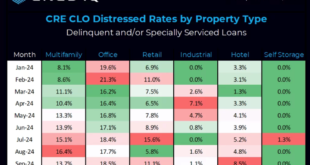

Read More »Distress in Commercial Real Estate Bonds Hits All-Time High

Commercial real estate continues to suffer despite the Federal Reserve’s attempt at ameliorating the capital markets with a 50-basis point rate cut in September.The pain is especially apparent in the so-called “CRE-CLO” bond market. CRE-CLO bonds are packaged commercial real estate mortgages comprising short-term floating rate loans. These bridge loans were recently, and most notably, used to facilitate the biggest apartment investment bubble in history, but were...

Read More »Draper on War: When Is War Just?

War and Individual Rights by Kai Draper; Oxford University Press, 2016, xii + 254 pp.Many people make fun of analytic philosophy because of its use of imaginary cases, often elaborated with what seems perverse ingenuity. It is better, critics claim, to stick close to reality. While there is much to be said for this, the analytic method is frequently insightful, as I’ll try to show. War and Individual Rights is the best analytic discussion of the just war, both the...

Read More »Erzwungene Transformation – das große Missverständnis

Erzwungene Transformation – das große Missverständnis 22. November 2024 – von Rainer Fassnacht Zur Bedeutung des Wortes Transformation ist im Duden zu lesen „das Transformieren; das Transformiertwerden“. Diese Erklärung weist aus Sicht der Sprache auf einen Doppelcharakter hin – der Mensch kann selbst aktiv gestalten oder ein Objekt für die Umgestaltungswünsche anderer Menschen sein. Genau dieser Doppelcharakter zeigt sich auch, wenn Ökonomen von...

Read More »Logs Only Roll In One Direction: Fighting Kinetic Energy

Before anyone gets their hopes up about a reduction in government expenditures resulting from the upcoming Department of Government Efficiency (DOGE), remember that, once rolling, a log rolls in one direction—downhill—until stopped. But have any of us ever tried stopping a log as it accelerates down a hill?The LogAh, the log. Speaking with the voice of a legislator, it blocked your path—your desired line-item, buried deep in a spending bill, which was on its way to...

Read More »The Fed’s Gold Standard Confusion

By Bryan Cutsinger Why did the United States abandon the gold standard? In an article published recently by the Federal Reserve Bank of St. Louis, Maria Hasenstab cites the international gold shortage during the Great Depression. “Countries around the world basically ran out of supply and were forced off the gold standard,” she writes. In passing, the article mentions the American people were not forced off by an international gold shortage,...

Read More »Avec 35 % des ventes, la vignette électronique s’est rapidement imposée en 2024

Pour l’année 2024, les acheteuses et les acheteurs avaient le choix, pour la première fois, entre la vignette autocollante conventionnelle et la vignette électronique. Un bon tiers des personnes ont opté pour la version numérique. [embedded content] Tags: Featured,newsletter

Read More »Wealth and Income Inequality Are Essential for Social Cooperation

It is popularly deemed a sign of moral superiority and a mark of the “progressive” mind to heavily criticize the existence of inequalities of wealth and income within the social order of the division of labor and private ownership in the means of production. However, the sober mind, careful of being unduly biased by errant ideological presuppositions, is often found to hold views that run contrary to the prevalent lines of reasoning advanced by these critics. This...

Read More »Switzerland launches national digital inclusion alliance

The Swiss interior ministry estimates that around a third of society, including the elderly and people with disabilities, have difficulty grasping the basic functions of digital tools. Keystone / Christian Beutler Listen to the article...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org