What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »No, Affirmative Action and Merit Are Not Compatible

Supporters of affirmative action often claim that taking race or sex into account is compatible with merit-based selection. In the wake of the United State Supreme Court ban on affirmative action in college admissions, and with diversity, equity and inclusiveness schemes banned in several states, the question now arises whether promoting racial or sexual “diversity” as a component of merit remains permissible. Proponents of this type of identity-based diversity...

Read More »Get the Government out of the Classroom

President-elect Trump has nominated former World Wrestling Entertainment CEO Linda McMahon for Secretary of Education. President-elect Trump promised that, if confirmed, Mrs. McMahon would “spearhead” the effort to “send education back to the states.” This has led some people to wonder if Linda McMahon may be the last Secretary of Education.The Constitution does not give the federal government any role in education. Instead, education is left in the hands of state...

Read More »Biden’s Last Gasp Threatens to Destroy the World

Lame duck “President” Joe Biden and his gang of neocon controllers, overcome by hatred of Donald Trump and the near certainty that, if they do not act now, the Ukraine War will soon be settled, have set in motion a process that could destroy the world in a nuclear Armageddon.As everybody knows, Donald Trump wants to terminate the Ukraine war, and he wants to accomplish this by negotiating a settlement in which Ukraine would give up some disputed territory also...

Read More »Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Overview: As some market pundits were debating about a possible grand deal between the US and China. In exchange for a lighter tariff regime, Beijing would accept yuan appreciation. As far-fetched as such scenario may be, it was predicated on ideas that people like the Bessent, the Treasury Secretary-nominee, was pragmatic. Trump's comments hit in early Asia Pacific turnover specifically cited a 25% tariff on all product from Canada and Mexico and 10% more on China...

Read More »The Economic and Social Consequences of Rent Control

Economic liberalism advocates for a clear separation between government and commerce, allowing the market to operate independently without state interference. This philosophy, termed “laissez-faire,” posits that individuals pursuing their self-interest ultimately benefit society without central organization, planning, or control. However, government intervention disrupts natural market processes.In a capitalist society, all firms should enjoy equal rights in...

Read More »The 3-3-3 Rule

Donald Trump nominated seasoned hedge fund manager Scott Bessent as the next Treasury Secretary. While the Treasury Secretary has many responsibilities, debt management is one of the most important. Therefore, given the recent scrutiny the bond market has been paying to high deficits and associated debt, Scott Bessent appears to be a timely appointment. Bessent appears to appreciate the bond market's concern, which helps explain why he immediately released his 3-3-3...

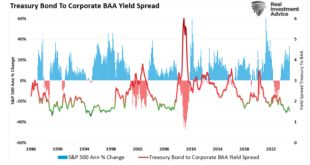

Read More »Credit Spreads: The Markets Early Warning Indicators

Credit spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often involves Treasury bonds (considered risk-free) and corporate bonds (which carry default risk). By observing these spreads, investors can gauge risk appetite in financial markets. Such helps investors identify stress...

Read More »Our History of Protectionist Tariff Train Wrecks

Protectionist tariffs are associated with a long history of economic and social calamities in America. An important reason for this is that protectionist tariffs are a political tool of plunder and theft, and people don’t generally take kindly to being plundered and robbed. The only real difference between a lobbyist for protectionist tariffs and an armed robber is that the robber is armed. If the robber says “Give me a thousand dollars or I will shoot you” it is...

Read More »Bitcoin knapp unter 100’000-Dollar-Marke: Das waren die wichtigsten Meilensteine der Krypto-Erfolgsgeschichte

• "Satoshis Whitepaper" in 2008 veröffentlicht <br> • Bitcoinkurs von starker Volatilität gekennzeichnet <br> • Ein Schmuddelkind wird salonfähig<br> <!-- sh_cad_1 --> Obwohl es schon davor Versuche einer digitalen und dezentralisierten Währungen gab, gilt der <a href="/devisen/bitcoin-dollar-kurs" target="_blank"... [embedded content]...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org