Medical vs. Financial Engineering I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later. What would have happened if I had suffered the same accident in 1975? The surgery would probably be in-patient, requiring a couple of days in the hospital. The broken fragments would take weeks to heal, in a cast. Rehab would take many months while I may never regain the previous range of motion or strength again. Medical engineering has advanced so much in the last forty years. Before I stray too far, why 1975? That was the year in which I entered the real estate market. In comparison, real estate involves just simple transactions, nowhere near the complexity of cutting up a body, drilling holes and screwing some plate into human bones. In forty years, the real estate market should have advanced to the point where a transaction is no more cumbersome than ordering some merchandise on Amazon, prepackaged with financing, right? Wrong.

Topics:

Ramsey Su considers the following as important: Case-Shiller, Case-Shiller composite home price index, Debt and the Fallacies of Paper Money, Fannie Mae, Featured, Heli Mortgage, Jack Lew, Janet Yellen, Mel Watt, Metropolitan Statistical Area, newsletter, Real estate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Medical vs. Financial EngineeringI broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later. What would have happened if I had suffered the same accident in 1975? The surgery would probably be in-patient, requiring a couple of days in the hospital. The broken fragments would take weeks to heal, in a cast. Rehab would take many months while I may never regain the previous range of motion or strength again. Medical engineering has advanced so much in the last forty years. Before I stray too far, why 1975? That was the year in which I entered the real estate market. In comparison, real estate involves just simple transactions, nowhere near the complexity of cutting up a body, drilling holes and screwing some plate into human bones. In forty years, the real estate market should have advanced to the point where a transaction is no more cumbersome than ordering some merchandise on Amazon, prepackaged with financing, right? Wrong. Not only has financing engineering not advanced like medical engineering, it has deteriorated into one of the most destructive forces in the modern world. Pertaining to real estate, it was failed financing engineering that brought us the Savings and Loans debacle. It brought us Greenspan bubble part one, which paused on September 11, 2001, then went ballistic with Greenspan’s sub-prime bubble. It created derivatives and derivatives derived from derivatives. |

This isn’t Ramsey’s elbow specifically, but a random post surgery elbow collection from the inter-webs, to illustrate how it’s done. The contraption in the lower right-hand corner is generally used to hold an elbow together after a complicated fracture. As you can see from the x-rays, this is then complemented with additional thingamabobs as required. Image source: eortopedi.com |

The Helicopter MortgageWhere has financial engineering led us to today? Over a recent weekend, Mel Watt (FHFA), Jack Lew (Treasury) and Janet Yellen (Federal Reserve) held a summit meeting and came up with a plan that will forever eliminate the possibility of another housing crisis. The plan is the Helicopter Mortgage. Here is how it works:

Of course I am joking but I am not the comedian. The comedians are the central bankers and they are dead serious. Central bankers are financing sovereign debt at negative interest rates. In other words, one arm of the government spends, and the spending is financed by another arm of the government, which pays interests to the spending arm. Just like the Helicopter Mortgage, though this has not been specified, we know these government securities holdings will be extended indefinitely with no maturity and bear no cost. |

|

We are not far from the Helicopter Mortgage. Take a look at this recent Fannie Mae guideline. A 3% down payment is now the norm, not just for FHA loans. The Federal Reserve will continue its efforts to drive mortgage rates to zero, or lower. Should yields on treasuries go below zero, agency MBS at zero will be relatively attractive.

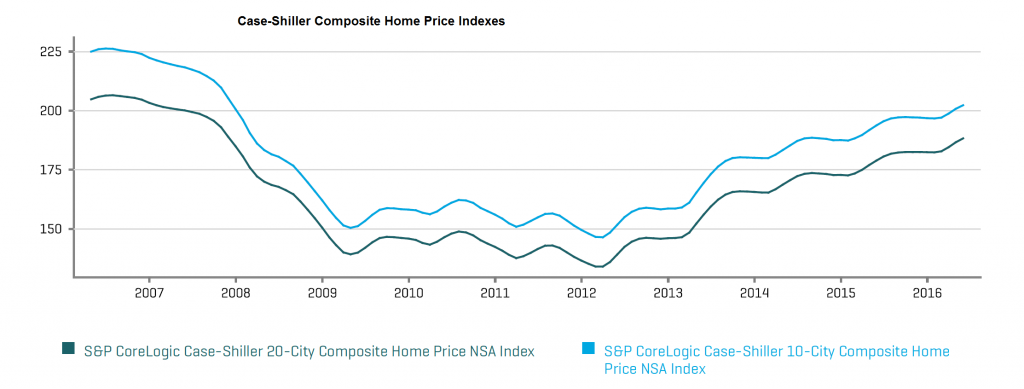

Case-Shiller composite home price indexesOne would think that the real estate market must be in dire conditions for policy makers to be so accommodating. As a matter of fact, many Metropolitan Statistical Areas (MSA) are already back to or above the peak price levels of the sub-prime era. Defaults and foreclosures are back to pre-subprime era lows. Case-Shiller has been reporting price appreciation at 2 to 3 times the inflation rate for several years. Is this a real estate market that needs help? |

Case-Shiller composite home price indexes – while the overall market still remains below the peak levels of the sub-prime bubble era, the former price peaks have been eclipsed in a number of metropolitan areas (such as in San Francisco and Washington, to name two of the most egregious examples) – click to enlarge. |

| Since the real estate market has been placed in the capable hands of the Treasury as conservator of the agencies, CFPB as the watch dog, FHFA setting underwriting standards and the Federal Reserve as the supreme guardian, it will no longer fail – they won’t allow it.

Many, including myself, opine that we are in another housing bubble. Regardless, all it will take is a minor setback in real estate for the aforementioned government entities to launch the Helicopter Mortgage. Then what? |

|

ConclusionIn closing, let me return to the subject of engineering advances in the past few decades. Of all the government agencies, it appears that NASA is the only one with real accomplishments. After sending a man to the moon, it regularly put astronauts in space for months at a time. It sent up the Hubble telescope to peek into the universe, a rover to Mars and one of its probes is now reaching Jupiter after a five year journey. Here is my thought: why not replace all the economists at the Federal Reserve with NASA engineers? Let them put some science into policies. If they come up with the Helicopter Mortgage, it might be dropped from helicopters that can actually fly. We have to disagree with Ramsey on the final point, even though it is made tongue-in-cheek: it actually won’t matter. The NASA helicopters might fly, but it will still be impossible to centrally plan the economy, or even just aspects of it (to be precise: it will be impossible for such a plan to deliver an outcome superior to a free market outcome and it will produce even greater impoverishment in the long run). This does not depend on the quality of the engineers – it is a result of the fact that economic calculation is nigh impossible for bureaucracies (in fact, central banking is a special case of the socialist calculation problem pertaining to the area of finance). |

Chart by: Core-Logic / S&P

Chart and image captions by PT