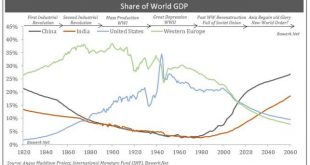

Share of World GDP A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future. As an experiment, assume, as most long term forecasters do,...

Read More »Cool Video: Chat with the FT’s John Authers

I was just as surprised as anyone by the election outcome. The initial market reaction was not as surprising, but the dramatic reversal was. About a dozen hours after the election was called, John Authers from the Financial Times came to my office and we chatted. Check out the cool video here.

Read More »FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

Comment on GBP and CHF by Matt Vassallo My articles About meMy booksFollow on: Swiss Franc EUR/CHF - Euro Swiss Franc, November 10(see more posts on EUR/CHF, ). - Click to enlarge GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald...

Read More »Federal Department of Finance and SNB enter new distribution agreement

The Federal Department of Finance (FDF) and the Swiss National Bank (SNB) have signed a new agreement regarding the SNB’s profit distribution for 2016 to 2020. Subject to a positive distribution reserve, the SNB will in future pay CHF 1 billion p.a. to the Confederation and cantons, as was previously the case. In future, however, omitted distributions will be compensated for in subsequent years if the distribution...

Read More »Gold Price Skyrockets in India after Currency Ban

India’s Government Makes Banknotes Worthless by Decree Overnight As I write this in the morning of 9th November 2016, there are huge lines forming outside gold shops in India — and gold traded heavily until late into the night yesterday. Depending on who you ask, the retail price of gold has gone up between 15% and 20% within the last 10 hours. At some places, it was sold for as much as US$ 2,294 per ounce. That is,...

Read More »China Update

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The evolving political situation in China is worth monitoring. China’s trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so. There have...

Read More »Who Lost: A Biased Media, Pundits, Pollsters, Political Parties, Warmongers, the Corporatocracy, Pay-to-Play Grifters, Neoliberals

Fake Progressives are perfectly fine with soaring inequality and corrupt governance, as long as everyone’s public utterances are politically correct. Sometimes who lost is more important than who won. Let’s review who lost the election: 1. Let’s start with the Corporatocracy, which expected to once again wield unlimited influence by funding political campaigns with millions of dollars in contributions and speaking...

Read More »Gold Surges Post-Trump, Nears Heaviest Volume Day Ever

Gold futures had their heaviest day of trading during April 2013 when a mysterious flash crash sent the precious metal collapsing with no clear fundamental/news catalyst. In June, Brexit sparked massive volume buying in the barbarous relic, but overnight, as a Trump victory became more and more of a reality, gold futures are approaching their busiest day ever. As Bloomberg notes, that’s triple the full-day average this...

Read More »FX Daily, November 09: Mourning in America?

Comment on GBP and CHF by Joshua Privett My articles My booksFollow on:LinkedIN Swiss Franc In the Swiss Television, Swiss National Bank’s Andrea Maechler promised interventions for the case that Trump wins the elections. It was probably not necessary. The EUR/CHF fell to 1.0753, but interventions were rather limited to our view. For the second after Brexit, many market participants are...

Read More »Swiss government opposes initiative to transform monetary system

The Swiss government urged rejection of a popular initiative that would transform the monetary system and end fractional-reserve banking, according to its dispatch to Parliament. The measure seeks to put the central bank solely in charge of money supply and forbid commercial banks from granting loans that aren’t fully backed by deposits, effectively ending the way banking has been conducted for centuries. It’s a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org