Comment on GBP and CHF by Dayle Littlejohn My articles My siteAbout meMy booksFollow on: Swiss Franc EUR/CHF - Euro Swiss Franc, October 28(see more posts on EUR/CHF, ). - Click to enlarge Since the UK public decided to vote out of the European Union GBP/CHF exchange rates have dropped 22 cents. To put this into monetary value a 200,000 Swiss Franc purchase now costs an extra £26,000 and I believe buying the Franc is going to get more expensive next week. The Bank of England are set to release their latest interest rate next Thursday. Many economists are predicting further cuts potentially to 0%. When a central bank cuts interest rates it entices investors to move their assets out of that currency and into another currency that provides a higher yield. Personally I believe there is a 50-50 chance the 9 members of the monetary policy committee will vote in favour to cut rates. Either way I still expect sterling weakness as Governor Mark Carney will address the public after the decision and of late he has taken a dovish tone which has devalued the pound. GBP/CHF - British Pound Swiss Franc, October 28(see more posts on GBP/CHF, ) - Click to enlarge FX Rates The main development here in the last full week of October is the sharp rise in bond yields.

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Eurozone Consumer Confidence, Featured, France Gross Domestic Product, FX Daily, FX Trends, GBP, Germany Consumer Price Index, Japan Unemployment Rate, JPY, newslettersent, SEK, Spain Consumer Price Index, U.S. Gross Domestic Product, U.S. Gross Domestic Product QoQ, U.S. Michigan Consumer Sentiment, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, October 28(see more posts on EUR/CHF, ) |

|

Since the UK public decided to vote out of the European Union GBP/CHF exchange rates have dropped 22 cents. To put this into monetary value a 200,000 Swiss Franc purchase now costs an extra £26,000 and I believe buying the Franc is going to get more expensive next week. The Bank of England are set to release their latest interest rate next Thursday. Many economists are predicting further cuts potentially to 0%. When a central bank cuts interest rates it entices investors to move their assets out of that currency and into another currency that provides a higher yield. Personally I believe there is a 50-50 chance the 9 members of the monetary policy committee will vote in favour to cut rates. Either way I still expect sterling weakness as Governor Mark Carney will address the public after the decision and of late he has taken a dovish tone which has devalued the pound. |

GBP/CHF - British Pound Swiss Franc, October 28(see more posts on GBP/CHF, ) |

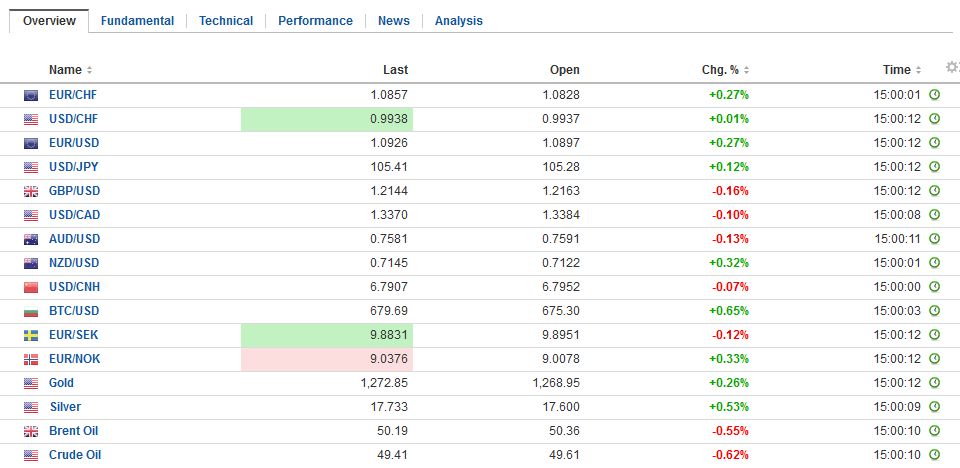

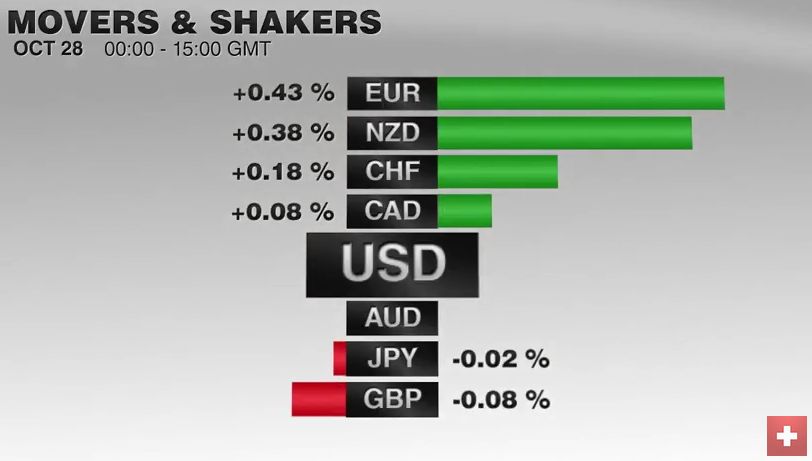

FX RatesThe main development here in the last full week of October is the sharp rise in bond yields. US 10-year yields rose nine bp this week coming into today’s session, which features the first look at Q3 GDP. The two-year yield is up four bp. European 10-year benchmark yields mostly rose 11-17 bp. UK Gilts were are the upper end of that range. Two-year yields are 3-5 bp higher. The odds of a Fed hike in December has risen this week and depending on precise assumptions about where Fed funds will trade, have risen around five percentage points to be a little over 70%. This does not seem to adequately explain the rising long end yields. We anticipate that a Fed hike would flatten the curve as has often been the case in monetary tightening cycles, and was dubbed the Greenspan conundrum in the last cycle in the early noughts. |

FX Performance, October 28 Source: Dukascopy.com - Click to enlarge |

| Equity markets were fairly resilient to the backing up of interest rates though most major equity markets moved lower over the course of the week. Losses were minor. The UK appears to be the worst of major markets, with the FTSE 250 off a little less than 2% before today’s loss brings it closer to 2.8%. Enjoying a weaker yen, the Nikkei gained 1.5% for the week, with a third coming today. Despite today’s 0.75%-0.85% loss today, the Italy and Spain are eking out minor equity gains.

The US dollar is mostly softer today, but on the week it has edged up against most of the major currencies. The euro is the main exception. A little over $1.0900, the single currency is about 0.25% for the week. The yen is the weakest of the majors, off 1.4% this week. After moving above JPY105 yesterday, the dollar remained above it in Asia and Europe today. The Swedish krona has stabilized after yesterday’s (exaggerated ?) shellacking. Its 0.5% gain today, leave it off by 1.3% for the week. |

FX Daily Rates, October 28 (GMT 15:00) |

| Another feature of this week’s activity has been the rise of commodity prices. Iron ore prices rose for the seventh day, the longest streak since 2013. The 10% gain this week is being attributed to Chinese demand amid an increase in steel output (despite the declaratory policy to cut capacity and output). Aluminum prices have also rallied strongly this week, for example, to five-year highs. Oil prices are an important exception. They are off 2.5%. |

FX Performance, October 28 |

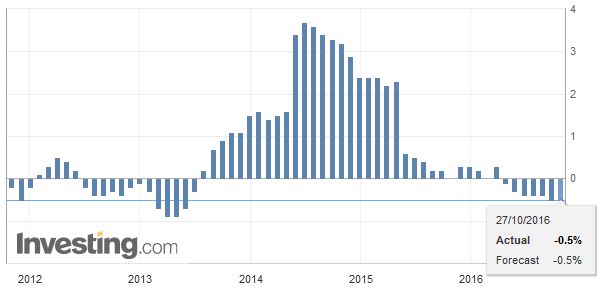

JapanThere has been a flurry of economic data released today beginning in Japan. Headline and core (excluding fresh food) CPI fell 0.5% as expected, while the measure excluding food and energy slipped to 0 from 0.2%. It had been expected to hold up better. |

Japan National CPI, September . Source: Investing.com - Click to enlarge |

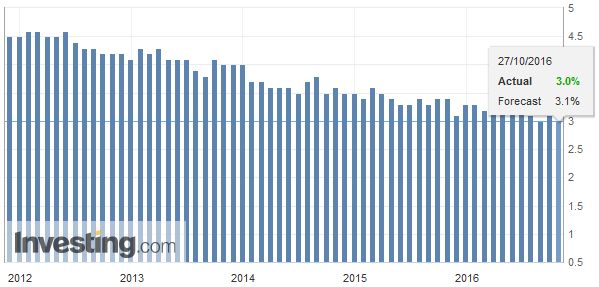

| The unemployment rate slipped back to 3.0% from 3.1%. Household spending fell 2.1% (year-over-year) improving from a 4.6% decline in August. Although poor, the report was better than the Bloomberg median of a 2.7% decline. |

Japan Unemployment Rate, September 2016(see more posts on Japan Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

EurozoneIn terms of prices, a talking point today is news that Apple raised the price of some of its computers by 20%. Sterling has fallen 18.3% against the dollar since the referendum. The decline in the pound, which does not look over, will boost imported inflation and, given the UK’s trade deficit in goods, will filter into higher CPI and lower real earnings. Better than expected data this week, including Q3 GDP, failed to give sterling any traction. At $1.2150, it is off 0.7% this week. |

Eurozone Consumer Confidence, October(see more posts on Eurozone Consumer Confidence, ) . Source: Investing.com - Click to enlarge |

Spain

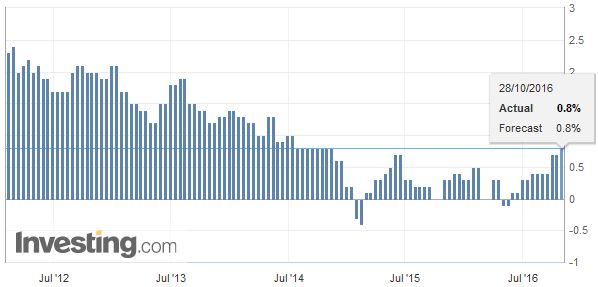

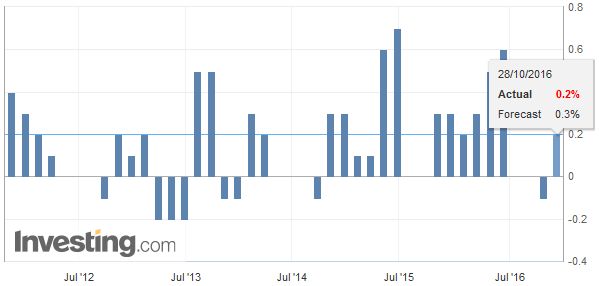

France and Spain reported Q3 GDP figures. France expanded by 0.2%, after contracting 0.1% in Q2. This was still a bit disappointing, and the details show that the swing in inventories accounts for the growth. |

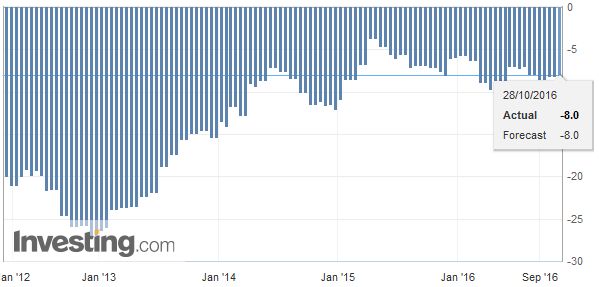

GDP Spain Q3/2016 . Source: Investing.com - Click to enlarge |

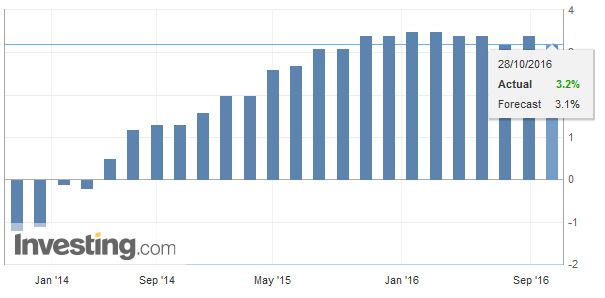

| On the other hand, net exports were a 0.5% drag. Spanish GDP rose 0.7%, in line with expectations and a tad softer than the 0.8% pace seen in Q2. The year-over-year rate was steady at 3.2%. The pace of French growth is about 2/3 less at 1.1%. |

CPI Spain October (Flash Estimate)(see more posts on Spain Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

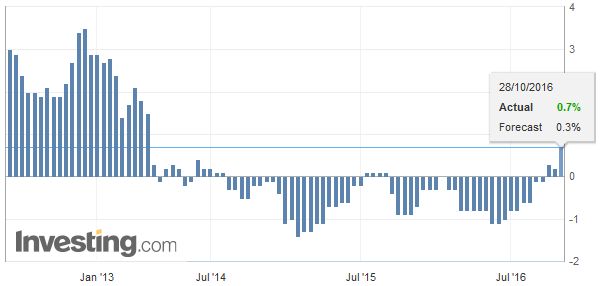

GermanyGermany, France, and Spain reported October CPI figures. We are waiting for the national figure that will be out shortly, but German states all reported an increased in the year-over-year pace. The national rate is expected to rise to 0.7% from 0.5%. Spain also reported firm CPI figures. The 0.5% year – the over-year pace was more than expected (~0.3%) after the flat reading in September. Although still low, Spanish inflation stands at a three-year high. Recall as recently as August; Spain was still in deflation (year-over-year decline in CPI). |

CPI Germany October (Flash Estimate)(see more posts on Germany Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

FranceFrench CPI was unchanged at 0.5%. It was a little disappointing as the median expected a tick up. The aggregate figure for EMU will be published Monday. The rise in energy prices will lift the headline, but the underlying rate will still not be satisfying. Many suspect the core rate needs to get closer to 1.25% (from 0.8%) to make the ECB’s leadership more confident. |

GDP France Q3/2016(see more posts on France Gross Domestic Product, ) . Source: Investing.com - Click to enlarge |

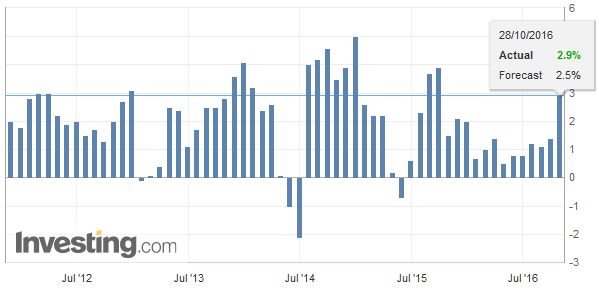

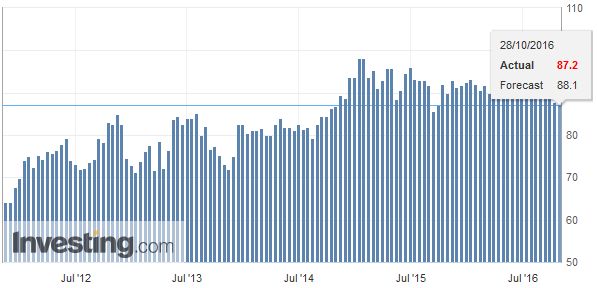

United StatesThe US reports Q3 GDP. That is the highlight before the weekend. Although the Atlanta and NY GDP trackers are for closer to 2.0% growth, the market appears to be looking for something closer to 2.5% (Bloomberg median 2.6%). |

U.S. Gross Domestic Product (GDP) QoQ annualized, Q3/2016(see more posts on U.S. Gross Domestic Product QoQ, ) . Source: Investing.com - Click to enlarge |

| There is some headline risk, but barring a significant surprise, look for the effect to fade. How the economy did in the July-September period has little if any impact on what the Fed decides in December (next week’s FOMC meeting will likely produce a statement very much like September). |

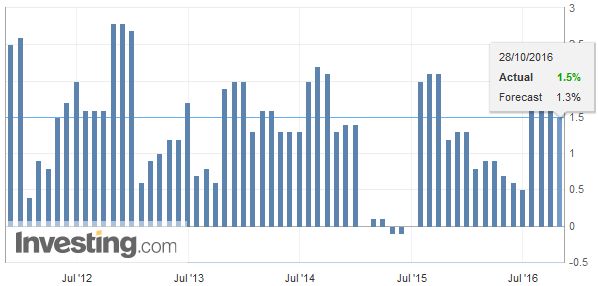

GDP Price Index US Q3/2016, QoQ annualized, Q3/2016(see more posts on U.S. Gross Domestic Product, ) . Source: Investing.com - Click to enlarge |

| One of the most important developments this year has been the Federal Reserve’s recognition that trend growth has slowed in the US. It now estimates it at 1.8%. This means that despite what seems like slow growth relative to pre-crisis, trend growth is consistent with the gradual removal of accommodation. |

Michigan Consumer Confidence October(see more posts on U.S. Michigan Consumer Sentiment, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.