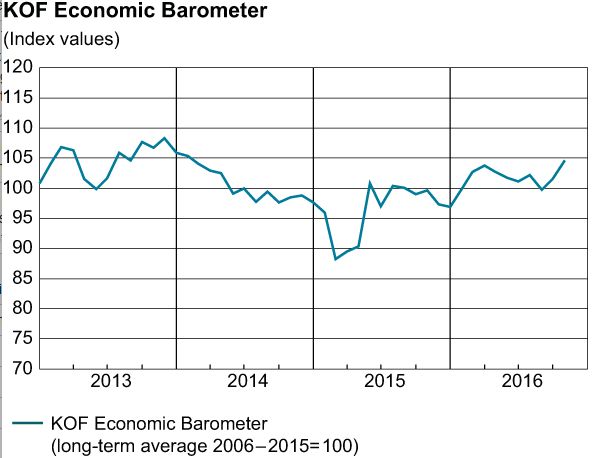

KOF Economic Barometer rose by 3.1 points (from revised 101.6 in September) to 104.7. It thus recovered from its recent summer trough of below the 100 points and stands as high as for the last time in January 2014. Accordingly, the outlook for the Swiss suggests above potential short-term growth rates. In October 2016, the KOF Economic Barometer, with a new reading of 104.7, pointed visibly above its long-term average. The strongest impulses contributing positively to the dynamics of the Barometer came from hospitality services and manufacturing. The only negative impacts came from the financial sector. Within the manufacturing sector, the improved outlook is manifesting itself primarily in the electrical and machine building industries. Wood-processing and timber were the negative outliers. The improved sentiment in manufacturing as a whole is primarily driven by a favourable assessment of the overall business climate and the improved competitiveness of manufacturing. Hence, the January 2015 appreciation shock appears to have been digested by many firms by now.

Topics:

KOF Economic Barometer considers the following as important: Featured, newslettersent, Swiss Macro, Switzerland KOF Economic Barometer

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| KOF Economic Barometer rose by 3.1 points (from revised 101.6 in September) to 104.7. It thus recovered from its recent summer trough of below the 100 points and stands as high as for the last time in January 2014. Accordingly, the outlook for the Swiss suggests above potential short-term growth rates.

In October 2016, the KOF Economic Barometer, with a new reading of 104.7, pointed visibly above its long-term average. The strongest impulses contributing positively to the dynamics of the Barometer came from hospitality services and manufacturing. The only negative impacts came from the financial sector. Within the manufacturing sector, the improved outlook is manifesting itself primarily in the electrical and machine building industries. Wood-processing and timber were the negative outliers. The improved sentiment in manufacturing as a whole is primarily driven by a favourable assessment of the overall business climate and the improved competitiveness of manufacturing. Hence, the January 2015 appreciation shock appears to have been digested by many firms by now. |

KOF Economic Barometer October 2016(see more posts on Switzerland KOF Economic Barometer, ) |

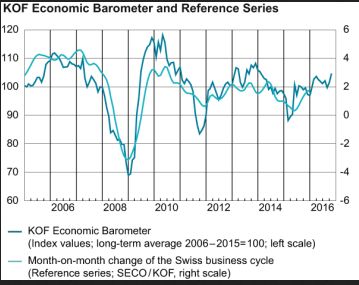

KOF Economic Barometer and reference time series: annual updateIn September 2016, the scheduled annual update of the KOF Economic Barometer took place. The annual update of the Barometer concerns the following stages: redefinition of the pool of indicators that enter the selection procedure, update of the reference time series, a new execution of the variable selection procedure and a procedure to estimate missing monthly values of quarterly variables. The updated reference series is the smoothed continuous growth rate of Swiss GDP according to the new System of National Accounts ESVG 2010, released at the end of August 2015, which takes into account the release of the previous year’s annual Gross Domestic Product (GDP) data by the Swiss Federal Statistical Office. As a result of the indicator variable selection procedure, the updated KOF Economic Barometer is now based on 272 indicators (instead of 238 as in the previous vintage) from a pool of more than 400 potential indicator series. They are combined using statistically determined weights. |

KOF Economic Barometer and Reference Series October 2016(see more posts on Switzerland KOF Economic Barometer, ) |