Last week, work started on a project to construct 1,000 apartments in Geneva. The project known as the Quartier de l’Etang will unfold over an 11 hectare site in Vernier, not far from Geneva airport. The video above shows the commencement ceremony and a computer animation of the completed project. The man behind it, Claude Berda, is a French-Swiss billionaire who started out selling jeans in the corridors of Dauphine...

Read More »Why the World’s Central Banks hold Gold – In their Own Words

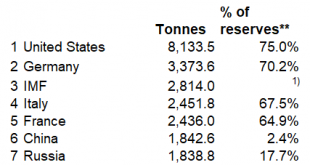

Collectively, the central bank sector claims to hold the world’s largest above ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range. This worldwide central bank group, also known as the official sector, spans central banks (such as the Deutsche...

Read More »Solutions Only Arise Outside the Status Quo

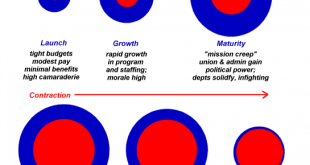

Solutions are only possible outside these ossified, self-serving centralized hierarchies. Correspondent Dan F. asked me to reprint some posts on solutions to the systemic problems I’ve outlined for years, most recently in How Much Longer Can We Get Away With It? and Checking In on the Four Intersecting Cycles. I appreciate the request, because it’s all too easy to dwell on what’s broken rather than on the difficult task...

Read More »US Stock Market – The Flight to Fantasy

Divergences Continue to Send Warning Signals The chart formation built in the course of the early February sell-off and subsequent rebound continues to look ominous, so we are closely watching the proceedings. There are now numerous new divergences in place that clearly represent a major warning signal for the stock market. For example, here is a chart comparing the SPX to the NDX (Nasdaq 100 Index) and the broad-based...

Read More »„Vollgeld“ ist rotester Kommunismus – lanciert vom Ausland

„Schuldfrei“ – so soll unser Geld zukünftig in Umlauf kommen. Das Wort „schuldfrei“ ist positiv besetzt. Wer möchte nicht schuldfrei sein? Jedermann. „Schuldfrei“ ist das zentrale Wort im Initiativtext der kommenden Vollgeld-Initiative, über die das Schweizervolk am 10. Juni 2018 abstimmen wird. Die Initiative kommt daher wie der Wolf im Schafspelz. Absatz 3 des Initiativtextes besagt: „Sie (die SNB) bringt im Rahmen...

Read More »Switzerland’s parliament rejects plan to cut health insurance discounts

Switzerland has a system of compulsory health insurance. Residents must choose an insurer and pay. Those who don’t are automatically signed up and sent a bill. © Auremar | Dreamstime.com - Click to enlarge Other than shopping around, choosing a policy with an excess, a sum that must be covered out of your own pocket before the insurance kicks in, is one of the few ways to reduce your premium. Like much insurance in...

Read More »Swiss accounts blocked over suspected Nigerian oil bribery case

The Shell Eni corporate bribery trial is billed as the biggest in history. (Keystone) - Click to enlarge The Office of the Attorney General of Switzerland (OAG) has blocked various bank accounts in Switzerland regarding an alleged oil bribery scheme linked to Nigeria. Executives from oil giants Shell and Eni are due to stand trial in Milan, Italy, in May. At the request of the Milan public prosecutor, the...

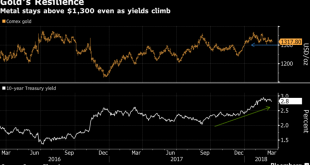

Read More »Four Charts: Debt, Defaults and Bankruptcies To See Higher Gold

– $8.8B Sprott Inc. sees higher gold on massive consumer debt, defaults & bankruptcies – Rising and record U.S. debt load may cause financial stress, weaken dollar and see gold go higher– Massive government and consumer debt eroding benefits of wage growth (see chart) by Bloomberg Rising U.S. interest rates, usually bad news for gold, are instead feeding signs of financial stress among debt-laden consumers and...

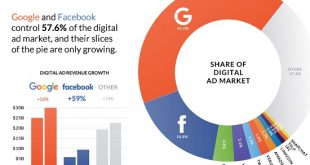

Read More »Is Profit-Maximizing Data-Mining Undermining Democracy?

If targeting political extremes generates the most profit, then that’s what these corporations will pursue. As many of you know, oftwominds.com was falsely labeled propaganda by the propaganda operation known as ProporNot back in 2016. The Washington Post saw fit to promote ProporNot’s propaganda operation because it aligned with the newspaper’s view that any site that wasn’t pro-status quo was propaganda; the...

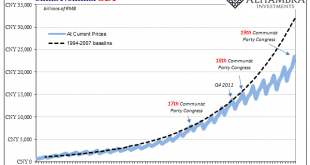

Read More »The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org