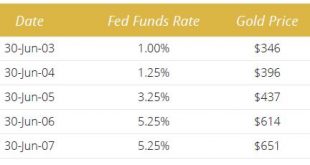

– Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday – Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range – Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018 – Markets disappointed at lack of hawkish comments from new Fed Chair – Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products...

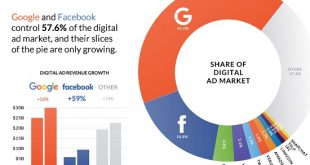

Read More »Should Facebook and Google Pay Users When They Sell Data Collected from Users?

Let’s imagine a model in which the marketers of data distribute some of their immense profits to the users who created and thus “own” the data being sold for a premium. It’s not exactly news that Facebook, Google and other “free” services reap billions of dollars in profits by selling data mined/collected from their millions of users. As we know, If you’re not paying for it, you’re not the customer; you’re the product...

Read More »Europe chart of the week – monetary policy

Much of recent ECB dovish rhetoric has been building around the (not-sonew) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good...

Read More »Cool Video: Let’s Not Declare Trade War Yet

- Click to enlarge Trade tensions have risen. No doubt about it, but to consider this a trade war is premature. We should not pretend that this is the first time that the US adopted protectionist measures that ensnarled are military allies. We have been to this dance before. Countries will respond with some symbolic retaliation on a small number of goods that make a little more than a rounding error in bilateral...

Read More »US trade disputes indirectly threaten Swiss economy

US metal industry trade disputes could disrupt the Swiss economy indirectly (Keystone) - Click to enlarge Ongoing global trade disputes involving the United States are casting a potential shadow over Swiss economic growth, along with other international events, such as the Italian elections and Brexit. However, the Swiss economy is forecast to expand 2.4% this year and 2% in 2019. The Swiss State Secretariat...

Read More »Raising Switzerland’s retirement age – like death and taxes

Last week, State Councillor Peter Hegglin (PDC/CVP) withdrew his motion demanding Switzerland’s retirement age automatically rise with life expectancy. Retirement-Switzerland_©-Famveldman Dreamstime.com_ - Click to enlarge He argues that Switzerland urgently needs to find a way to ensure the financial health of its pension system and raising the retirement age is the main way to do this. Across most of the OECD...

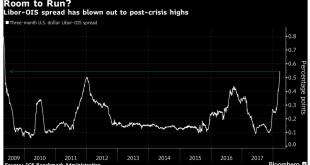

Read More »Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

Key Metric LIBOR OIS Signals Major Credit Concerns – Widening of the spread between LIBOR OIS (overnight index swap) rate raises concerns – Spread jumped to 9 year widest spread, rising to 54.6bps, most since May 2009. – Libor recently moved to over 2% for first time since 2008 – Wider spread usually associated with heightened credit concerns Editor: Mark O’Byrne Major credit concerns are back as one of the key U.S....

Read More »Incrementum’s New Cryptocurrency Research Report

Another Highly Useful Report As we noted on occasion of the release of the first Incrementum Crypto Research Report, the report would become a regular feature. Our friends at Incrementum have just recently released the second edition, which you can download further below (if you missed the first report, see Cryptonite 2; scroll to the end of the article for the download link). BTC Hourly, 16 - 23 March 2018(see more...

Read More »Swiss central bank records huge profits after franc slide

The Swiss central bank confirmed a record CHF54 billion overall profit in 2017 (Keystone) - Click to enlarge The Swiss National Bank (SNB) was less active on the foreign exchange markets last year, acquiring CHF48.2 billion ($50.8 billion) in foreign currency to weaken the franc. On Thursday, the central bank nonetheless confirmed massive profits on currency holdings in 2017. In 2017, the SNB purchased...

Read More »FX Daily, March 22: Dollar Trades Off

Swiss Franc The Euro has fallen by 0.37% to 1.167 CHF. EUR/CHF and USD/CHF, March 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has not recovered from the judgment that yesterday’s that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org