Sygnum’s Swiss HQ is situated in the heart of Zurich’s banking district. Some of the doyens of the Swiss financial industry, including former Swiss National Bank president Philipp Hildebrand and ex-UBS CEO Peter Wuffli, have joined the cryptoasset revolution with new financial services operator Sygnum. The Swiss-Singapore enterprise announced itself suddenly on Thursday after operating in stealth mode for months. It is...

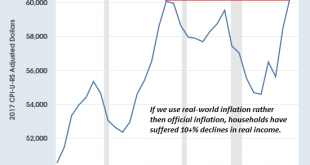

Read More »Why Are so Few Americans Able to Get Ahead?

Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Despite the rah-rah about the “ownership society” and the best economy ever, the sobering reality is very few Americans are able to get ahead, i.e. build real financial security via meaningful, secure assets which can be passed on to their children. As I’ve often discussed here,...

Read More »Sterling hits highest buying level against Swiss Franc since August

The Pound has made good gains against the Swiss Franc over the course of November so far, hitting the highest level we have seen since August and smashing through the 1.30 level. Sterling strength: Rumours of Brexit deal agreement lead to Sterling boost The main reasons behind the rise in value of Sterling is due to positive vibes surrounding Brexit. It appears that a Brexit deal for the UK is edging closer, but anyone...

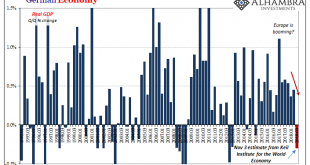

Read More »Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death. While...

Read More »Gold ETFs See Strong Demand In Volatile October After Robust Global Gold Demand In Q3

Gold ETFs saw inflows in volatile October as investors again hedged risk Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of US$1B in inflows Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy Strong central bank and store of value coin and bar demand offset the gold ETF outflows in Q3 Central bank gold reserves grew 148.4t in Q3, up 22% yoy Gold coin and...

Read More »New Swiss broadcasting fee starts next year

© Scyther5 | Dreamstime.com After a referendum in March 2018 threatened to axe Switzerland’s costly broadcasting fee, the government put forward a counter proposal, which was adopted when 71.6% of voters voted to keep the fee. On 1 January 2019, the lower fee contained in the government’s plan will come into force. Next year, instead of CHF 451, each household will need to cough up CHF 365. Virtually every household...

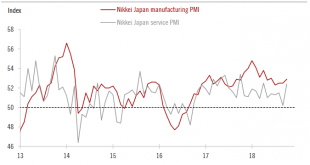

Read More »Japan services PMI rebounds strongly in October

SUMMARY Japan’s services PMI surged by 2.2 points to 52.4 in October after a notable drop in September. The manufacturing PMI rose modestly to 52.9 in October from 52.4 in September. The strength in services PMI may suggest momentum in Japan’s domestic economy remains solid. Consumption recovery and expansion of corporate capex are driving growth. However, headwinds are building on the external fronts. Elevated trade...

Read More »Swiss franc still highly valued, but no policy change

Jordan has been chairman of the SNB since 2012. The Swiss franc, investment in arms, and the housing market were some of the issues the government discussed with the chairman of the Swiss National Bank. SNB chairman Thomas Jordan told the government that he sees the Swiss currency as highly valued and warned of the continuing risks of bubbles in the housing market. “Jordan emphasised that monetary policy with negative...

Read More »FX Daily, November 07: Equities and Bonds Jump While the Dollar Slumps

Swiss Franc The Euro has risen by 0.03% at 1.1455 EUR/CHF and USD/CHF, November 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has fallen against nearly every currency. It had been moving lower at the start of the week, but what seems like a correction broadened and deepened following the US midterm election. The outcome was largely in line with...

Read More »‘Lighthouse’ Planned for Swiss Mountain Top

The Titlis is a popular tourist destination in central Switzerland. with up to 2,000 visitors a day. (Source: Herzog & De Meuron) Plans have been presented to upgrade a popular tourist destination on a mountain top in central Switzerland. As part of the CHF100 million ($100 million) project on the Titlis, a building made of steel and glass will be added to the existing tower for technical installations on 3,028...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org