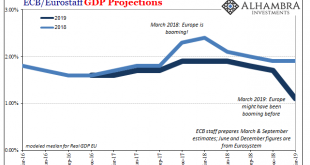

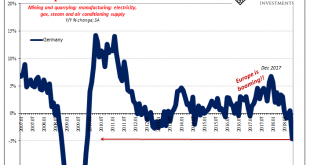

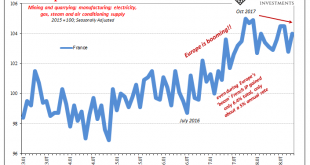

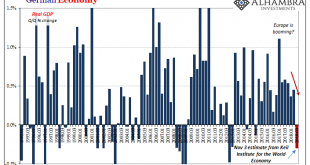

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were. If you read nothing other than Bloomberg, it’s as if some alien...

Read More »Not Buying The New Stimulus

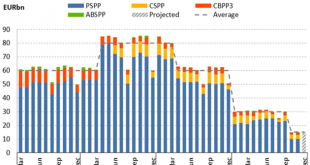

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates. The reaction to this new round was immediately negative: The euro and euro zone government bond yields fell sharply...

Read More »…And Get Bigger

Just as there is gradation for positive numbers, there is color to negative ones, too. On the plus side, consistently small increments marked by the infrequent jump is never to be associated with a healthy economy let alone one that is booming. A truly booming economy is one in which the small positive numbers are rare. The recovery phase preceding the boom takes that to an extreme. If conditions swing the other way,...

Read More »EU Recession Imminent – Euro Disunion as Brexit, Italy and End of QE Loom

Someone asked recently how many times I had “crossed the pond” to Europe. I really don’t know. Certainly dozens of times. It’s been several times a year for as long as I remember. That makes me an extremely unusual American. Most of us never visit Europe, except maybe for a rare dream vacation. And that’s okay because our own country is wonderful and has a lifetime of sights to see. But it does affect our perspective on...

Read More »‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts. Italy has found competition in the race to violate EU fiscal guidelines. Around the rest of Europe, the question is being asked....

Read More »Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death. While...

Read More »London House Prices Fall At Fastest Rate Since Height Of Financial Crisis

London house prices fall at the fastest annual rate since height of the financial crisis London house prices fall in 5th month in row, worst falls since 2009 London rents dropped at the fastest rate in eight years – ONS Brexit, London property slump put brake on UK house price growth Consumer spending declined in July as inflation increased UK house price growth slowed in June to the lowest annual rate in five years...

Read More »London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy) London house prices still 50% above 2007 bubble peak (see chart) Brexit and weak consumer confidence to blame say experts Little sign that U.K. property “weakness” is likely to change London property bubble appears to be bursting Editors Note: The London property bubble appears to be in the early stages of bursting. House prices are falling with reports of falls of as...

Read More »Credit Spreads: Polly is Twitching Again – in Europe

Junk Bond Spread Breakout The famous dead parrot is coming back to life… in an unexpected place. With its QE operations, which included inter alia corporate bonds, the ECB has managed to suppress credit spreads in Europe to truly ludicrous levels. From there, the effect propagated through arbitrage to other developed markets. And yes, this does “support the economy” – mainly by triggering an avalanche of capital...

Read More »Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

– Eurozone threatened by trade wars, Italy and major political and economic instability – Trade war holds a clear and present danger to stability and economic prospects – Italy represents major source of potential disruption for the currency union – Financial markets fail to reflect the “eurozone time-bomb” in Italy – Financial volatility concerns in Brussels & warning of ‘sharp correction’ on horizon – Euro and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org