Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More »European Commission Offers 5 Scenarios

Summary: EC is committed to the future of Europe. Juncker presented five scenarios. Even if the populist-nationalist do not win the electoral contests, the national identity issues will continue to exert influence. Later this month, Europe celebrates the 60th anniversary of the Treaty of Rome, which established the European Economic Community. Very near to the anniversary, which was not one of the original...

Read More »Greece and the Return of the Repressed

Summary: Don’t expect a deal between Greece and its official creditors until late spring or early summer. Grexit is still not a particularly likely scenario. It was the European governments not Greece which put other taxpayers’ skin in the game. Freud warned that unresolved psychological conflicts might be repressed but they keep returning. So too with Greece debt problems. A new crisis is at hand. Investor...

Read More »Martin Armstrong: “EU in Disintegration Mode”

Martin Armstrong Frames the Issue Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong’s piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that, “The EU leadership is really trying to make Great Britain pay dearly for voting to exit the Community. Like the...

Read More »Expropriation and Impoverishment: “Capitalist” Greece and “Socialist” Venezuela

Neocolonial “capitalist paradise” or crony “socialist paradise”: the net result is the same: expropriation and impoverishment. Yesterday I noted that not all assets will make it through the inevitable financial re-set. ( Which Assets Are Most Likely to Survive the Inevitable “System Re-Set”?) Those that are easy to expropriate will be expropriated, and those assets vulnerable to soaring taxes, inflation and currency...

Read More »Great Graphic: French Premium over Germany Continues to Grow

Summary: European premiums over Germany typically increase in a rising interest rate environment. France’s premium is at the most in two years. France is still set to turn back the challenge from Le Pen. The rise of interest rates in Europe have seen premiums over Germany increase. This is not unusual. Often the intra-European spreads are sensitive to the underlying direction of rates. The premiums often...

Read More »Pressure on Greece Mounts, New Crisis Looms

Summary: Greece needs to implement its commitments in the next few weeks or it faces a new crisis. The more the government implements its commitments, the less public support it draws. New elections in Greece cannot be ruled out. The problem is uncomfortably familiar. Greece has a chunky payment due to its official creditors. Reports suggest that Greece has not completed much more than a third of the measures...

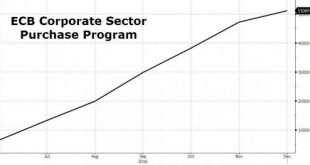

Read More »ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More »These Are The 3 Main Issues For Europe In 2017

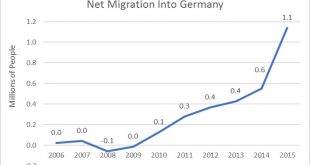

Submitted by George Friedman and Jacob Shapiro via MauldinEconomics.com, What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake....

Read More »Draghi Lets Steam out of Euro

Summary: US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration. The combination of stronger US economy data and a dovish Draghi has seen the US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org