Summary: Risk that NAFTA collapses weighs on CAD and MXN. Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own. The sterling is consolidating after sharp moves at the end of last week. (Greetings from San Francisco, where I will be speaking at a CFA seminar on currencies tomorrow. The rebuilding from destruction of the of...

Read More »FX Weekly Preview: The Markets and the Long Shadow of Politics

Summary: Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month. Why should we think there is anything amiss by looking at the global capital markets? The S&P 500 and the German Dax are at record levels. The Japanese market is at 20-year...

Read More »Political Focus Shifting in Europe

There was a huge sigh of relief among investors when it became clear that the populist-nationalist wave that ostensibly led to Brexit and Trump’s election was not going to sweep through Europe. The euro gapped higher on April 24, and it has not looked back. We have suggested that with the outcome of the German election, European politics shift from tailwind to headwind. Spain’s most serious constitutional crisis in 40...

Read More »Brief Thoughts on the Euro

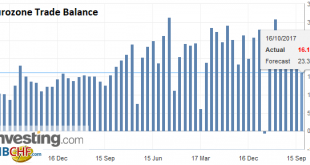

Summary: Euro peaked a month ago. The reversal before the weekend marks the end of the leg lower. ECB meeting is next big focus. ECB may focus on gross rather than net purchases. The euro peaked a month ago near $1.2090. It recorded a low near $1.1670 after the weather-skewed US jobs data seen at the end of last week. The euro recovered from the weekend and set new session highs late US dealings. That...

Read More »FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

Swiss Franc The Euro has fallen by 0.03% to 1.1533 CHF. EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The EU’s leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The...

Read More »FX Daily, October 12: Discipline Argues Against Consensus Narrative

Swiss Franc The Euro has risen by 0.09% to 1.155 CHF. EUR/CHF and USD/CHF, October 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Following the release of the FOMC minutes from last month’s meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This...

Read More »FX Daily, October 11: Markets Looking for a New Focus

Swiss Franc The Euro has risen by 0.04% to 1.1515 CHF. EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday’s ranges against the major currencies, the euro has made a...

Read More »FX Daily, October 10: Dollar Pullback Extended

Swiss Franc The Euro has risen by 0.06% to 1.1507 CHF. EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though...

Read More »FX Weekly Preview: Forces of Movement

Over the past few weeks, the markets have come to accept the likelihood of a December Fed hike. US interest rates have adjusted. The pricing of December Fed funds futures contract is consistent with around an 80% chance of a hike. The two-year yield is trading at the upper end of what is expected to be the Fed funds target range at the end of the year, after slipping below the current range a month ago. The Dollar Index...

Read More »Cool Video: Double Feature Courtesy of Bloomberg

Tom Keene and Francine Lacqua gave me a most appreciated opportunity to present my dollar views on Bloomberg TV earlier today. They also let me opine about current events, like Catalonia’s push for independence and May’s troubled speech at the Tory Party Conference. Bloomberg made two clips of the discussion available. The first is about the dollar’s outlook broadly. I suggest a combination of technical and fundamental...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org