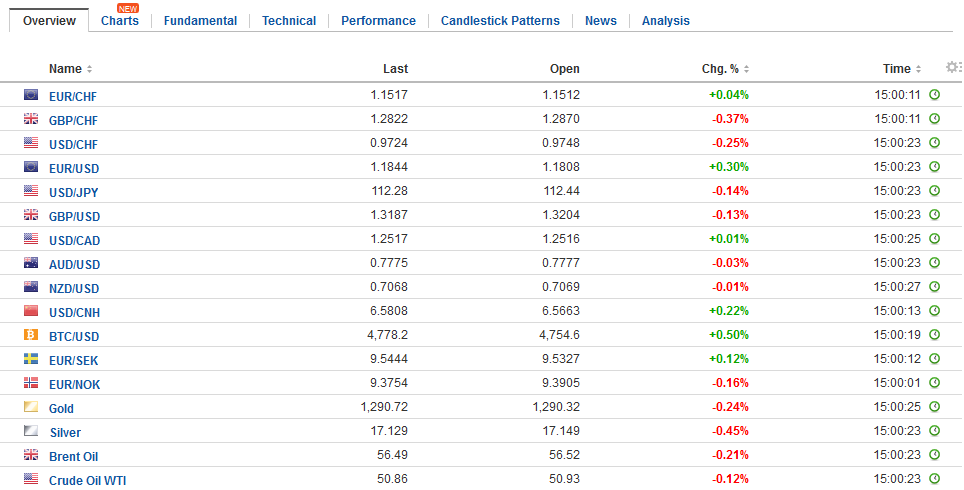

Swiss Franc The Euro has risen by 0.04% to 1.1515 CHF. EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday’s ranges against the major currencies, the euro has made a marginal new high, briefly trading through the .1830 area noted yesterday. The dollar, which briefly dipped below JPY112 yesterday is trading inside yesterday’s range. On the one hand, this may suggest a bit of resilience on the dollar’s part, as the US 10-year Treasury yield is off nearly two bp

Topics:

Marc Chandler considers the following as important: $CNY, EUR, EUR/CHF, Featured, France Non-Farm Payrolls, FX Trends, Japan Core Machinery Orders, JPY, newslettersent, Spain, Spain Consumer Price Index, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.04% to 1.1515 CHF. |

EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday’s ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday. The dollar, which briefly dipped below JPY112 yesterday is trading inside yesterday’s range. On the one hand, this may suggest a bit of resilience on the dollar’s part, as the US 10-year Treasury yield is off nearly two bp (@~2.34%). On the other hand, the dollar has not been able to distance itself from the 20-day moving average, which is near JPY112.20. The dollar has not closed below the 20-day moving average since September 11. A break is seen testing support near JPY111.50. |

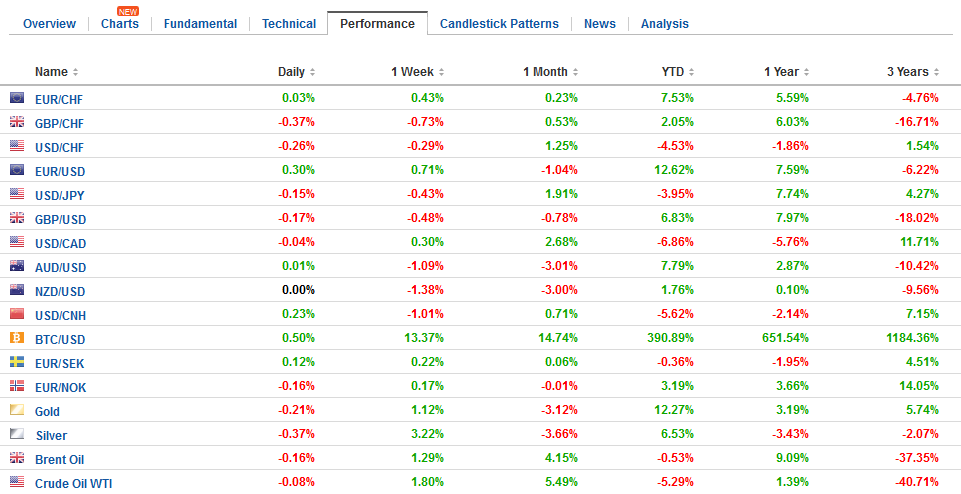

FX Daily Rates, October 11 |

| The economic highlight from the US today will be the FOMC minutes from the September 20 meeting, at which it provided new economic forecasts and decided to begin its balance sheet operations. In some ways, the minutes are old news. The day before the FOMC meeting concluded, Bloomberg calculated at 53% chance of a hike before year end was discounted. Now it says there is a nearly 77% chance. On September 19, the Dec funds implied a 1.23% yield. Today the yield is 1.265%. Our work suggests fair value, assuming no chance of a November hike, is 1.29%. |

FX Performance, October 11 |

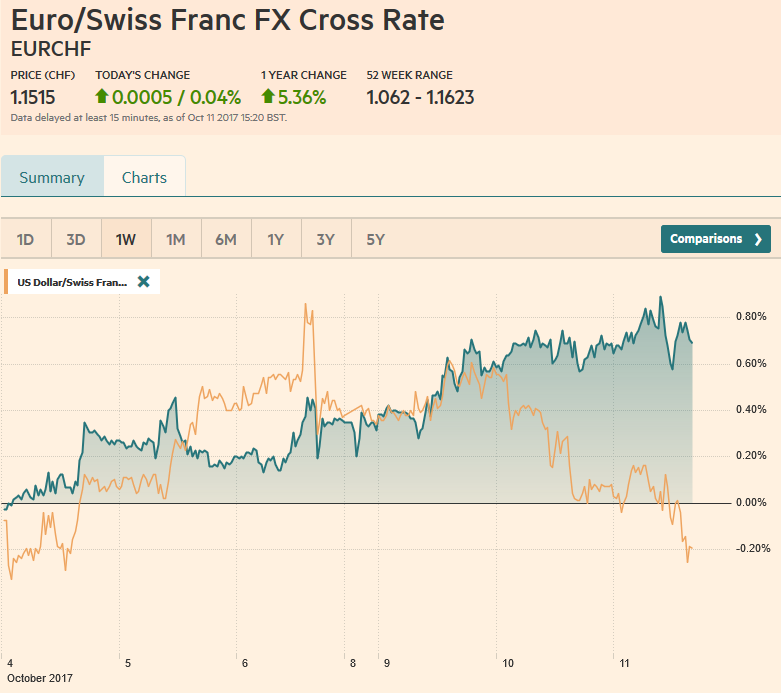

SpainSpanish assets are rallying following Puigdemont’s attempt to square the circle yesterday by deferring the independence announcement, which he claims he is still entitled to make, for a few “weeks” hoping for talks with Madrid. Prime Minister Rajoy has called an emergency cabinet meeting for today, and the outcome can be announced any minute. Although investors are having a collective sigh of relief, Madrid will seek greater closure, but it will likely reject any talks under the threat of secession. If Puigedemont gives up the drive for independence, what political future has he? Spain’s 10-year bond yield is off three bp while the comparable yield in Italy is off less than a single basis point, and core bond yields are slightly higher. Spanish stocks are up 1.3%, outperforming all the major bourses today. Telecoms and real estate of leading what is a broad advance. Only consumer staples are lower, and this is due to a sell-off a leading supermarket. |

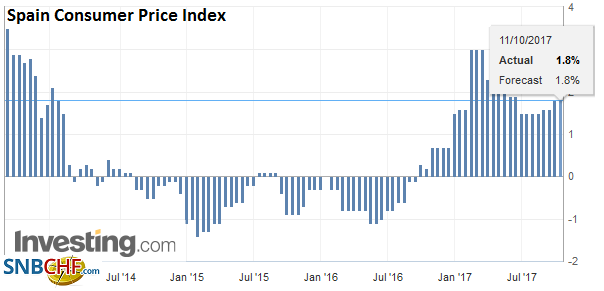

Spain Consumer Price Index (CPI) YoY, Sep 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

JapanNew revelations from Japan’s Kobe Steel that its deception of its materials extend beyond copper and aluminum to include iron ore powder and an unspecified metal still being investigated, saw its share prices fell another 18% after yesterday nearly 22% decline. Nevertheless, the Nikkei and Topix managed to post minor gains, which were sufficient to lift both to new two-year highs. |

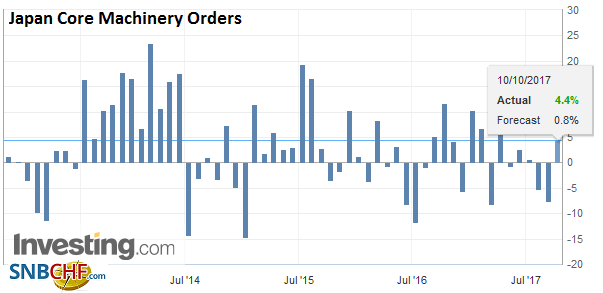

Japan Core Machinery Orders YoY, Aug 2017(see more posts on Japan Core Machinery Orders, ) Source: Investing.com - Click to enlarge |

France |

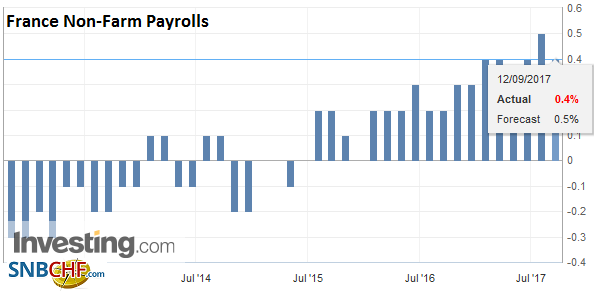

France Non-Farm Payrolls QoQ, Q3 2017(see more posts on France Non-Farm Payrolls, ) Source: Investing.com - Click to enlarge |

The US 10-year yield had risen to 2.40% in the initial response to the jobs data. This is the upper end of the six-month range. Some profit-taking on the run up from nearly 2.0% on September 8 should not be surprising or require a large explanation. Nevertheless, many accounts see doubts over US tax reform as the proximate driver.

First, several Senators appear to be carving out a position that is critical for various reasons. Second, there is an ongoing squabble between the White House and Senator Corker, a fiscal hawk, and an early supporter of the President. Third, Trump himself has indicated he will adjust his tax plan in the new few weeks. Fourth, the IMF has dropped the prospects for fiscal stimulus from the US next year (though it sees the US economy expanding 2.3% in 2018).

China has announced it will raise $2 bln by selling a five- and ten-year dollar bonds in Hong Kong shortly. It is the first time in more than a decade that the central government is issuing dollar bonds. Despite the recent downgrade and concern over the country’s debt burden, we suspect there will be strong demand for this offering.

It is a relatively small offering. There is a scarcity of such paper. While some emerging market countries that borrow dollars may experience a currency mismatch if they do not have sufficient dollar receivables, but that is not China’s problem. It is sitting on over $3 trillion of reserves, and have, according to US data, bought more than $100 bln of US Treasuries in the first seven months of the year.

Lastly, we note that the fourth round of the NAFTA negotiations is set to begin. Although some progress had been reported in earlier rounds, there is a sense of foreboding about the new round, which is to discuss domestic content rules, which will prove very controversial. Ironically, the US is pushing for a higher minimum wage in Mexico, and Canada wants better labor rights in the US.

Reports suggest the US is arguing that 85% of vehicles must be made in NAFTA countries to count and up to as much as 50% must originate in the US. Such a demand, coupled with the push for a “sunset” clause (which would end NAFTA at some future date unless explicitly endorsed by all three countries) is seen a part of the “poison pill” strategy, according to the Chamber of Commerce. The idea is that although Trump backed off from his threat to leave NAFTA, his Administration’s demands will not produce an agreement.

The US Congress will ultimately have to ratify the final agreement. Just like the White House stance spurred a bipartisan response from Congress regarding sanctions against Russia, North Korea, and Iran, there seem to be bipartisan efforts to resist a disruption of supply chains and trade relations. Thisis part of the check and balances, which, at least up until now are working.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,$EUR,$JPY,$TLT,EUR/CHF,Featured,France Non-Farm Payrolls,Japan Core Machinery Orders,newslettersent,Spain,Spain Consumer Price Index,USD/CHF