The focus in Europe has been Catalonia’s push for independence and the attempt by Madrid to prevent it. Tomorrow’s ECB meeting, where more details about next year’s asset purchases, is also awaited. There are three developments that we suspect have been overshadowed but are still instructive. First, the ECB reported that its balance sheet shrank last week. With the ECB set to take another baby step toward the exit, many...

Read More »FX Daily, October 25: Sterling and Aussie Interrupt the Waiting Game

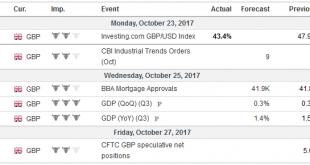

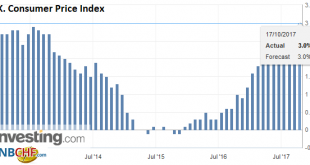

Swiss Franc The Euro has risen by 0.32% to 1.1689 CHF. EUR/CHF and USD/CHF, October 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Most participants seemed comfortable marking time ahead of tomorrow’s ECB meeting, and an announcement President Trump’s nominations to the Federal Reserve. However, softer than expected Australian Q3 CPI and a stronger than expected UK Q3...

Read More »FX Daily, October 24: Dollar Treads Water as 10-year Yield Knocks on 2.40percent

Swiss Franc The Euro has risen by 0.51% to 1.1627 CHF. EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed in mostly uneventful turnover in the foreign exchange market. There is a palpable sense of anticipation. Anticipation for the ECB meeting on Thursday, which is expected to see a six or nine-month extension of...

Read More »FX Daily, October 23: US Dollar Starts New Week on Firm Note

Swiss Franc The Euro has fallen by 0.04% to 1.1578 CHF. EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying modest gains against most currencies as prospects of both tax reform and additional monetary tightening by the Fed carry over from last week. The strong showing of the Liberal Democrats in Japan, where the...

Read More »FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Summary: Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are...

Read More »FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Summary: Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are...

Read More »FX Daily, October 20:Tax Prospects Lift Rates and Dollar Ahead of Weekend

Swiss Franc The Euro has fallen by 0.19% to 1.1589 CHF. EUR/CHF and USD/CHF, October 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US Senate approved a budget resolution that is a necessary step toward using a parliamentary maneuver that prevents the Democrats to block tax reform by filibuster. This has helped spur dollar gains against all the major currencies...

Read More »FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

Swiss Franc The Euro has fallen by 0.25% to 1.1539 CHF. EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these...

Read More »Great Graphic: The Euro’s Complicated Top

Summary Euro looks like it is carving out a top. The importance also lies in identifying levels that the bearish view may be wrong. Widening rate differentials, a likely later peak in divergence than previously anticipated, and one-sided market positioning lend support to the bearish view. This Great Graphic depicts the top the euro is carving. We suggest that several fundamental developments lie behind the...

Read More »Central Bank Chiefs and Currencies

Summary: Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election. The market is fickle. It has jumped from one candidate to another as the most likely Fed Chair. Until his belated and mild criticism of the President dealing with race issues,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org