China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand. According to China’s National Bureau of Statistics, however, exports in June rose by...

Read More »Can Switzerland Survive Today’s Assault On Cash And Sound Money?

Authored by Marcia Christoff-Kurapovna via The Mises Institute, “Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world...

Read More »U.S. Treasuries: Not Really Wrong On Bonds

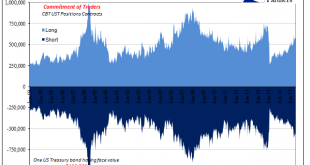

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014. In truth, the liquidity side of cash market UST’s has been diminished since around 2013. Largely as a...

Read More »Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and “other bonds”, at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable –...

Read More »Bi-Weekly Economic Review: Extending The Cycle

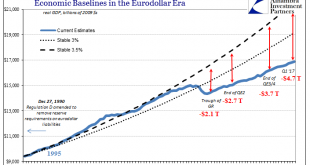

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and "other bonds", at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable - and unexpected - development, and it had to do with the SNB's -0.75%...

Read More »The Scaling Debate & Hard Fork Highlight Several Key Differences Between Bitcoin And Gold

Authored by Mike Krieger via Liberty Blitzkrieg blog, You know stuff’s going down when I write two posts in a row about Bitcoin, something which almost never happens anymore. In Friday’s piece, Is the Bitcoin Civil War Over? Here’s How I’m Thinking About Bitcoin Cash, I discussed a potential strategy that “big blockers” might attempt to execute should the 2x part of Segwit2x not happen later this year. Today, I want to discuss how the entire episode...

Read More »When Do We Know These Are Delusional Markets

Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take...

Read More »U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org