Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level. If there’s a country in the world which is really...

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

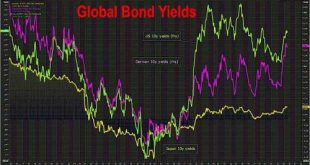

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »Sornette’s Supercomputer Is Betting On A Market Crash

Via FinancialSense.com, One of the world's most powerful supercomputers, retrofitted for trading the stock market, appears to be betting on a crash in the months ahead. The Financial Crisis Observatory (FCO) at ETH Zurich released its latest Global Bubble Status Report on July 1st. As we discussed with FCO’s director, Didier Sornette, on our podcast in May, they use one of the world’s leading supercomputers to monitor global markets each day for two distinct bubble-like...

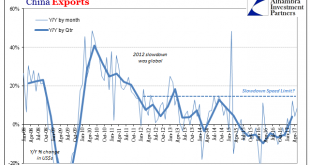

Read More »Questions Persist About China Trade

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became...

Read More »“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side,...

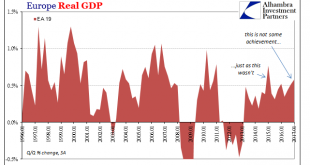

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More »All About Inventory

Andy Hall has been called the God of Oil. As chief of Astenbeck Capital, he has proven at times that even gods can be mortal. In the “rising dollar” period, for example, after making money on the way down Mr. Hall went bullish. That was March 2015: We suspect their projection of current prices into the future will again be frustrated by the market. For that reason we have closed out all of our bearish bets (at a...

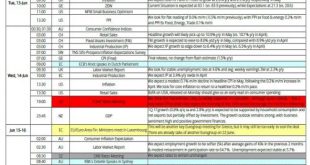

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May. Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website. “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday,...

Read More »Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014. At that time, the BLS in its various data series suggested an almost perfect labor market acceleration...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org