Stocks took another beating last week as the scope of the coronavirus shutdown started to sink in. The S&P 500 was down 15% last week with most of that coming on Monday after the Fed’s emergency rate cuts. Our accounts performed much better than that, but were still down on the week as corporate and municipal bonds continued to get marked down. Municipals recovered slightly at the end of the week as the Fed announced they would be buying highly-rated bonds with...

Read More »Stagnation Never Looked So Good: A Peak Ahead

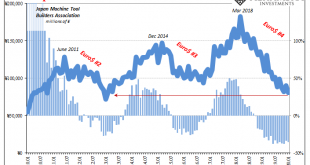

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry. The latest sentiment figures from ZEW as well as IFO are sobering. Taking the former first, it had been quite buoyant last year on the false...

Read More »Is GFC2 Over?

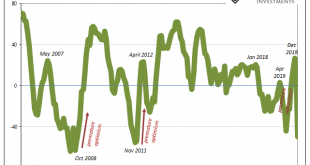

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either. Stocks rebounded because of “major helicopter stimulus” or because that’s just what stocks do during times like these. Some of the biggest up days have followed, and are often found in between, the greatest...

Read More »What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way. Starting with the fact QQE remains ongoing approaching its seventh birthday. Over here in...

Read More »(Almost) Everything Sold Off Today

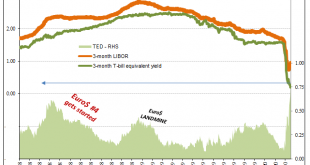

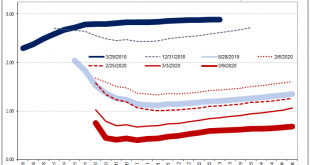

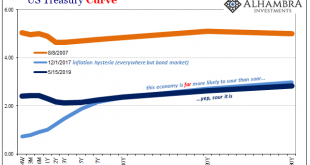

The eurodollar curve’s latest twist exposes what’s behind the long end. To recap: big down day in stocks which, for the first time in a while, wasn’t accompanied by massive buying in longer maturity UST’s. Instead, these were sold, too. Rumors of parity funds liquidating were all over the place, which is consistent with this curve behavior. Let’s start with eurodollar futures; the curve had absolutely collapsed up to Monday. It was remarkable even though not...

Read More »Low Rates As Chaos, Not ‘Stimulus’

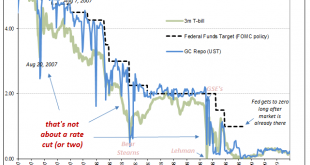

Basic recession economics says that when you end up with too much of some commodity, too much inventory that you can’t otherwise sell, you have to cut the price in order to move it. Discounting is a feature of those times. What about a monetary panic? This might sound weird, but same thing. In other words, if you have too much cash (stay with me) and not enough takers, then the price you’ll accept to lend that cash must fall to accommodate the lack of demand. How...

Read More »Is this the Beginning of a Recession?

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn. The case of recession does seem to be one of those open...

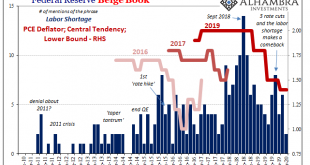

Read More »Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors. The other one has been about this epically tight labor market, which, Jay Powell...

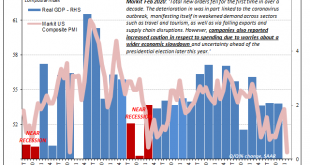

Read More »Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January. Today’s update to that flash estimate with more survey responses in hand validated the 49.6....

Read More »The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events. The short version: monetary authorities as well as the “experts” describe almost perfectly risk averse behavior among the central money dealing system in outbreaks like September’s repo – but...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org