Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. The problems In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies. He outlined how a decade of extremely aggressive monetary interventions have resulted in an erosion of financial stability and now...

Read More »FX Weekly Preview: Is Conventional Wisdom Too Optimistic?

There have been three general issues that the macro-fundamental picture has revolved around this year: trade, growth, and Brexit. On all three counts, conventional wisdom seems unduly optimistic, and this may have helped dampen volatility. A series of signals suggest that the US and China remain far apart in trade negotiations. The US wants China to promise to increase agriculture imports from American farms to more than twice the 2017 peak. Not only is China...

Read More »QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since. It is easy to forget that less than a year ago, all official statements and...

Read More »QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since. It is easy to forget that less than a year ago, all official statements and market expectations...

Read More »QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since. It is easy to forget that less than a year ago, all official statements and market expectations...

Read More »FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

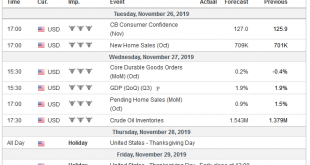

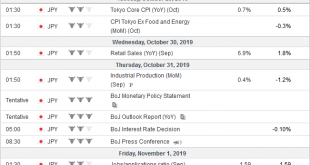

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30,...

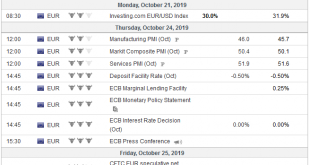

Read More »The Growing Opposition Against the ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone. After all, over the last decade, the ECB has proved to be a “one-trick pony”, with negative rates and bond-buying...

Read More »THE GROWING OPPOSITION AGAINST THE ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone. After all, over the last decade, the ECB has proved to be a “one-trick pony”, with negative rates and bond-buying being used as a...

Read More »THE GROWING OPPOSITION AGAINST THE ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone. After all, over the last decade, the ECB has proved to be a “one-trick pony”, with negative rates and bond-buying being used as a...

Read More »FX Weekly Preview: The Week Ahead Excluding Brexit

I feel a bit like the proverbial guy that asks, “Besides that, Mrs. Lincoln, how did you like the play?” in trying to discuss the week ahead without knowing the results of the UK Parliament’s decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate. Europe is front and center. Three...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org