Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

Read More »FX Weekly Preview: Gaming the ECB and Putting the Cart Before Horse in the Brexit Drama

The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to...

Read More »How much ECB QE is needed? Go big, or go home!

We expect the ECB to strengthen its forward guidance by linking the future path of policy rates to a new asset purchase programme.We estimate that a new QE2 programme worth at least EUR600bn would be needed for the ECB to close a 0.50% inflation gap. If anything, the decreasing marginal returns of QE and the risk of a de-anchoring of inflation expectations call for a more aggressive programme.How much does the ECB need to ease? QE size matters, but so do other parameters including the...

Read More »FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the Eurozone economy and...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the...

Read More »The case for fiscal stimulus strengthens in Germany

German real GDP shrank in the second half of the year, reinforcing our view of a significant ECB action in September.The German economy shrank by 0.1% quarter-on-quarter (q-o-q) in Q2. Today’s report contained some positives news, notably regarding the resilience of domestic demand.Nevertheless, the ongoing trade disputes between China and the US, China weakness, the threat of auto tariffs and the threat of a no-deal Brexit to supply chains, in addition to the auto sector’s own issues are...

Read More »FX Weekly Preview: The Dog Days of August are Upon Us

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies). Following the end of the tariff truce, and after the July...

Read More »DATA ADDS TO THE CASE FOR ECB ACTION IN SEPTEMBER

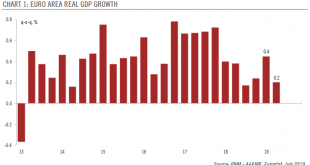

Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year. The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1. While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy. Tentative signs of...

Read More »DATA ADDS TO THE CASE FOR ECB ACTION IN SEPTEMBER

Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year.The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1.While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy.Tentative signs of weakening domestic demand, the possibility of a hard Brexit, potential US tariffs...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org