Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher. Benchmark 10-year yields are firmer, and the US Treasury yield is near 67 bp...

Read More »FX Daily, April 30: ECB Takes Center Stage

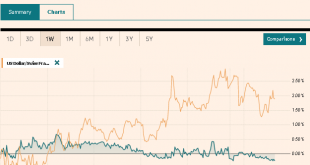

Swiss Franc The Euro has fallen by 0.38% to 1.0545 EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest...

Read More »FX Daily, April 29: Heavy Dollar amid Month-End Pressure

Swiss Franc The Euro has risen by 0.05% to 1.0553 EUR/CHF and USD/CHF, April 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar is lower across the board as dealers attribute the selling to month-end pressures ahead of the FOMC today and ECB tomorrow and long-holiday weekend for many. Japan’s Golden Week holiday has already begun. Despite the loss in US equities yesterday, despite the higher opening,...

Read More »The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam? My very first day on the job, as an intern my first boss told me to prepare myself. I was embarking on a career in the most absurd industry...

Read More »FX Daily, March 25: Relief, but…

Swiss Franc The Euro has risen by 0.02% to 1.0589 EUR/CHF and USD/CHF, March 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are marching higher. While the Dow Jones Industrials posted its biggest advance since 1933, the US is lagging behind other leading benchmarks. The MSCI Asia Pacific advanced, led by Japan’s Nikkei’s 8% gain. It was third consecutive gain, during which time the Nikkei has...

Read More »FX Daily, March 23: Greenback Demand Not Satisfied by Swap Lines

Swiss Franc The Euro has risen by 0.45% to 1.0587 EUR/CHF and USD/CHF, March 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In HG Wells’ “War of the Worlds,” the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities....

Read More »FX Daily, March 20: Markets Ending the Week on Better Note

Swiss Franc The Euro has fallen by 0.08% to 1.0531 EUR/CHF and USD/CHF, March 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Dramatic price action continues but in the other direction. Stocks and bonds have rallied strongly, and the US dollar is snapping a strong advance with a sharp and broad setback. The immediate trigger is hard to identify. Some accounts linking it to fears that the California shutdown...

Read More »FX Daily, March 19: ECB’s Bazooka Support Bonds but not the Euro

Swiss Franc The Euro has fallen by 0.32% to 1.0531 EUR/CHF and USD/CHF, March 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is not just that the dollar soared while stocks and bonds continued to plunge. The dollar’s strength is, in effect, a powerful short-covering rally. It was used to fund a great part of the global circuit of capital. The circuit of capital is in reverse now, and the funding currency...

Read More »FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Swiss Franc The Euro has fallen by 0.01% to 1.0541 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and...

Read More »FX Daily, March 12: Trump Dump as Market Turns to ECB

Swiss Franc The Euro has fallen by 0.06% to 1.057 EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org