Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy. Lastly, we are concerned that the virus may provide further momentum for the...

Read More »DM Equity Allocation Model For Q1 2020

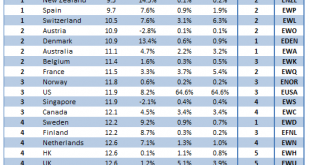

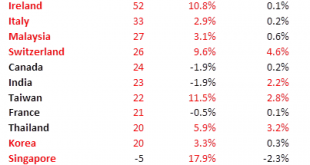

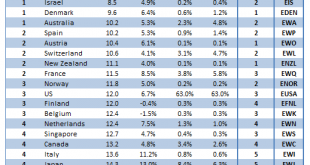

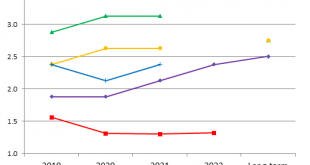

Developed equity markets remain near the highs despite mounting concerns about the impact of the coronavirus MSCI World made a new all-time high last week near 2435 and is up 2.5% YTD Our 1-rated grouping (outperformers) for Q1 2020 consists of Ireland, Israel, New Zealand, Spain, and Switzerland Our 5-rated grouping (underperformers) for Q1 2020 consists of the Italy, Germany, Portugal, Japan, and Greece Since our last update on November 19, our proprietary DM...

Read More »Drivers for the Week Ahead

We get the first February data from the US manufacturing sector this week; the US economy remains strong; FOMC minutes will be released Wednesday Canada reports some key data this week Preliminary eurozone February PMI readings will be reported Friday; UK has a busy data week Japan has a busy data week; Australia reports January jobs data Thursday Concerns about the coronavirus are likely to keep risk sentiment under pressure, as the ultimate impact is still...

Read More »Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb This is another big data week for the US; the US economy remains strong Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday President Trump will unveil his budget proposal for FY2021 beginning October 1 this Monday Eurozone and UK have heavy data weeks Riksbank meets Wednesday and is...

Read More »Some Thoughts on the Latest Treasury FX Report

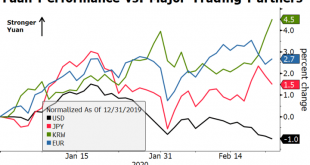

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners. This suggests there will still be many minor trade skirmishes this year. RECENT DEVELOPMENTS The latest...

Read More »Hard Brexit Redux?

The risks of a hard Brexit are perhaps higher than markets appreciated. Here, we set forth some possible scenarios as to what may unfold after the January 31 deadline. Uncertainty is likely to be protracted and markets hate uncertainty. As such, we see UK assets continuing to underperform. RECENT DEVELOPMENTS Fears of a hard Brexit are still alive and well. Prime Minister Johnson is pushing to guarantee a Brexit by end-2020 even if a new trade arrangement is not in...

Read More »Drivers for the Week Ahead

The dollar was surprisingly resilient last week; we look for further dollar gains ahead It is a holiday shortened week in the US, but there are still some major data releases There is a fair amount of eurozone data this week; UK Prime Minister Johnson unveiled his Tory manifesto Hong Kong held local elections this weekend; tensions between Japan and Korea appear to have eased, but questions remain The dollar was surprisingly resilient last week. Despite the lack of...

Read More »DM Equity Allocation Model For Q4 2019

Global equity markets continue to power higher US-China trade tensions have eased MSCI World made a new all-time high today near 2290 and is up 23% YTD Our 1-rated grouping (outperformers) for Q4 2019 consists of Ireland, Sweden, Israel, Denmark, and Australia Our 5-rated grouping (underperformers) for Q4 2019 consists of the UK, Hong Kong, Greece, Germany, and Portugal Since our last update on August 21, our proprietary DM equity portfolio has risen 6.7%, slightly...

Read More »FOMC Preview

The FOMC begins a two-day meeting today with the decision due out tomorrow afternoon. The Fed is widely expected to cut rates 25 bp for the third meeting in a row. What’s next? RECENT DEVELOPMENTS US data have undeniably softened in September. Weakness in the manufacturing sector appears to have spread to the wider economy. ISM PMI, jobs, CPI, PPI, and retail sales all came in weaker than expected. So too have inflation expectations. October data is just...

Read More »A New Stage of the US-China Conflict

The US-China diplomatic relationship may be entering a new stage. The balance of power between the key players – Trump, China, the US Congress, and the Democrats – is changing and their roles are being reshuffled. This might be enough to break the endless cycle of agreements and re-escalations. In short, we think both Trump and Chinese officials have a greater incentive to reach a deal (or at least not to escalate) this time around. Meanwhile, the rising antagonist...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org