The dollar rally has been derailed by weak US data and rising recession fears The September jobs data was not a game-changer and so we are left waiting for more clues Believe it or not, the US economy remains solid; however, the US repo market has not fully normalized yet The Chinese trade delegation arrives in Washington Thursday for two days of trade talks Brexit optimism has worn off; there are several key EM events . The dollar rally has been derailed by weak US...

Read More »Musings on the Repo Market, Fed Policy, and the US Economy

The US repo market appears to finally be normalizing. The low pace of normalization is concerning and so a more permanent solution may be needed to head off similar problems at year-end. We do not think this issue has any implications for the economic outlook, which we continue to view as solid. RECENT DEVELOPMENTS The repo market provides an efficient, reliable, and predictable channel to raise short-term funding. It is but one part of a larger short-term funding...

Read More »Drivers for the Week Ahead

We continue to think that the US economy is in better shape than most appreciate, and that underpins our strong dollar call Tensions are likely to remain high after reports emerged last week that the US will look into limiting capital flows into China US September jobs data Friday will be the data highlight of the week; there is a heavy slate of Fed speakers this week UK, eurozone, and Japan are expected to report weak data this week RBA meets Tuesday and is expected...

Read More »Some Thoughts on the Fed and Oil Shocks

Oil prices have spiked after the weekend attack on Saudi oil facilities. Will it impact the Fed tomorrow? No. We compare the current (but still unfolding) situation to past oil shocks from the 1970s and discuss the policy responses taken. RECENT DEVELOPMENTS The weekend bombing of Saudi oil facilities continues to reverberate. The drone strike removed about 5% of global supplies from the market, leading Brent oil to spike to $72 per barrel Monday before falling...

Read More »Latest Thoughts on the US Economic Outlook

The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising. RECENT DEVELOPMENTS US ISM manufacturing PMI fell to 49.1 vs. 51.3 expected. This is the first sub-50 reading since August 2016 and the lowest since January 2016. The employment component fell to 47.4 from 51.7 in July, while new orders fell to 47.2 from 50.8...

Read More »Drivers for the Week Ahead

We remain dollar bulls; this is an important data week for the US Final August eurozone manufacturing PMIs will be reported Monday; UK reports August PMIs this week RBA meets Tuesday and is expected to keep rates steady at 1.0%; BOC meets Wednesday and is expected to keep rates steady at 1.75% Swedish Riksbank meets Thursday and is expected to keep rates steady at -0.25%; in EM, the central banks of Chile and Russia meet Market sentiment rallied last week on a lot of...

Read More »DM Equity Allocation Model For Q3 2019

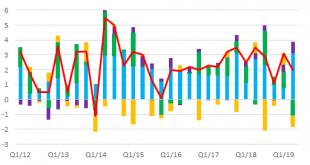

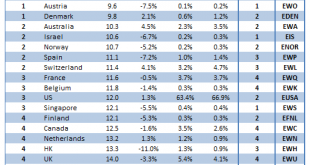

We recently introduced our Developed Markets (DM) Equity Allocation model. Building on the success of our EM model, this new framework extends our analysis to cover 24 DM equity markets. Our analysis is meant to assist global equity investors in assessing relative sovereign risk and optimal asset allocation across countries within the DM universe. DM EQUITY OUTLOOK Global equity markets have come under pressure in recent weeks as the US-China trade war intensified....

Read More »Emerging Equities Outshine Developed Markets

In the years before the 2008 financial crisis, investors flocked to equities in fast-growing emerging economies. But when the crisis put the brakes on global growth, that attraction to emerging markets proved a fickle one, and investors sought safe haven in less risky investments. In late 2016, however, the pendulum is swinging back again, with investors citing several reasons for renewed confidence in emerging market equities. Among the most surprising? Their politics are relatively more...

Read More »The Emerging Slump

Every now and then, the developed and emerging economies of the world find themselves in sync, growing or contracting together. This is not one of those times. In late 2015, a trend that started in 2014 accelerated, as the balance of global growth is tilting toward developed markets and away from emerging ones. Whereas Credit Suisse economists expect growth in developed economies to accelerate this year—up 1.9 percent versus 1.7 percent in 2014—they forecast slower growth in emerging ones, up...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org