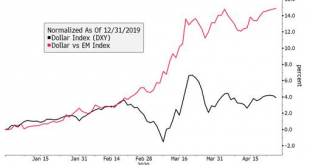

Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses. As April reserves data...

Read More »Drivers for the Week Ahead

The FOMC meets Wednesday; first look at Q1 US GDP comes out Wednesday; weekly jobless claims Thursday are expected at 3.5 mln vs. 4.427 mln last week Italy dodged a bullet last Friday; ECB meets Thursday; eurozone reports Q1 GDP and April CPI data ahead of the ECB decision; Sweden’s Riksbank meets Tuesday BOJ meets Monday; Japan has a busy data week after the BOJ meeting The dollar continues to edge higher. On Friday, DXY traded at the highest level since April 6...

Read More »Thoughts on the Potential Market Impact of US Downgrades

Our sovereign rating model suggests the US will lose its AAA/Aaa rating. With fiscal stimulus efforts continuing with this latest $484 bln package, the case for downgrades just keep getting stronger but the timing is unclear. How might markets react? We look back to 2011 for some clues. RECENT DEVELOPMENTS The White House and House Democrats struck a deal on a new aid package worth $484 bln. The extra $500 bln amounts to about 2.5% of GDP. The IMF estimated...

Read More »Drivers for the Week Ahead

Markets continue to digest the implications of the Fed’s bazooka moment last week The data highlight this week will be March jobs data Friday; key manufacturing sector data will come out earlier in the week On Friday, BOC delivered an emergency 50 bp rate cut to 0.25% and started QE Final eurozone and UK PMI readings for March will be reported; late Friday, Fitch cut UK’s rating by a notch to AA- with negative outlook Japan has a fairly busy data week; RBA minutes...

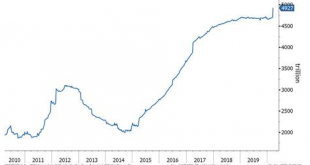

Read More »ECB Approaching its Bazooka Moment

The ECB appears to be moving closer to activating Outright Monetary Transactions (OMT). Despite being part of Draghi’s “whatever it takes” moment, OMT has never been used. If the Fed’s open-ended QE is seen as dollar-negative, then OMT should be seen as euro-negative. ECB Balance Sheet Total Assets, 2010-2019 - Click to enlarge RECENT DEVELOPMENTS At the regularly scheduled March 12 meeting, the ECB delivered a package of easing measures that were in hindsight...

Read More »Drivers for the Week Ahead

Risk sentiment is likely to remain under pressure this week as the impact of the coronavirus continues to spread; demand for dollars remains strong As of this writing, the Senate-led aid bill has stalled; the US economic outlook is getting more dire; Canada is experiencing similar headwinds This is a big data week for the UK; eurozone March flash PMIs will be reported Tuesday; oil prices continue to slide Japan has a heavy data week; RBNZ will start QE; China offers...

Read More »ECB Preview, March 11

Christine Lagarde will chair her third ECB meeting Thursday. She faces growing risks of recession but also widespread skepticism within the ECB regarding the efficacy of negative rates. Markets have priced in several rate cuts this year. Here, we discuss what measures the ECB may take this week. POLICY OUTLOOK It’s worth noting that even with the complicated voting rights system, a formal vote is not always needed to act. For instance, at the September 2019...

Read More »Drivers for the Week Ahead

Risk-off sentiment continues to build as the coronavirus spreads Fed easing expectations continue to intensify; February inflation readings for the US will be reported this week The ECB meets Thursday and markets are split; the stronger euro is doing the eurozone economy no favors The UK has a heavy data release schedule Wednesday; UK government also releases its budget that day Japan has a fairly heavy data week; the yen continues to benefit from risk-off sentiment...

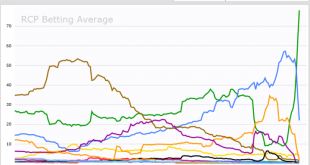

Read More »Updated Democratic Primary Timeline

Super Tuesday has come and gone. Bloomberg has suspended his campaign after an extremely poor showing, and Warren is expected to follow suit soon. Here is our updated take on the likely Democratic candidate. RECENT DEVELOPMENTS Biden exceeded expectations on Super Tuesday. He won Alabama, Arkansas, Massachusetts, Minnesota, North Carolina, Oklahoma, Tennessee, Texas, and Virginia and leads in Maine. Sander won Colorado, Utah, and Vermont and leads in California. As...

Read More »Drivers for the Week Ahead

The dollar has softened as Fed easing expectations have picked up Late Friday, Chair Powell issued an unscheduled statement saying the Fed is monitoring the virus and will act as appropriate This is a big data week for the US; the Fed releases its Beige Book report Wednesday Super Tuesday comes this week; Bank of Canada meets Wednesday Final eurozone and UK February PMI readings will be reported this week Reserve Bank of Australia meets Tuesday; BOJ Governor Kuroda...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org