Some are holding out hope but we think the stimulus package remains dead; Fed releases its Beige Book report Wednesday; there is a full slate of Fed speakers this week Fed manufacturing surveys for October will continue to roll out; weekly jobless claims will be reported Thursday; BOC releases results of its Q3 Business Outlook Survey Monday Renewed virus restrictions are weighing on the economic outlook for the eurozone; no wonder ECB officials are sounding very...

Read More »Drivers for the Week Ahead

Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week The main data event this week is September retail sales Friday; ahead of that, we get inflation readings for September; Fed manufacturing surveys for October will start to roll out The account of the ECB’s September meeting added a layer of...

Read More »Drivers for the Week Ahead

The US political outlook has been upended by recent developments; lack of a significant safe haven bid for the dollar so far is telling This is a very quiet week in terms of US data; FOMC minutes will be released Wednesday; there is a full slate of Fed speakers The eurozone has a fairly heavy data week; Brexit talks continue in London; UK has a heavy data week Japan has a fairly heavy data week; RBA meets Tuesday and is expected to keep policy unchanged; that same...

Read More »ECB Preview

The ECB meets tomorrow and is widely expected to stand pat. Macro forecasts may be tweaked modestly and there are some risks of jawboning against the stronger euro, but it should otherwise be an uneventful meeting. Looking ahead, a lot of room remains for further ECB actions. We expect the ECB to increase QE at the December 10 meeting. However, another rate cut seems very unlikely, as does activation of OMT. POSSIBLE NEXT STEPS 1. Jawbone the euro weaker – POSSIBLE...

Read More »Recent Trade Developments Suggest Some Caution Ahead Warranted

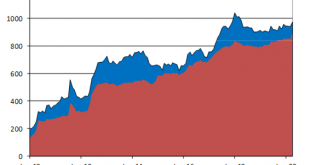

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities. RECENT DEVELOPMENTS Back in April, the WTO set forth two distinct pandemic scenarios for world trade. The “relatively optimistic”...

Read More »Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week Eurozone reports preliminary June PMI readings Tuesday; ECB releases its account of the June meeting Thursday All quiet on the Brexit front; UK reports preliminary June PMI readings Tuesday Japan...

Read More »SNB Preview

The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB. WHAT ELSE CAN THE SNB DO? The SNB meets quarterly in March, June, September, and December. At the March 19 meeting, the SNB took a series of measures to help mitigate the impact of the pandemic. Whilst SNB officials have always said that rates...

Read More »Our Latest Thoughts on the Dollar

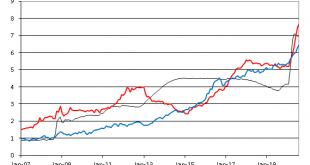

The dollar remains under pressure, due in large part to the Fed’s aggressive efforts to inject stimulus. We see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows. Dollar Index, 2015-2020 - Click to enlarge RECENT DEVELOPMENTS There is a growing debate as to the root causes of recent dollar weakness. Is it the burgeoning national debt? The poor US...

Read More »Asia Lockdowns vs. Re-Openings

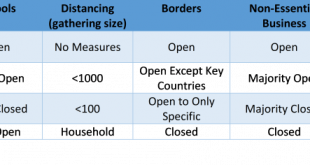

By Ilan Solot and Kieran Chard We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a)...

Read More »Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further. POLITICAL OUTLOOK Legislation was introduced last week that allows Beijing to directly impose a national security law on Hong Kong. Local legislative approval would be circumvented but Chief Executive Lam said Hong Kong authorities would fully...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org