Trump vs. the Deep State If there had been any doubt that the land of the free and home of the brave is now a totalitarian society, the revelations that its Chief Executive Officer has been spied upon while campaigning for that office and during his brief tenure as president should now be allayed. President Trump joins the very crowded list of opponents of the American State which includes the Tea Party, tax resistors,...

Read More »The Long Run Economics of Debt Based Stimulus

Onward vs. Upward Something both unwanted and unexpected has tormented western economies in the 21st century. Gross domestic product (GDP) has moderated onward while government debt has spiked upward. Orthodox economists continue to be flummoxed by what has transpired. What happened to the miracle? The Keynesian wet dream of an unfettered fiat debt money system has been realized, and debt has been duly expanded at...

Read More »Boosting Stock Market Returns With A Simple Trick

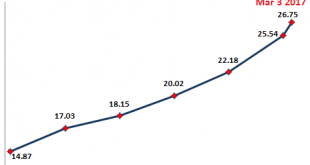

Systematic Trading Based on Statistics Trading methods based on statistics represent an unusual approach for many investors. Evaluation of a security’s fundamental merits is not of concern, even though it can of course be done additionally. Rather, the only important criterion consists of typical price patterns determined by statistical examination of past trends. Systematic trading on the basis of statistical...

Read More »Speculative Blow-Offs in Stock Markets – Part 2

Blow-Off Pattern Recognition As noted in Part 1, historically, blow-patterns in stock markets share many characteristics. One of them is a shifting monetary backdrop, which becomes more hostile just as prices begin to rise at an accelerated pace, the other is the psychological backdrop to the move, which entails growing pressure on the remaining skeptics and helps investors to rationalize their exposure to...

Read More »Speculative Blow-Offs in Stock Markets – Part 1

Defying Expectations Why is the stock market seemingly so utterly oblivious to the potential dangers and in some respects quite obvious fundamental problems the global economy faces? Why in particular does this happen at a time when valuations are already extremely stretched? Questions along these lines are raised increasingly often by our correspondents lately. One could be smug about it and say “it’s all...

Read More »The Big Myth

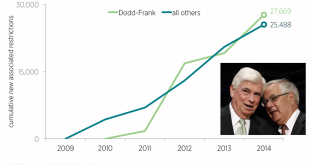

Debunking a Lie Don Watkins of the Ayn Rand Institute wrote an article, The Myth of Banking Deregulation, to debunk a lie. The lie is that bank regulation is good. That it helped stabilize the economy in the 1930’s. And that deregulation at the end of the century destabilized the economy and caused the crisis of 2008. As of early 2015, Dodd-Frank had imposed altogether 27,670 new restrictions, more than all other laws...

Read More »Farewell, Welfare State

Impossible Bills BALTIMORE – The tweet was never sent and never received: “Lying Otto von Bismarck set us up for bankruptcy! What was he thinking? Sad!!” Instead, Mr. Trump said last weekend that, far from trying to curb the promises and cut the costs of the welfare state, he was nearly ready to unveil a plan to replace Obamacare with something better: a plan that would provide “insurance for everybody.” The “iron...

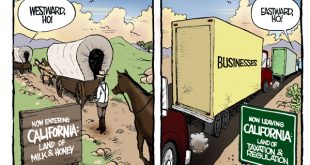

Read More »California, Nestle and Decentralization

Goodbye, Socialist Paradise Nestle USA has announced that it will move its headquarters from Glendale, California, to Rosslyn, Virginia, taking with it about 1200 jobs. The once Golden State has lost some 1690 businesses since 2008 and a net outflow of a million of mostly middle-class people from the state from 2004 to 2013 due to its onerous tax rates, the oppressive regulatory burden, and the genuine kookiness...

Read More »Is an Inflation Comeback in the Works?

Exterminating Angel LOVINGSTON, VIRGINIA – Amid all the sound and fury of the Trump news cycle, hardly anyone noticed. There is a specter haunting this economy. It is the specter of inflation… Bloomberg has the report: The U.S. cost of living increased in January by the most since February 2013, led by higher costs for gasoline and other goods and services that indicate inflation is gathering momentum. The...

Read More »How to Outperform Hedge Funds with Just a Few Trades

A Simple Way In their efforts to beat the market, many investors are spending a lot of time searching for rare undiscovered gems or sophisticated trading rules. There is actually a simpler way. I will show below how one could have beaten the market by a sizable margin over approximately the past 90 years – with only two trades per month, while being invested only one third of the time and without employing any...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org