The Wrong Approach This question is no longer moot. As the world moves inexorably towards the use of metallic money, interest on gold and silver will return with it. This raises an important question. Which interest rate will be higher? It’s instructive to explore a wrong, but popular, view. I call it the purchasing power paradigm. In this view, the value of money — its purchasing power —is 1/P (where P is the price...

Read More »The Triumph of Hope over Experience

The Guessers Convocation On Wednesday the socialist central planning agency that has bedeviled the market economy for more than a century held one of its regular meetings. Thereafter it informed us about its reading of the bird entrails via statement (one could call this a verbose form of groping in the dark). A number of people have wondered why the Fed seems so uncommonly eager all of a sudden to keep hiking rates...

Read More »“Sell in May and Go Away” – in 9 out of 11 Countries it Makes Sense to Do So

An Old Seasonal Truism Most people are probably aware of the saying “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months. Numerous studies have been undertaken particularly with respect to US stock markets, which confirm the relative weakness of the stock market in the summer months. What is the...

Read More »Emerging Markets: Buyer Beware – An Interview with Jayant Bhandari

Jayant on Emerging Markets, Precious Metals and Mining Companies Maurice Jackson of Proven & Probable has once again interviewed one of our friends, namely Jayant Bhandari, a frequent and highly valued contributor to Acting Man. Jayant is probably best known to our readers for his strong criticism of the economic and nationalist policies implemented by prime minister Narendra Modi in India since he decreed the...

Read More »Central Banks’ Obsession with Price Stability Leads to Economic Instability

Fixation on the Consumer Price Index For most economists the key factor that sets the foundation for healthy economic fundamentals is a stable price level as depicted by the consumer price index. According to this way of thinking, a stable price level doesn’t obscure the visibility of the relative changes in the prices of goods and services, and enables businesses to see clearly market signals that are conveyed by...

Read More »The Fed Will Blink

Honest Profession GUALFIN, ARGENTINA – The Dow rose 174 points on Thursday. And Treasury Secretary Steve Mnuchin said we’d have a new tax system by the end of the year. Animal spirits were restless. But which animals? Dumb oxes? Or wily foxes? Probably both. But what caught our attention were the central bankers strutting across the yard and crowing with such numbskull cackles that even barnyard animals would be...

Read More »Cracks in Ponzi-Finance Land

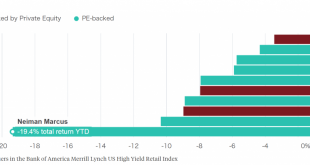

Retail Debt Debacles The retail sector has replaced the oil sector in a sense, and not in a good way. It is the sector that is most likely to see a large surge in bankruptcies this year. Junk bonds issued by retailers are performing dismally, and within the group the bonds of companies that were subject to leveraged buyouts by private equity firms seem to be doing the worst (a function of their outsized debt loads)....

Read More »French Selection Ritual, Round Two

Slightly Premature Victory Laps The nightmare of nightmares of the globalist elites and France’s political establishment has been avoided: as the polls had indicated, Emmanuel Macron and Marine Le Pen are moving on to the run-off election; Jean-Luc Mélenchon’s late surge in popularity did not suffice to make him a contender – it did however push the established Socialist Party deeper into the dustbin of history. That...

Read More »Central Banks Have a $13 Trillion Problem

Paycheck to Paycheck GUALFIN, ARGENTINA – The Dow was down 118 points on Wednesday. It should have been down a lot more. Of course, markets know more than we do. And maybe this market knows something that makes sense of these high prices. What we see are reasons to sell, not reasons to buy. Nearly half of all American families live “paycheck to paycheck,” say researchers. Without borrowing, 46% couldn’t raise $400 to...

Read More »Simple Math of Bank Horse-Puckey

The Raw Deal We stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights. After a brief moment, we locked the door behind us and got into our car. Springtime southern California...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org