Thirty Year Retread What will President Trump and Japanese Prime Minister Shinzo Abe talk about when they meet later today? Will they gab about what fishing holes the big belly bass are biting at? Will they share insider secrets on what watering holes are serving up the stiffest drinks? [ed. note: when we edited this article for Acting Man, the meeting was already underway] Indeed, these topics are unlikely. Rather,...

Read More »Incrementum Advisory Board Meeting, Q1 2017 and Some Additional Reflections

Looming Currency and Liquidity Problems The quarterly meeting of the Incrementum Advisory Board was held on January 11, approximately one month ago. A download link to a PDF document containing the full transcript including charts an be found at the end of this post. As always, a broad range of topics was discussed; although some time has passed since the meeting, all these issues remain relevant. Our comments below...

Read More »India: The World’s Fastest Growing Large Economy?

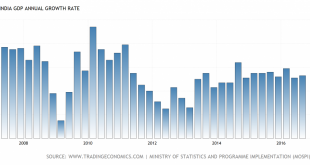

Popular Narrative India has been the world’s favorite country for the last three years. It is believed to have superseded China as the world’s fastest growing large economy. India is expected to grow at 7.5%. Compare that to the mere 6.3% growth that China has “fallen” to. The IMF, the World Bank, and the international media have celebrated this event. Declining commodity prices and other problems in Russia, Brazil and...

Read More »The Futility of Predictions

Awesome Forecasts and the Unknowable Future Back in late 2013 I wrote a piece on human nature which was in part inspired by the bullish exuberance exhibited by a MarketWatch article predicting the DJIA at 20,000 in the near term future. Yesterday afternoon, a bit over three years later, that prediction actually became reality and I’m sure the author of that article as well as many other like minded traders popped some...

Read More »Don’t Blame Trump When the World Ends

Alien Economics There was, indeed, a time when clear thinking and lucid communication via the written word were held in high regard. As far as we can tell, this wonderful epoch concluded in 1936. Everything since has been tortured with varying degrees of gobbledygook. One should probably not be overly surprised that the abominable statist rag Time Magazine is fulsomely praising Keynes’ nigh unreadable tome. We too...

Read More »Adventures in Currency Debasement

Rekindling the Dollar Debasement Strategy The U.S. dollar, as measured by the dollar index, has generally gone up since mid-2014. The dollar index goes up when the U.S. dollar gains strength (value) against a basket of currencies, including the euro, yen, pound, and several others. Conversely, the dollar index goes down when the U.S. dollar loses value. Between July 30, 2014 and December 28, 2016, the dollar’s value,...

Read More »With Trump Optimism of Small Business Soars

Pledges for Trump “You boys know what makes this bird go up? Funding makes this bird go up. That’s right. No bucks, no Buck Rogers.” – Gordon Cooper and Gus Grissom, The Right Stuff (film) Things are looking up for the United States economy in 2017. You can just feel it. Something great is about to happen. Sam Sheppard in “The Right Stuff” – a 1983 docudrama about the Mercury 7 program and “the...

Read More »Donald and the Dollar

No Country Can be Made Great by Devaluation John Connally, President Nixon’s Secretary of the Treasury, once remarked to the consternation of Europe’s financial elites over America’s inflationary monetary policy, that the dollar “is our currency, but your problem.” Times have certainly changed and it now appears that the dollar has become an American problem. In a recent interview with the Wall Street Journal, the...

Read More »US Financial Markets – Alarm Bells are Ringing

A Shift in Expectations When discussing the outlook for so-called “risk assets”, i.e., mainly stocks and corporate bonds (particularly low-grade bonds) and their counterparts on the “safe haven” end of the spectrum (such as gold and government bonds with strong ratings), one has to consider different time frames and the indicators applicable to these time frames. Since Donald Trump’s election victory, there have been...

Read More »Crony Socialism and Failed CEOs

Blind to Crony Socialism Whenever a failed CEO is fired with a cushy payoff, the outrage is swift and voluminous. The liberal press usually misrepresents this as a hypocritical “jobs for the boys” program within the capitalist class. In reality, the payoffs are almost always contractual obligations, often for deferred compensation, that the companies vigorously try to avoid. Believe me. I’ve been on both sides of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org