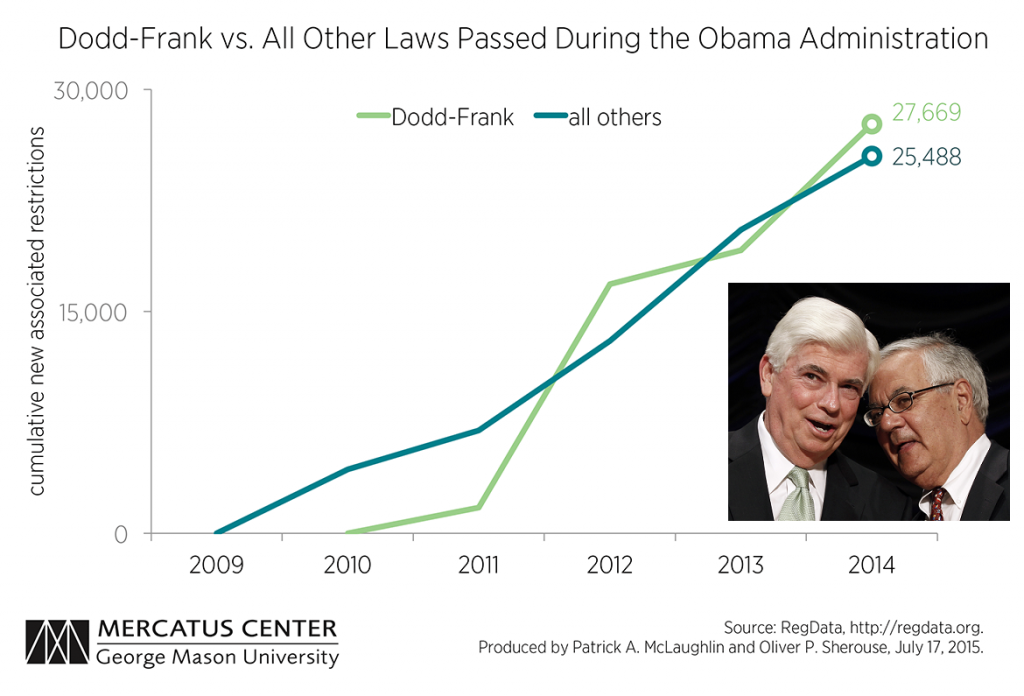

Debunking a Lie Don Watkins of the Ayn Rand Institute wrote an article, The Myth of Banking Deregulation, to debunk a lie. The lie is that bank regulation is good. That it helped stabilize the economy in the 1930’s. And that deregulation at the end of the century destabilized the economy and caused the crisis of 2008. As of early 2015, Dodd-Frank had imposed altogether 27,670 new restrictions, more than all other laws passed under Obama combined (that is really saying something, considering the regulatory frenzy let loose by his administration. Note: the law may have “only” 2,300 pages, but more than 10 different regulatory agencies have been producing administrative laws for six years in a row to put it into practice – and they are not finished yet. Don’t you feel safer already? Dodd Frank and All Other Laws 2009 - 2015If deregulation is the problem, then re-regulation is the solution. So, in the wake of the crisis, Congress enacted a 2,300-page monstrosity of regulation known as Dodd-Frank. - Click to enlarge Watkins does a good job describing government regulation of finance, in particular addressing the savings and loan industry. He gives an example where people commonly assume that Congress reduced regulation, the Graham-Leach-Bliley Act of 1999.

Topics:

Keith Weiner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Debunking a LieDon Watkins of the Ayn Rand Institute wrote an article, The Myth of Banking Deregulation, to debunk a lie. The lie is that bank regulation is good. That it helped stabilize the economy in the 1930’s. And that deregulation at the end of the century destabilized the economy and caused the crisis of 2008. |

Dodd Frank and All Other Laws 2009 - 2015 |

| Watkins does a good job describing government regulation of finance, in particular addressing the savings and loan industry. He gives an example where people commonly assume that Congress reduced regulation, the Graham-Leach-Bliley Act of 1999.

The headline is that this law reduced regulation, and allowed banks to be in the securities business. However, the truth is that it mixed in a dollop of increased regulation. |

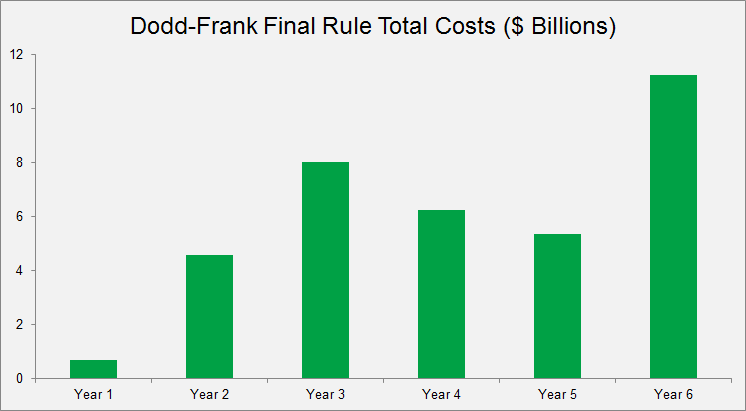

Dodd Frank Final Rule Total Costs The economic cost of Dodd-Frank (one guess as to who is going to end up paying for this…). Note: this is not cumulative – the cumulative tally so far is a cost of $36 billion (about $310 per household!); it has so far taken 74.8 million paperwork man hours to create this monster. You will be happy to learn that the law not only makes us perfectly safe, but introduces racial and gender quotas as well. The number of final rules exceeds those generated by Sarbanes-Oxley by a factor of 30 – so far. - Click to enlarge |

Imagined StabilityI commend him for tackling regulation and the moral hazard of deposit insurance, and calling for real deregulation. However, I must criticize his article. He says:

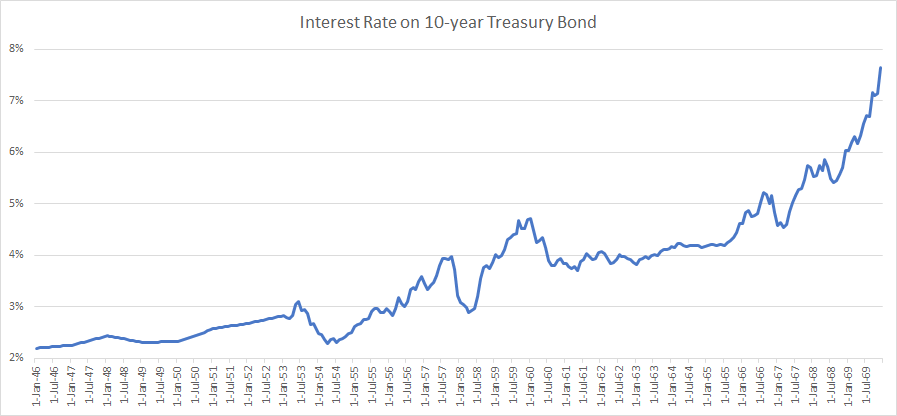

Here is a graph of the interest rate on the benchmark 10-year Treasury bond from 1946 through 1969. |

10 Year Treasury Bond - Interest Rate, 1946 - 1969 |

| Even during the initial smooth period through 1953, the rate of interest climbed 27 percent. By this point, the instability had only just begun. If “into the 1960’s” refers to the last plateau in 1965 before the rate destabilizes further, then the rate was about 4.2%.

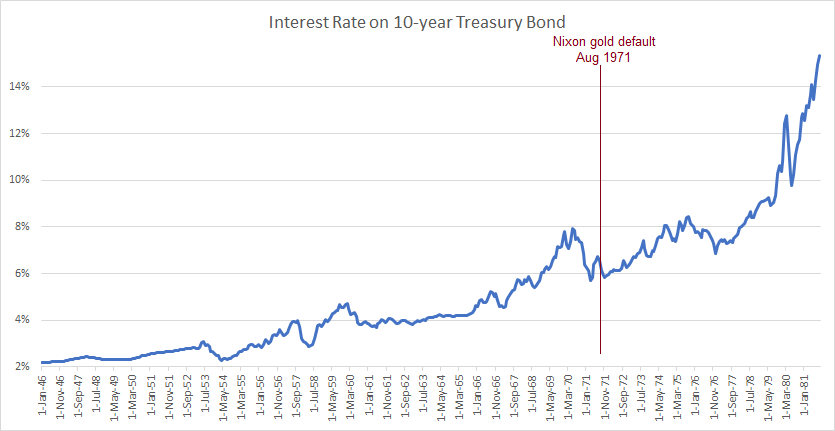

This is about double what it had been just 15 years earlier. And at the end of the 1960’s, the interest rate had hit 7.7%, or about 3.5 times where it started. Watkins gives us a hint that he means that the interest rate destabilized after President Nixon severed the last link to gold in 1971. He says, “…[the] U.S. government cut its remaining ties to gold in 1971. The volatile inflation and interest rates that followed…” So let’s look at the interest rate for the full period of rising rates, up to the peak hit in 1981. We can see that it does indeed get worse after Nixon’s ill-conceived act. However, it is just a continuation of the same trend that had been underway since 1946. It’s a combination of rising interest rates with rising interest rate volatility. Both phenomena inflict damage on the economy. |

10 Year Treasury Bond - Interest Rate, 1946 - 1981 |

The “Good Monetary Policy” MythWatkins claims, “Part of the credit for this [interest rate] stability goes to monetary policy.” He thus contributes — I assume unintentionally — to the myth of monetary central planning.

If our civilization is to have a future, then this myth must come down! In recent decades, most people believed that Fed Chairmen Greenspan and Bernanke administered a strong and stable economy. They called it “the great moderation”. Of course, this view ended with a crash in 2008, along with the markets. Watkins reinforces the myth in his subsequent discussion of regulation and the savings and loan crisis. He says that New Deal regulation, “collapsed under the pressure of bad monetary policy from the Federal Reserve…” The very phrase “bad monetary policy” implies that there is such a thing as good monetary policy. There is no such thing as good monetary policy. There is no such thing as effective monetary policy, or monetary policy that does no harm. There are only the times when most people see no overt symptoms, when they don’t realize the damage being done. And there are times of pain, when reality takes hold again. Since monetary policy can have lags of decades, most people do not know how to ascribe the blame properly. |

|

The Quality of Economic GrowthOne economic indicator that may make the postwar economy appear strong is Gross Domestic Product. GDP quadrupled from 1946 to 1969. Unfortunately, GDP is not a measure of the quality of economic activity. A fever is not a measure of the quality your health, but merely the quantity of calories your sick body is burning. Similarly, GDP is not a measure of the quality of the economy, only the quantity of dollars turned over. GDP should be understood to be a measure combining destruction plus production. Government waste is added to private activity. And of course, not all private activity is productive. GDP does not distinguish between the squandering of precious capital during false booms and the genuine productive enterprise. It also includes many other wasteful activities, such as regulatory compliance. A rapidly-rising GDP does not necessarily mean the economy is healthy or stable. In fact, it was not in the postwar period. One subtle but deadly problem was described by economist Robert Triffin in 1959. Rational domestic fiscal policy was in conflict with international demand for the US dollar, used as their monetary reserve asset. The US was obliged — and happy to oblige — to run greater and greater budget deficits. Triffin knew that a crisis was inevitable. It came under the Nixon administration. |

What is known as gross domestic product isn’t really “gross” at all, since it ignores the bulk of the production structure. It does however contain activities that don’t generate any wealth, and partly even destroy it. We have discussed a number of the problems of GDP in past missives (see e.g. “The Mirage of Economic Growth”, which inter alia looks at Oskar Morgenstern’s objections to the measure). Cartoon by Bob Rich - Click to enlarge |

The Self-Immolating Gold Standard MythI want to pick on a phrase that feeds — again I assume inadvertently — into the anti free market, anti gold standard myth. Watkins uses the passive voice to say that the classical gold standard “had fallen apart during World War I…”. Most people today, if you press them, will tell you that that a free market contains the seeds of its own destruction. “Falling apart” is precisely what they fear will happen when a free market is unregulated, uncontrolled, and not centrally planned. That’s why they want regulators and central planners. It needs to be said again and again. No. The classical gold standard did not fall apart! It was killed by government. In 1913, the Federal Reserve was created. That altered the gold standard the way drinking a bottle of wine alters consciousness. If a drunken worker drives a bulldozer through a house, no one says that “the building had fallen apart.” In addition to the Fed in the U.S., the governments of Britain and Germany and other belligerent powers suspended the gold convertibility of their currencies in 1914. Many people blithely say that the gold standard fell apart. I say, again, it did not. After the war, the victorious countries claimed they were returning to the gold standard, but instead they created a pseudo gold standard. As everyone knows now, it didn’t work. At least one economist, Heinrich Rittershausen, knew in advance. He warned that this dysfunctional monetary system would cause great unemployment. |

Ludwig von Mises noted: “[T]he gold standard is not a game, but a social institution. Its working does not depend on the preparedness of any people to observe some arbitrary rules. It is controlled by the operation of inexorable economic law.” and furthermore: “What the expansionists call the defects of the gold standard are indeed its very eminence and usefulness. It checks large-scale inflationary ventures on the part of governments. The gold standard did not fail. The governments were eager to destroy it, because they were committed to the fallacies that credit expansion is an appropriate means of lowering the rate of interest and of “improving” the balance of trade.” Photo via mises.org - Click to enlarge |

Rigorous Economic Logic and a Rational Assessment of History

We, the advocates of liberty, will only succeed if we are rigorous. We must know the facts we present in our writings, and our theories must take these facts in account. Otherwise, we may get a hosanna from the choir, but we will not persuade the mainstream. False facts will not win people who have studied the field.

Objectivism is the philosophy which reveres facts and integrates facts into theories which explain reality. The fact is that since at least 1913, we have not had capitalism (and there was not a free market in banking in 1912, or even in 1812). Instead, since 1913, we have had a central bank.

The Fed has been taking for itself more and more power over the decades. Our central bank administers the interest rate. Interest, being the price of money, affects every other price and every economic decision in the economy. Distorting interest can have terrible consequences, which can come decades later.

More importantly than deregulating — and that is very important — we need to end central planning. The collapse of the Soviet Union proved that even corn production cannot be centrally planned. Corn is a simple product. You put seeds in fertile ground, wait for sun and rain to do their thing, and then harvest it. Yet the Soviets starved.

We are smart enough to know that we can’t centrally plan corn. However, we think we can centrally plan the most complex of man’s products: credit. We must talk about this in plain language. The gold standard of a freer era did not just collapse, without cause.

Power-lusting, war-mongering governments killed it to do away with the discipline it imposed. Then, free from this constraint, they marched men off to worldwide wars twice in 30 years (no, I am not saying that the US had the same moral stature as the European belligerents).

Towards the of the second world war, the US forced the allied powers to agree to a new monetary order at Bretton Woods. The architect of this vicious scheme was Harry Dexter White, a communist and tool of the Soviet Union. Ever since then, the worldwide monetary system has been dominated by the Fed.

And the US has been abusing what Valéry Giscard d’Estaing, the French Minister of Finance in the 1960’s, called the “exorbitant privilege”. The Fed’s central planning could not possibly have delivered stability, as any rational theory tells us. The Fed’s central planning did not in fact deliver stability, as any rational reading of history shows us.

Charts by: Mercatus Center, American Action Forum, Monetary Metals

Chart and image captions by PT

Tags: Featured,newslettersent,On Economy,On Politics