◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch ◆ Growing stresses in U.S. banking and financial system should support...

Read More »Germany Increase Gold Reserves In September For The First Time In 21 Years – IMF

◆ The gold reserves of the German Bundesbank rose in September for the first time in 21 years; German gold reserves rose to 108.34 million ounces in September from 108.25 million ounces last month ◆ It was the Germany’s first gold purchase since 1998 and while the amounts are not huge at 90,000 troy ounces, it highlights the Bundesbank and German concerns about the global monetary system and euro itself as Christine Lagarde takes over the ECB ◆ International...

Read More »IMF Warning: ‘World’s Financial System Is More Stretched, Unstable and Dangerous Than It Was On the Eve of the Lehman Crisis’

◆ The International Monetary Fund (IMF) has again warned that the world’s financial system is more stretched, unstable and dangerous than it was on the eve of the Lehman crisis ◆ Quantitative easing, zero percent interest rates and massive financial repression has pushed investors – and in the case of pension funds or life insurers, actually forced them – into taking on ever more risk ◆ Ambrose Evans-Pritchard analyses the IMF warning in The Telegraph and concludes...

Read More »Dutch Central Bank: Gold Bars ‘Always Retain Their Value, Crisis Or No Crisis’

◆ “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system” says the Central Bank of the Netherlands ◆ “If the system collapses, the gold stock can serve as a basis to build it up again” astutely and prudently observes the Dutch Central Bank ◆ The Dutch people “hold more than 600 tonnes of gold. A bar of gold always retains its value, crisis or no crisis” ◆ “Gold bolsters confidence in the stability of the central bank’s balance sheet and...

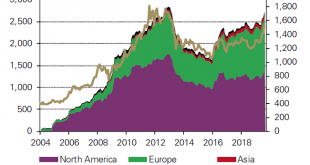

Read More »Gold ETFs See Holdings Reach All Time Record Highs In September

◆ Global gold ETF holdings reach all time record highs, increasing by 13.4% so far in 2019 on hedging and safe haven demand ◆ Global gold ETFs, ETCs and similar products had US$3.9bn of net inflows across all regions, increasing their collective gold holdings by 75.2 tonnes(t) to 2,808t, the highest levels of all time in September ◆ Gold ETF holdings have surpassed late 2012 levels, at which time the gold price was near US$1,700/oz, 18% higher than current levels. ◆...

Read More »China’s Central Bank Buys 100 Tons Of Gold As Trade and Dollar Tensions With U.S. Escalate

◆ China has added more than 100 tons of gold bullion bars to its gold reserves since it resumed buying in December; China’s gold holdings rose to 62.64m ounces in September, an increase of 190,000 ounces in one month ◆ The People’s Bank of China (PBOC) increased it’s gold reserves for a 10th straight month in September, reinforcing its standing as one of the major official accumulators as many creditor nation central banks stock up on the precious metal ◆ China and...

Read More »Chinese Buy Gold In Large Volume In Holiday Week as Gold Jewelry Sales ‘Soar’

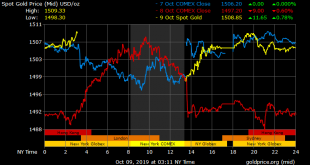

◆ Gold is marginally lower today at $1,503/oz and stocks are mixed ahead of what are set to be tense U.S. and China trade negotiations. ◆ Gold sales are expected to accelerate through the end of the year due to weakening global economic conditions, according to Mike McGlone, a Bloomberg Intelligence senior commodity strategist as quoted by China Daily (see below) ◆ Gold buying in China has fallen 3.3 (yoy) to 523.54 metric tons as safe haven buying of gold bars and...

Read More »World’s Largest Gold ETF Sees Holdings Rise 1.8 percent to 924.94 Tonnes In One Day

◆ Gold prices have inched 0.3% higher today as a sharp drop of nearly 2% yesterday has attracted bargain hunters ◆ Gold tested support at $1,500/oz after another peculiar sell off in the futures market saw prices fall $30 in two hours on the COMEX yesterday with most of the selling coming after European and London markets had closed ◆ The sell off came despite robust demand for gold globally as seen in the world’s largest gold ETF seeing yesterday, in just one day,...

Read More »Gold At 3 Week High As Stocks and Dollar Fall On Trump’s Hard Line Stance Against Iran and China

◆ Gold has edged higher to reach three week highs at $1,535/oz today after Trump took a hard-line stance on China and Iran during his U.N. speech ◆ Stocks fell in the U.S. yesterday and today in Europe on increasing political turmoil in the U.S. and the UK; Concerns about the global economy and the outlook for stocks is enhancing gold’s safe haven appeal ◆ Palladium has surged to an all time record high and we expect gold and silver to follow suit in the...

Read More »Central Bank Gold Buying Is “Sustainable and Indeed May Accelerate”

◆ Why central banks including China and Russia will keep buying gold due to concerns about the outlook for currencies, including the dollar and the euro, Mark O’Byrne, Research Director of GoldCore told Marketwatch ◆ While the gold tonnage demand from central banks in recent months has been significant and near records, gold remains a tiny fraction of most central banks’ massive foreign-exchange reserves,” O’Byrne says, adding that the trend is “sustainable and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org