◆ Prudent leaders in Eastern European countries are repatriating their national gold reserves and diversifying into gold due to geopolitical risks and monetary risks posed to the dollar, euro and pound ◆ Slovakia has joined China, Russia and a host of countries buying gold or seeking to repatriate their gold from the Bank of England and the New York Federal Reserve ◆ “Brexit and the risk of a global economic crisis put Slovak gold stored in Britain in a dangerous...

Read More »Global Gold Buyers Are ‘Confident’ in Gold

‘Retail Gold Insights 2019’ has just been published by the World Gold Council. It is a thematic analysis of their new consumer research survey. With a base of 18,000 participants across India, China, Russia, Germany, the US and Canada, we believe it is the largest ever consumer survey on the global gold market. 5 main themes of the report People are confident in – and loyal to – gold. Gold already has strong foundations and it’s important to know where that...

Read More »CNBC is careful to admit that owning GLD is not owning gold

Chris Powell of GATA writes today about how he finds it interesting that CNBC are careful to admit that owning the GLD ETF is not the same thing as owning physical gold, a theme that has run strongly throughout our market commentaries for many years. He writes… Two cheers for today’s CNBC report celebrating the 15th anniversary of the gold exchange-traded fund GLD, since the report does not pretend that owning GLD is the same as owning the monetary metal itself....

Read More »True US Economy About To Be ‘Revealed’ – Stockman Interview

David Stockman is the former budget director for President Ronald Reagan and author of “Peak Trump: The Undrainable Swamp and the Fantasy of MAGA” He believes that the market “can’t digest” all the money flooding into Wall Street and that the Federal Reserve responded with panic. Click Here to Watch the Full Interview David Stockman Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World ◆ GOLDNOMICS PODCAST – Episode 13 – Lucky for some ! ◆ Why is nobody...

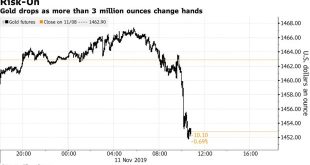

Read More »Gold Price Falls on Selling of Gold Futures Equal to 3 Million Ounces in 30 Minutes

◆ Gold price falls to a three-month low as concentrated selling of COMEX gold futures contracts equal to over 3 million ounces are sold in 30 minutes ◆ 33,596 contracts were aggressively sold in the 30 minutes between 10:00 and 10:30 a.m. New York time which is more than triple the 100-day average for that time of day ◆ This pushed the most active gold contract to as low as $1,448.90 an ounce, the lowest since August 5 as reported by Bloomberg (see chart below) ◆ It...

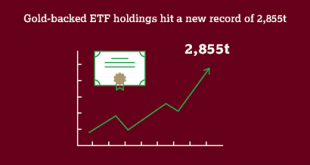

Read More »Gold ETF and Central Bank Gold Buying Supports Gold Demand In Q3

Gold demand grew modestly to 1,107.9 tonnes (t) in Q3 thanks to the largest ETF inflows since Q1 2016 ◆ A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3 ◆ Global central bank buying remained healthy but significantly lower than the record levels of Q3 2018 ◆ Central banks added 156.2t to reserves in Q3. Year to date, central banks have purchased 547.5t on a net basis, 12% higher y-o-y. The -38% monthly...

Read More »Time To Replace Bonds With Gold

◆ “It may be time to replace bonds with gold”according to the just released excellent new Investment Update by the World Gold Council. ◆ Central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns. ◆ As negative yielding debt increases alongside stock-to-yield valuations to all-time highs, gold may become an attractive and more effective diversifier than bonds, justifying a higher portfolio allocation than historical...

Read More »Global Economy Faces ‘Scary Situation’ – Billionaire Investment Manager Dalio Warns

Likely to have a downturn while “there is noteffective monetary policy and that is a ‘scary situation’ – Billionaire Investment Manager Ray Dalio [embedded content] Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World [embedded content] Related posts: JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’ Oil prices and the global economy SNB to cut rates in early 2020 as global economy sours – UBS...

Read More »Trump Pumps Market With Trade Talks, Stocks Move Higher, Gold Lower

Sue Trinh, Managing Director of global macro strategy at Manulife Investment Management, speaking on Bloomberg. She had some interesting comments regarding the current market structure, in the shadow of the FED, which is expected to drop rates yet again. Ms Trinh sees boosts in asset prices not translating into any real uptick in the real economy. She also sees some cracks in the one bright spark that is the US consumer. She points to lower US job openings in...

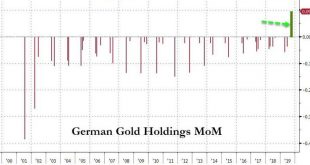

Read More »Bundesbank Buys Gold – Increasing Concerns About Deutsche Bank, European Banks, the Euro and Dollar

◆ The End Of Fiat In One Chart? ◆ For the first time in 21 years, Germany has openly bought gold into its reserve holdings ◆ With ECB mutiny and Deutsche Bank’s rapid demise, fears are rising of a looming financial crisis, and with that, Germany has shown a renewed interest in gold German Gold Holdings MoM, 1999-2019 - Click to enlarge ◆ Which came after Germany’s stunning announcement in January 2013 that the Bundesbank would repatriate 674 tons of gold from the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org