As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust. Because of this set of numbers, officials here as well as elsewhere around the world chose the most extreme form of pandemic mitigations, trusting...

Read More »Great Graphic: Euro Bulls Stir but Hardly Shaken

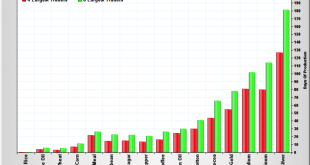

Summary: Euro has fallen 10.5 cents since mid-February. Net speculative longs in the futures market remain near record. Gross long euros have actually increased over the past month. When one trades futures, one declares whether one has an underlying business need, in which case one is considered a commercial. If no underlying business need exists, one is classified as a non-commercial, which in the vernacular of...

Read More »Great Graphic: Has Position Adjustment Begun in Treasury Futures?

This Great Graphic from Bloomberg shows the net large speculative positioning in the 10-year note futures over the past five years. They began last year with a huge next short position of more than 400k contracts. By May-June, the speculators had reversed themselves and were net long over 350k contracts. In the middle of December 2017, the net position was short again and peaked in early February near 327.5k contracts....

Read More »Great Graphic: Bears Very Short US 10-Year Ahead of CPI

Summary: Speculators have a large net short 10-year Treasury position. The gross short position is a record. CPI is likely to be softer, while retail sales may show a still robust consumer. The US reports January CPI figures tomorrow. The market seems especially sensitive to it. The main narrative is that it is an inflation scare spurred by the jump in January average hourly earnings that pushed yields higher...

Read More »Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

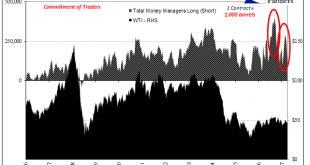

Read More »COT Report: Black (Crude) and Blue (UST’s)

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year. It was earlier in February when money managers piled in to WTI longs, apparently expecting better things...

Read More »Weekly Speculative Positions (as of August 29): Speculators Make Minor Position Adjustments, but Like that Aussie

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Positions (as of August 22): Sterling Bears Press, but Too Much?

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Positions (as of August 15): Speculators Add to Sterling and Peso Shorts, While Cutting Euro and Canadian Dollar Longs

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Weekly Speculative Positions (as of August 01): Speculators Press Ahead with Dollar-Bloc Currencies, but Hesitate with Euro and Yen

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org