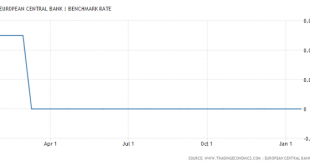

24 Heures. On Monday the franc went as low as 1.0825 to the euro, the lowest since early December last year. © Yulan | Dreamstime.com - Click to enlarge According to some experts, the weaker franc can be partly explained by the market activities of the Swiss National Bank (SNB). The cantonal bank of Thurgau said that the SNB appeared to be targeting a weaker franc ahead of the Dutch elections on Wednesday. Adding that...

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

Read More »What Vice Costs – The World’s Cheapest (& Most Expensive) Countries For Drugs, Booze, & Cigarettes

Indulging in a weekly habit of drugs, booze and cigarettes can cost you as little as $41.40 in Laos and a whopping $1,441.50 in Japan, according to the Bloomberg Vice Index. Bloomberg compared the price of a basket of goods — tobacco, alcohol, amphetamine, cannabis, cocaine and opioids — in more than 100 countries relative to the U.S., where your fix of the vices adds up to almost $400, or about a third of the weekly...

Read More »Swiss franc less overvalued according to latest Big Mac index

On 12 January 2017, the Economist came out with its latest Big Mac index. Also known as the burger benchmark, the index compares the price of a Big Mac around the world. This catchy, if highly incomplete means of comparing the relative purchasing power of different currencies, uses the United States and the US$ as its base. Countries where Big Macs cost less than in the United States (in US$ terms) have weak currencies,...

Read More »SNB Line in Sand Breaks, EUR/CHF under 1.08

We have always emphasized that the SNB intervenes between 1.08 and 1.0850. Even if there was no change in sight deposits the 1.08 “line in sand” broke. Via ForexLive US election jitters kicked in yesterday as concerns grow on the fall-out and we’ve seen a sharp rise in the franc across the board EURCHF yesterday fell through 1.0800 which has been widely perceived as the SNB unofficial CHF cap but they’ve been...

Read More »Switzerland has world’s priciest Big Macs. So eat Swiss chocolate instead.

The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency. As it did last year, Switzerland topped the chart this year...

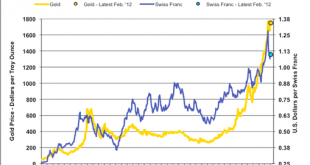

Read More »The relationship between CHF and gold

Gold versus Swiss Franc Many people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels. However the strong gold-CHF relationship broke from 1985 to 2007. Between 1985 and 2001: the reasons...

Read More »CHF Price Movements: Correlations between CHF and the German Economy

A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time. Correlations between CHF and the German economy The relationship between CHF and the German economy is very close for the following reasons: A big part of Swiss consumption is imported from Germany. Therefore, Swiss inflation...

Read More »El-Erian: Cash is more valuable than ever

Mohamed El-Erian says the global economy is at a crossroads. ‘Investors cannot rely on correlations as a risk mitigator,’ he says Investors shouldn’t underestimate the role of cash in their portfolios said Mohamed El-Erian, chief economic adviser at Allianz Global Investors. At a breakfast meeting with reporters on Monday, the former Pacific Investment Management Company chief executive said central bank asset...

Read More »Purchasing Power Parity, REER: Swiss Franc Overvalued?

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc were overvalued. Finally this claim is propaganda, because it is based on a not usable models (the REER and purchasing power parity) and wrong assumptions. The mistakes Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org