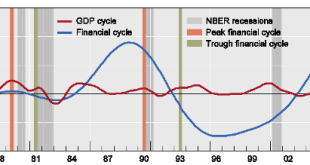

In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging Markets crisis. The last one culminated...

Read More »Economic Forecasts: Swiss Banks were too Optimistic

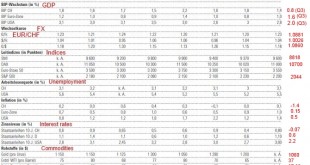

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates were far lower in 2015 than they expected. The forecast errors for stock indices and unemployment, however, were smaller. In December 2014, the Neue Zürcher Zeitung (NZZ) published the forecasts of the leading Swiss banks for the year 2015. UBS, Credit Suisse, Julius Bär, die ZKB, Raiffeisen, Pictet und J. Safra...

Read More »Switzerland to vote on ending fractional reserve banking

One year ago (and just two months before the shocking announcement the Swiss Franc’s peg to the Euro would end, dramatically revaluing the currency, and leading to massive FX losses around the globe and for the Swiss National Bank) the Swiss held a referendum whether to demand that their central bank should convert 20% of its reserves into gold, up from 7% currently. After the early polls showed the Yes vote taking a surprising lead, the Diebold machines kicked in and the result was a...

Read More »Will The Franc Follow In The Euro’s Footsteps?

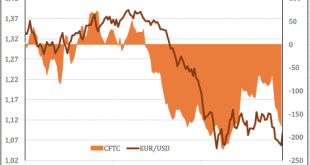

The SNB’s expected December 10 rate cuts have already been priced in to the Swiss Franc. The central bank’s failure to do more than the market expected resulted in a stronger CHF. Growing uncertainty over the Fed’s 2016 monetary policy is a bullish factor for the franc. As they watched the euro strengthen following the ECB’s meeting, SNB representatives rubbed their hands in glee. However, by the start of the Asian FOREX session, the franc was already recovering from its wounds. Now, Bern...

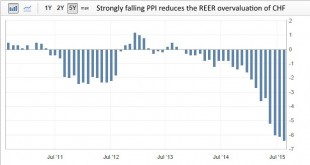

Read More »Purchasing Power Parity, REER: Is CHF Overvalued? (August 2015 update)

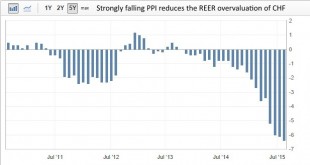

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values. The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong “base year”, i.e. to assume that in 1999 the CHF was correctly valued. The...

Read More »Lessons from History: The Volcker Moment and the First Cap on CHF

In 1978 the SNB established for the first time a cap on the Swiss franc, to prevent the inflows of American funds into Switzerland that escaped the US stagflation but caused some “imported inflation” in Switzerland, too. The Swiss introduced a DEM/CHF floor at 0.80 CHF on October 1, 1978, having known that the US government and the Fed were ready to fight inflation and the weak dollar. About one month later the FOMC hiked rates to 9%. Paul Volcker With the money supply (M1) targeting...

Read More »Purchasing Power Parity, REER: Is CHF Overvalued? (August 2015 update)

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values. The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong “base year”, i.e. to assume that in 1999 the CHF was correctly valued. The...

Read More »CHF

Newest Updates: Overview: Articles on the drivers of the CHF Exchange Rate: An article written in February 2012 that summarizes many of those points in an earlier version: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction. Will the EUR/CHF never rise over 1.22 or 1.23 again? On CHF Valuation: On money and real money: History and Background: Technicals and data: The curator is: George Dorgan...

Read More »Julius Bär’s Acket Talking Nonsense: Too Much Transparency on SNB Sight Deposits?

Acket: “Too much transparency is working against the SNB” Julius Baer Group Chief Economist Janwillem Acket argues today that by publishing weekly sight deposits, the SNB is telling the market too much. A more-mysterious SNB is a fresh option for a central bank that appears out of ideas. He also argues that using a basket of currencies, rather than the euro would allow them more flexibility. He points to Singapore as a successful example. Comment by Adam Button, Forex Live EUR/CHF...

Read More »Impressive Swiss Recovery After SNB Peg Removal

Retail data shows that the SNB peg removal in January 2015 as early as April 2015 with minimal adverse impact on the economy. Trade surplus showed that Switzerland had fully recovered its lost trade surplus in May and expectations crossed an important threshold into positive territory in June. CHF strengthened since May end, as the market caught wind of the Swiss recovery, and the Grexit would further strengthen the CHF if it were to occur....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org