In 1978 the SNB established for the first time a cap on the Swiss franc, to prevent the inflows of American funds into Switzerland that escaped the US stagflation but caused some “imported inflation” in Switzerland, too. The Swiss introduced a DEM/CHF floor at 0.80 CHF on October 1, 1978, having known that the US government and the Fed were ready to fight inflation and the weak dollar. About one month later the FOMC hiked rates to 9%. Paul Volcker With the money supply (M1) targeting since October 1979, Fed chairman Paul Volcker introduced the so-called “Volcker moment”. He hiked U.S. rates for a perceived unlimited time. This resulted into clearly positive real lending rates and helped to make safer US investments attractive again. Higher unemployment rates led to a recession and destroyed wage expectations and inflation. Finally the reason to buy Swiss assets nearly vanished, because the inflation difference U.S. to Switzerland fell to less than 1%, but U.S. rates remained high. Still in 1978, the US-Swiss inflation difference was at nearly 7%. SNB: High Yield Purchasing Power – return on bonds – helped to achieve positive equity again Despite massive losses on FX interventions, the Swiss National Bank could carry on its mission. In both 1971 and 1978 the bank went into negative equity, but the Swiss – at the time not member of the IMF – did not disclose this fact.

Topics:

George Dorgan considers the following as important: CHF, CPI, Georg Rich, intervention, Monetarist, Money Supply, Pierre Languetin, Volcker, Volcker moment

This could be interesting, too:

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Geopolitics Roil Capital Markets

Marc Chandler writes Fragile and Consolidative Tone Starts the Week in FX

Marc Chandler writes US Dollar Soars and US Rates Jump

In 1978 the SNB established for the first time a cap on the Swiss franc, to prevent the inflows of American funds into Switzerland that escaped the US stagflation but caused some “imported inflation” in Switzerland, too. The Swiss introduced a DEM/CHF floor at 0.80 CHF on October 1, 1978, having known that the US government and the Fed were ready to fight inflation and the weak dollar. About one month later the FOMC hiked rates to 9%.

Paul Volcker

With the money supply (M1) targeting since October 1979, Fed chairman Paul Volcker introduced the so-called “Volcker moment”. He hiked U.S. rates for a perceived unlimited time.

This resulted into clearly positive real lending rates and helped to make safer US investments attractive again. Higher unemployment rates led to a recession and destroyed wage expectations and inflation. Finally the reason to buy Swiss assets nearly vanished, because the inflation difference U.S. to Switzerland fell to less than 1%, but U.S. rates remained high. Still in 1978, the US-Swiss inflation difference was at nearly 7%.

SNB: High Yield Purchasing Power – return on bonds – helped to achieve positive equity again

SNB: High Yield Purchasing Power – return on bonds – helped to achieve positive equity again

Despite massive losses on FX interventions, the Swiss National Bank could carry on its mission. In both 1971 and 1978 the bank went into negative equity, but the Swiss – at the time not member of the IMF – did not disclose this fact. Today’s obligations to the IMF are different, our blog continuously tracks the SNB disclosures to the public and the IMF.

Moreover, in the 1970s the SNB possessed an explicit guarantee from the Swiss government. Having learned their lessons from the Swissair collapse in 2001, the new Swiss central bank act of 2003 established the SNB as corporation. In article 32, the shareholder rights in case of a SNB liquidation are detailed.

The high yield purchasing power with the regular income on high Fed Fund rates and on US treasuries of 9% yield and more helped the SNB to achieve positive equity again and to overcome the losses on the FX side. As we all know, rates are far lower today.

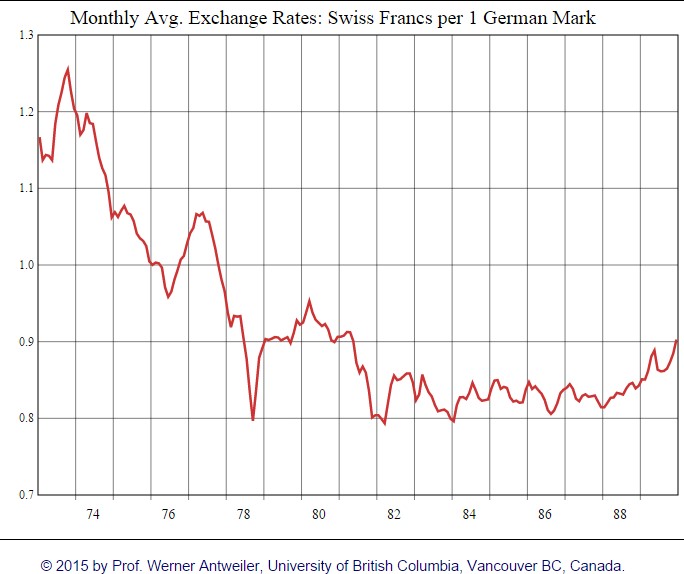

Introduction of a currency floor for the German Mark, A Mistake? In late September 1978, the German Mark (DEM) fell to 0.75 CHF. Having known about Volcker’s intentions in advance, the SNB introduced a floor of 0.80 for the DEM and promised unlimited currency intervention.

In late September 1978, the German Mark (DEM) fell to 0.75 CHF. Having known about Volcker’s intentions in advance, the SNB introduced a floor of 0.80 for the DEM and promised unlimited currency intervention.

Later, SNB president Fritz Leutwiler declared in private discussions with the chief economist Kurt Schildknecht that the cap on the CHF was a severe mistake.1. Effectively the German Mark was stronger than the franc during the 1980s: the Swiss CPI rose by 3.5% per year on average, but the German one by 2.78%. These price differences continued in the 1990s with the result that Switzerland became a so-called “high price island” (German “Hochpreisinsel”).One might argue that after all these years of high prices, the Swiss deserve deflation today.

In the following we take an old article from a French-speaking paper:

French speakers can go the next page to see the original French version:

The Introduction of the DEM/CHF floor in 1978 English translation from French:It was in 1976 that Pierre Languetin started at the SNB. He began a period that was “exhilarating but subject to strong tensions,” he said with paradoxical relaxation. “It was a long time ago, but my memories are intact,” reassuring us, before explaining the nature of the tensions.

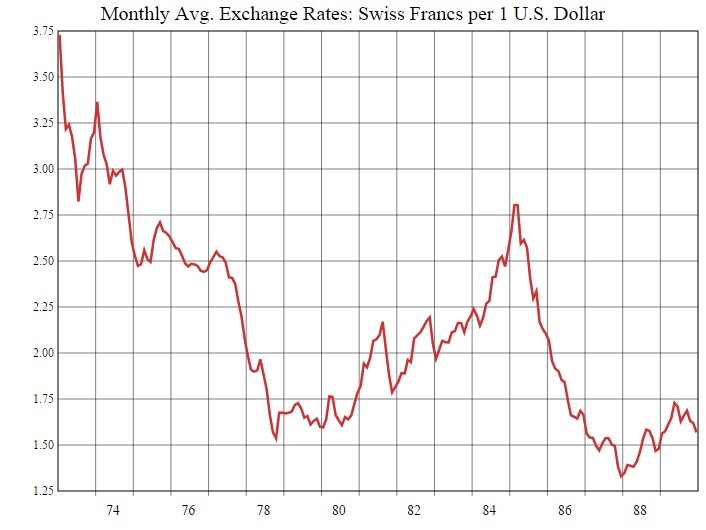

“Between late June 1977 and February 1978, the dollar rose from 2.46 francs to 1.79 francs. 27% in six months, it is comparable to a fall of 25% in the six months leading up to the historic low of 0.73 in August 2011. The SNB was under fire on all fronts. “Manufacturers would complain to Berne, remembers the former SNB number 3. And everyone turned towards us then.” Among other extraordinary measures, the SNB entered forward FX transactions with the textile, watch and timber industries to ensure an FX rate, which, if not advantageous, was at least stable; but in vain.

The Swiss economy started to really suffer from the weakness of the dollar.

Political pressuresOn 21 September 1978, the SNB council maintained a weekly meeting in Zurich, while bad news was piling up. Political pressures became particularly burdensome. The Swiss industry had huge problems. Several companies have been forced to close production lines due to the fluctuations of FX rates. The “National Council”, the parliament, started to become seriously impatient, as shown by internal discussions within the SNB.

The socialists started interpellations at the “Federal Council”, the government. They wanted to know what measures were planned to maintain employment. The left also wanted to know if Bern is ready to review the direction of monetary policy. Will they join the European Monetary Union?Will you attach the franc to the mark? Caught in the middle, the SNB was preparing a further tightening of controls (and discretionary) against capital inflows.

Before that, there were other requirements, the Swiss National Bank had some other fish to fry. As if nothing had happened that day, before discussing the situation on the currency markets and capital, the Executive speaks about banknotes. According to the extract from PV, “the Executive approves the sketch notes 10, 20, 50, 500 and 1000 francs.” One also wonders if, as a test, they should not at least print denominations of 50 and 100 francs. Today’s meeting is also an opportunity for the SNB council to decide … the Biel agency will close during the holiday season. The counters close at 15:30. Return to normal hours is agreed for January 3.

Will the dollar reach parity to the franc? after 3.75 in 1973…Six days later, on September 27. In the corridors of the institution, a rumour is circulating. The second package of measures being launched does not convince two economists at the SNB. Kurt Schiltknecht and Georg Rich also fear the consequences of political pressures involved. The SNB may eventually be removed from the open file, and they want to avoid the ultimate measure that has never been adopted in Switzerland: exchange controls.

The dollar is more than 1.45 to the franc, while it still 3.75 in 1973.The German mark was at 75 cents. “Some have wondered when the dollar will reach parity,” smiled Jean-Pierre Ghelfi. They will have to wait for thirty-two years, or until December 2010, when this symbolic threshold is crossed.

Still, this day, only four days before the start of an operation that is not practical, the two economists transmit a recommendation of three pages to their president, Fritz Leutwiler. In this “proposal for an improvement in the exchange rate,” an internal working document, they explain that since the currency market is no longer able to decide for itself the direction of the exchange rate; central banks should try to give a clear line. They call the SNB council to announce that the German mark will be set between 0.84 and 1 franc, and interventions will last until it goes back to 0.84 franc. “This kind of process is quite common within the institution,” says the chief archivist, Patrick Halbeisen. “It is normal that employees submit their ideas to their superiors.”

In the aftermath, Fritz Leutwiler convinces Kurt Schiltknecht. The President wants to know if the economists would rather support one goal of, setting “significantly above 0.80 francs.” Acquiescence. The floor is born. The ceiling, has never publicly existed.

The Americans are finally ready to oppose the weak dollarOn the 29th of the month, at the start of the regular meeting the decision was formally given birth, Fritz Leutwiler reported from Washington and New York a message, a month later, that showed its importance: the falling dollar also disturbs many U.S. officials. “Their willingness to oppose it lasts,” he says. But there is one obstacle: “The Congress, which is opposed to a restrictive monetary policy.”

Returned a few days before the president “to calm the Swiss,” Pierre Languetin add that extreme nervousness that was observed in the Swiss government. “It is important to keep their” notes the number 3 of the SNB. Fritz Leutwiler adds that these behaviors are “inappropriate”. “It is striking to see how our country is concerned about the future of unemployment. Our neighbors, despite having an unemployment rate persistently higher than ours, the atmosphere is much more serene,” he surprised him.

From a technical point of view, it is expected to weaken the franc by buying the dollar and other currencies. But not directly the mark. “The Germans were firmly opposed,” said Jean-Pierre Beguelin. “It is likely that they did not believe,” also remembers Peter Languetin. In fact, he says, the exchange rate of 80 francs for 100 deutsche mark was not really a floor. “I never approved this terminology,” said the annoyed former SNB number 3. This goal served as a “thermometer” to the SNB. “To learn how our actions worked and when we should stop,” he says.

The SNB leaders must convince the SNB FX Traders firstOn the morning of D-Day, October 1, the head of the trading room went to see Peter Languetin in his office at the SNB. He explained that his colleagues were reluctant to buy dollars. They struggle to believe this novel strategy. “Come and convince them,” he said. Pierre Languetin runs. “I spent a few hours with them. I told them 80,000 dollars? Buy them! 100,000? Go!” Mechanics is then introduced. “In four days, we purchased approximately $4 billion,” the figures are our witness.

Finally it worked and even the Fed bought dollarsIn the space of a few days, the mark rises above the threshold set. “It worked very well,” says Kurt Schildknecht today, one of the fathers of the strategy. “After some hesitation, the market was convinced that the situation would improve. And trafficking of capital was returned to normal,” he testified last year in an interview with Swissinfo.

A month later, as Fritz Leutwiler had foreseen, the Fed also announced that they would buy dollars. As it needs to borrow foreign currency in order to buy the own currency, the Fed then tried to borrow from other countries, including Switzerland.“You can imagine that we agreed …” Pierre Languetin says still smiling.

French speakers can go the next page to see the original French version References Schildknecht, K. (1994), Geldmengenpolitik und Wechselkurs: der schweizerische Weg, in: Alberini, F. von (editors), Schweizerische Geldpolitik im Dilemma: Geldmenge oder Wechselkurs, page 94 [↩] Page 112Next »