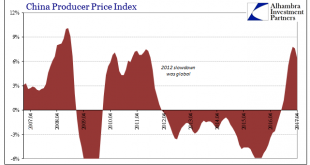

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

Read More »Blatant Similarities

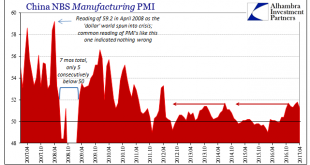

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows. While that might be erased next month as normal short run volatility, the indicators overall do seem to have stalled...

Read More »China: Blatant Similarities

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows. While that might be erased next month as normal short run volatility, the indicators overall do seem to have stalled...

Read More »Defining Labor Economics

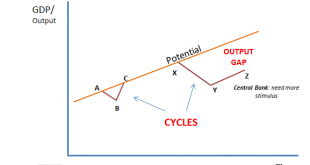

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to...

Read More »New Patterns of Disturbance

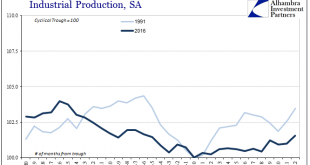

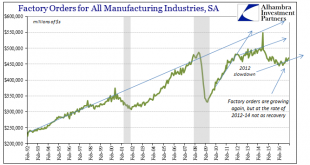

Having finally established that the economy of the “rising dollar” was appreciably worse than first estimated, we can turn our attention back toward figuring out what that means for the near future and beyond. According to the latest estimates for Industrial Production, growth has returned but in the same weird asymmetric sort of way that is actually common for the past decade. Year-over-year IP expanded by 1.5% in...

Read More »Durable Goods After Leap Year

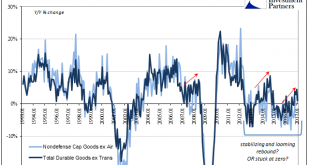

[unable to retrieve full-text content]New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

Read More »Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version. That would suggest that orders as well as shipments were somewhat better than they appear at least in in terms of...

Read More »Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them. At Janet...

Read More »Manufacturing Back To 2014

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but. The ISM’s gauge of orders increased to the highest level in just over three years, while an index of production...

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org