How do business cycles end? In the US, conventional wisdom is that they are murdered by the Federal Reserve. It is too slow to raise rates and then goes too quickly. This view is espoused by numerous well-respected economists and policymakers. President Trump’s criticism of the Federal Reserve is anchored by such views. America’s ambivalence toward a central bank is around 200-year old. It was the Panic of 1893 that...

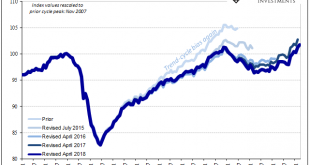

Read More »Why The Last One Still Matters (IP Revisions)

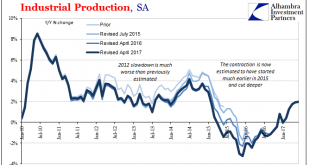

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »Giant Sucking Sound Sucks (Far) More Than US Industry Now

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really...

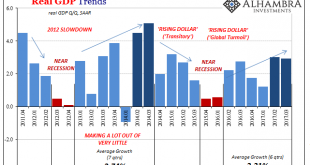

Read More »Strong Growth? Q3 GDP Only Shows How Weak 2017 Has Been

Baseball Hall of Famer Frank Robinson also had a long career as a manager after his playing days were done. He once said in that latter capacity that you have to have a short memory as a closer. Simple wisdom where it’s true, all that matters for that style of pitching is the very next out. You can forget about what just happened so as to give your full energy and concentration to the batter at the plate. They also say...

Read More »More Noise Than Signal

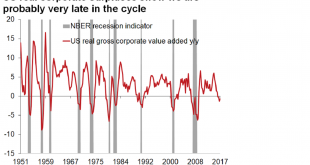

A number of people have forwarded this Bloomberg article – Wall Street Banks Warn Downturn Is Coming – to me over the last couple of days. That fact alone is probably a good argument to ignore it but I can’t help but read articles like this if for no other reason than to know what the crowd is thinking. The gist of the article is that a bunch of sell side analysts think we are nearing the end of the current business...

Read More »United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general. But even in our domestic...

Read More »U.S. Industrial Production: Industrial Drag

Completing a busy day of US economic data, Industrial Production was, like retail sales and inflation data, highly disappointing. Prior months were revised slightly lower, leaving IP year-over-year up just 2% in June 2017 (estimates for May were initially 2.2%). Revisions included, the annual growth rate has been stuck around 2% now for three months in a row, suggesting like those other accounts a pause or even...

Read More »Retail Sales Conundrum

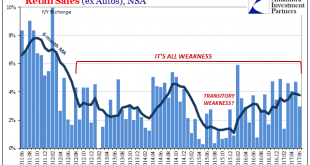

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January. The economy in 2017 is not...

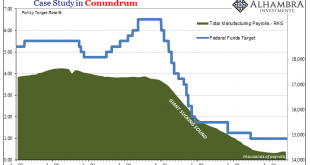

Read More »US S&P 500 Index, Federal Funds Target, Manufacturing Payrolls, US Imports and US Banking Data: All Conundrums Matter

Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s. But that latter example wasn’t truly the first conundrum for monetary policy. There remain a great many...

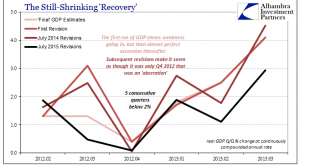

Read More »Hopefully Not Another Three Years

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org