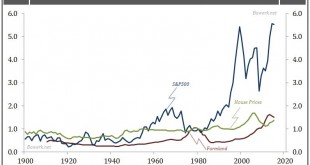

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated, by the whims of financial markets, clearly led to higher asset prices. Investors obviously picked up on the strong bias in the Greenspan-Fed’s conduct of monetary policy as they slashed rates at the tiniest hiccup in financial markets, and...

Read More »Revolutionary Guards: The Way of the Iranian Future

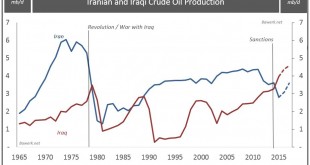

Iranian elections have supposedly put a very nice ‘moderate’ spin on Iranian politics in parliamentary ranks, and more importantly, Assembly of Experts composition. While it would be churlish to deny, it represents a significant step forward for President Rouhani’s agenda to 2017, albeit a number of vital caveats remain for how real any political shift actually is. We’ll do the Parliament first, and then move onto the Assembly second. With a ‘grand finale’ of what it means for Iranian...

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

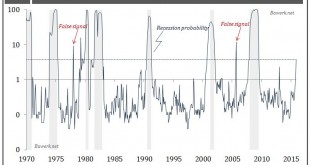

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More »Can Maduro Mayhem Last to 2017

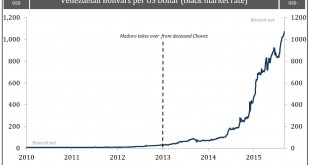

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legislative majority to start holding the government to account. Right on cue, Mr. Maduro just railed a decree through the Supreme Court (TSJ) giving him total control over budgetary measures, utilize any property, suspect constitutional rights...

Read More »Can Maduro Mayhem Last to 2017

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legislative majority to start holding the government to account. Right on cue, Mr. Maduro just railed a decree through the Supreme Court (TSJ) giving him total control over budgetary measures, utilize any property, suspect constitutional rights...

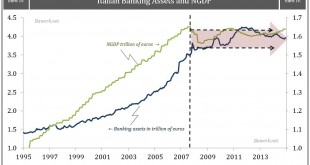

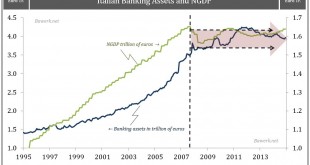

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

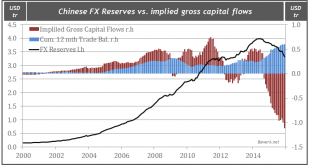

Read More »China’s 3 trillion dollar mistake

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in...

Read More »What the Fed Did NOT do

We will not spend much time discussing what the FOMC did as tons of ink have been spilled on that already. We will rather spend more time on what the FOMC did not do. A short recap will suffice; the FOMC did raise the interest rate band by 25 basis points to 0.25 – 0.5 per cent from the seven yearlong band of 0 – 0.25 per cent. No surprise there as this move was well communicated weeks in advance. As discussed in Unintended Consequences of Liftoff the recent move to secure a floor in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org