ECB press conference June 2 2016 Held in Vienna with Governor Nowotny Keep key ECB interest rates unchanged Will be kept at present or lower for an extended period of time, exceeding asset purchase program (80bn per month) which will end March 2017 sector program will start June 8 TLTRO start in June New measures will strengthen growth in euro area through credit expansion Very low inflation must not become entrenched in second round effects through effects on wages and prices. ECB...

Read More »Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has been driving the mainstream macroeconomic debate ever since. The question raised in this debate is how policy-makers can credible commit to promises made today when future events may cause short-term pain if restricted by stringent rules...

Read More »Fed Suppression, Long Term Economic Repression

The Federal Reserve really wants to raise rates, but they do not dare as the consequence of interrupting an unprecedented level of capital misallocation is too grave to face head on. So our money masters continue their low interest rate policy; pulling society further and further into a capital structure that cannot be sustained long term. In other words, scare capital is consumed in order to feed the present structure of production. Low rates thus cement what cannot be upheld and the...

Read More »OPEC Politics: Russian King, Iranian Crown Prince?

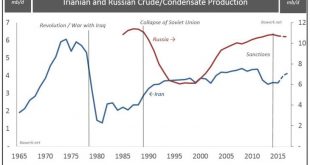

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town. It comes in the form of Russia; the number one global producer that’s not even technically a member of the cartel. Confused? Don’t be. The argument is quite simple. Irianian and Russian Crude/Condensate Production Iranian and Russian Crude/Condensate Production – click to enlarge. Unlike...

Read More »The ‘Strange’ Death of Mr. Abadi

As expected, Iranian Prime Minister Abadi was always going to come off worse in his last ditch attempt to try and regain some kind of political initiative by appointing a new look ‘technocratic’ government in Baghdad. But the ailing Prime Minister has managed to back himself into a particularly tight corner after being outplayed by Muqtada al Sadr, Iyad Allawi and even Nouri Al Maliki. Rather than sticking to his ‘technocratic guns’ Abadi blinked first on cabinet changes, by allowing more...

Read More »Hillary Will be the Least of Your Worries – America has Economic Diarrhea

Economic Expansions and Recessions in the US since 1900 According to the National Bureau of Economic Research (NBER), the official recession arbiter, the US economy is currently at its fourth longest expansion in history. By the sheer nature of a capitalistic society with its inherent cyclicality it is a safe bet that a new economic recession will hit in the not too distant future. We have argued since June last year that the next recession is imminent and we now feel increasingly...

Read More »Chinese Dragon: Breathing Credit Fumes

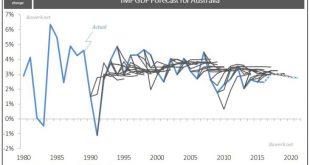

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate. However, spending millions of dollars to do the job of a ruler doesn’t seem like wise...

Read More »Circulus in probando

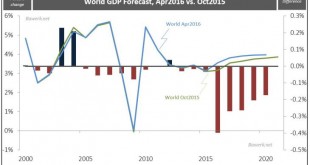

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that...

Read More »OPEC’s Doha Dilemma: 3mb/d US lock in?

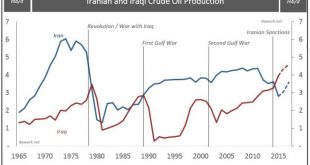

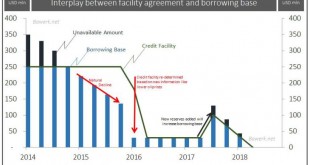

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs. Another month, another flight to Hamad international airport for 17th April after initial agreement to hold ‘upstream horses’ in February 2016. While it’s no doubt great fun getting back...

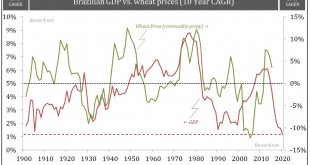

Read More »Latin America – Seven Ugly Sisters in Deep Political Trouble

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices. It’s merely a case of who’s in more advanced states of political decay where left leaning governments’ can’t hang on much longer vs. those trying to buy a bit of time with more ‘centrist’ positions. In...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org