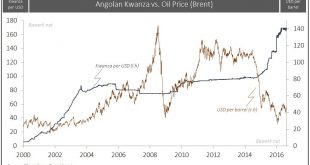

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August. That also...

Read More »Toward Stagflation

Norway Real House Price Per M2 We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved...

Read More »The FOMC Butterfly that Will Ruin the World

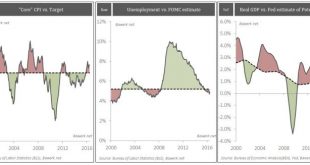

Imagine the financial crisis knocked you out and you did not wake up from the coma that followed until this day. Then, presented with the following three charts you were asked to guess where the federal funds rate was trading. Given the fact that the core CPI is on a steep uptrend and currently over the arbitrarily set 2 per cent target; unemployment below what the FOMC regards as full employment and; GDP running at a...

Read More »Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something...

Read More »Money confuses and blurs economic relations

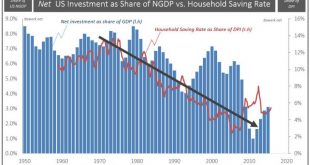

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters. To be clear, our long term geostrategic position remains unchanged; China moving towards the ‘nine dash’ line China will gradually secure control of...

Read More »China the lender of last resort for many oil producers

Summary: Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs. It took a while to play through, but our assessment that China would increasingly become the petro-state lender of last resort is starting to come good. The...

Read More »Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

We have seen several explanations for the financial crisis and its lingering effects depressing our global economy in its aftermath. Some are plain stupid, such as greed for some reason suddenly overwhelmed people working within finance, as if people in finance were not greedy before 2007. Others try to explain it through “liberalisation” which is almost just as nonsensical as government regulators never liberalised...

Read More »Saudi-Arabia: Peg or Banking Crisis?

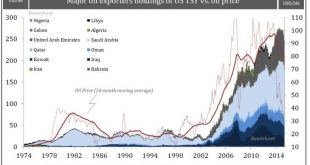

Oil exporters recycled their dollar in US treasuries During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the very centrepiece of this elaborate system and it is thus no surprise to see the dollar price correlate well with overall OPEC TSY holdings. In other words, when oil prices were high, oil...

Read More »OPEC’s Game within a Game

The fact OPEC just agreed to agree on nothing in Vienna isn’t particularly surprising given Doha wounds are still festering from the last attempt at ‘petro-diplomacy’. But the engagement ultimately has to been knocked up as a partial success for Saudi Arabia, where it’s managed to put itself back at the centre of cartel politics by thawing the ‘freeze discussion’ on Riyadh’s terms. Confused? Don’t be. As we flagged in OPEC Politics, Doha’s failure left a very dangerous door open for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org