There is sometimes a tendency to confuse ends and means. For example, in traveling through an airport there is extensive inspection of passengers. Before you are allowed to board an airplane, you must go through a process that is intrusive and increasingly invasive. This is deemed to be security. How do we know it makes us secure? Because it is annoying. See the switcheroo? The degree of disruption of your schedule and possessions bears only a faint relationship to...

Read More »Inflation or Lockdown Whiplash?

Mainstream analysis sees rising consumer prices, and looks for a monetary cause. Also, when it sees an increase in the quantity of dollars, it looks for rising consumer prices. It is a fact that the quantity of what the mainstream calls money (i.e. the dollar) has risen at an extraordinary rate. The M0 measure has nearly doubled since the start of Covid. It is also a fact that many prices have jumped up significantly. So only one question is open for debate. Is...

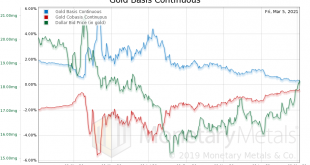

Read More »What the Heck Just Happened to the Price of Gold and Silver?!

[unable to retrieve full-text content]The price of gold (and silver) was on a tear in April and May. Then some sideways action. And then this week, thud. On Twitter, a popular meme is that the banks smashed the price by selling futures contracts, though there was no selling of gold bars. Let’s just say that if the price of an August contract fell by $120, while the price of a gold bar held steady, there would be a backwardation of around 40%!

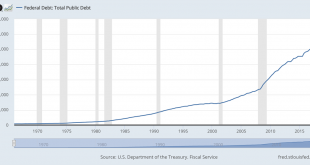

Read More »Resetting the Federal Debt

According to the US Treasury, the federal government owes $28.2 trillion. It crossed the “28” threshold on the last day of March. The debt was just under $25 trillion at the end of April a year ago. There’s no question it’s growing at a faster and faster pace, and now there’s the excuse of Covid to spend more. Keep in mind, this is only that part of the total liabilities that the government chooses to acknowledge. If it reported its financials the way all...

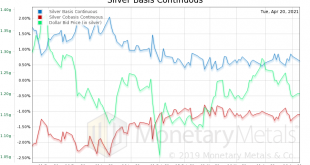

Read More »A Deeper Dive Into Silver

The prices of the metals hit their lows by the end of April. Gold traded for around $1,685, and is now over $1,900. Silver was around $24, and is now over $28. These are big moves (though of course nothing like bitcoin). Both metals are subject to the persistent belief that their prices are greatly suppressed. But right now, silver is widely believed to be in a global shortage. We have explained this as a shortage of retail products, most especially one-ounce silver...

Read More »The Truth about the Silver Squeeze

Some recent videos about the silver market are generating more buzz than we have seen in a while. They make several points, but the main one is that there is a global shortage of silver. This assertion stands in contradiction to the fact that the silver price has dropped. As of the date of the first of these videos, it had dropped around 10% from its level just a month earlier. An 8th grader is a good litmus test for ideas in economics and markets. What would a...

Read More »The Fedcoin is Coming, 8 March

Before we talk about Fedcoins, let’s look at the old school non-digital, non-blockchain, coin. Gold. And silver. Since January 4, the price has dropped about $244. And the price of silver has fallen about $4. Are these buying opportunities? Or the end of the brief gold bull market of 2020 (i.e. Covid)? It helps to return to the idea that gold is the unit of measure of value. Not as a rhetorical device to sell gold, but because it gives a clearer picture. If one...

Read More »Reddit Residue on Silver, 3 February

The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal. To be sure, there was retail buying. But even if they depleted the finite inventories of Eagles and Maples, they were not the buyers that pushed the price up to $30. That would be the futures speculators....

Read More »Ruh Roh Silver

Sometimes you can count on the manipulation conspiracy theorists to get it exactly wrong. Not just a little bit wrong, nor halfway wrong. Not even mostly wrong. Totally wrong, backwards. Michael Crichton, in talking about the Gell-Mann Amnesia Effect said this: “You open the newspaper to an article on some subject you know well. In Murray’s [Gell-Mann] case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding...

Read More »That Precious Metals Rumor Mill, 30 November

We are hearing rumors this week of a shortage of the big silver bars, the thousand-ouncers. No, we don’t refer to bullion banks saying this. Nor big dealers, who are happy to sell us as many of these as we can buy. Nor our peeps in high places (we don’t claim to have any such peeps). We refer to the usual suspects. We talk about abundance and scarcity of the metals in nearly every one of these reports, in terms of the spread between spot and futures prices. Some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org