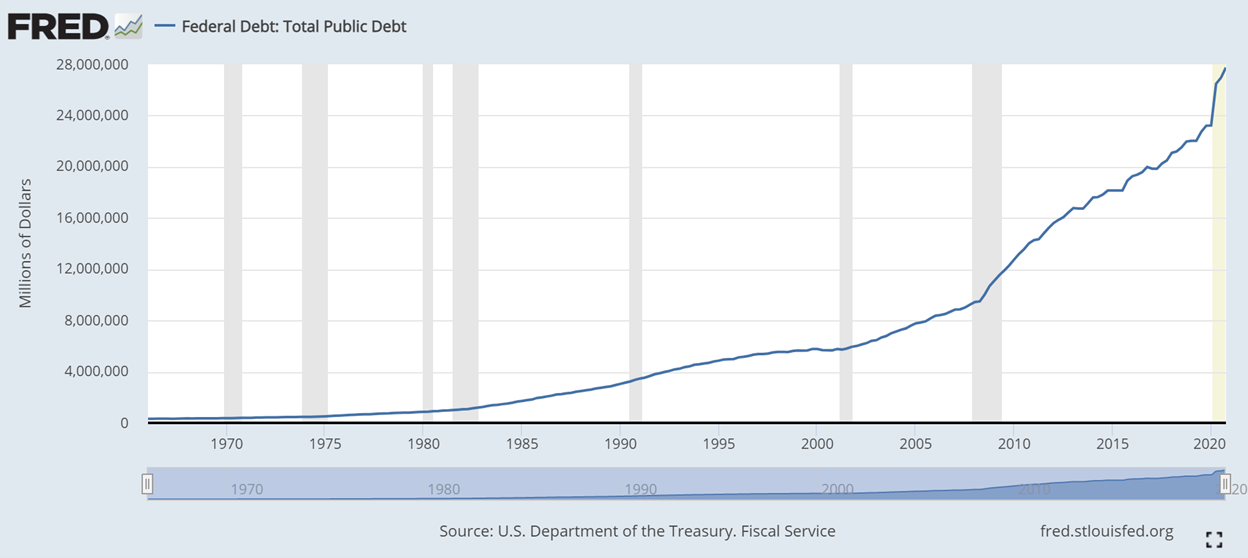

According to the US Treasury, the federal government owes .2 trillion. It crossed the “28” threshold on the last day of March. The debt was just under trillion at the end of April a year ago. There’s no question it’s growing at a faster and faster pace, and now there’s the excuse of Covid to spend more. Keep in mind, this is only that part of the total liabilities that the government chooses to acknowledge. If it reported its financials the way all substantial businesses do, then the number would not be a mere trillion but well over 0 trillion. An eighth-grader can see that this debt cannot be paid. Federal Debt: Total Public Debt, 1970 - 2020 - Click to enlarge The problem is debt, which cannot be paid Leaving aside that there is no political

Topics:

Keith Weiner considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, Basic Reports, Featured, Gold Exchange Report, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| According to the US Treasury, the federal government owes $28.2 trillion. It crossed the “28” threshold on the last day of March. The debt was just under $25 trillion at the end of April a year ago. There’s no question it’s growing at a faster and faster pace, and now there’s the excuse of Covid to spend more.

Keep in mind, this is only that part of the total liabilities that the government chooses to acknowledge. If it reported its financials the way all substantial businesses do, then the number would not be a mere $28 trillion but well over $100 trillion. An eighth-grader can see that this debt cannot be paid. |

Federal Debt: Total Public Debt, 1970 - 2020 |

The problem is debt, which cannot be paid

Leaving aside that there is no political will to even attempt it—most people seem happy to borrow more to spend more—it isn’t even mathematically possible. $28 trillion is an additional debt burden of about $280,000 on each and every person who works in the private sector. This is on top of their respective burdens of state government debt, county, city, and municipal water district, plus corporate, business, home, car, credit card, and student loan debt.

That the debt is unpayable may be obvious, but the endgame is not obvious at all. At first glance, it looks like the government will default. However, as the issuer of its own currency—and the world’s reserve currency at that—there is no reason to default.

The government can always get as many dollars as it needs. It can always sell more bonds.

This was the (evil) genius of President Roosevelt’s move in 1933 to make the dollar irredeemable to Americans. And President Nixon’s move in 1971 to make it irredeemable even to foreign central banks. It traps the nation’s savings (the world’s savings). It makes everyone a creditor to the government.

If you own a Treasury security, then you are directly lending to the government. If you own a Federal Reserve Note or have a bank deposit, then you are indirectly lending to the government through an intermediary.

You can buy real estate, stocks, or even gold. But the seller gets the dollars, and he is trapped in the same closed system. He is trapped into lending to the government.

With such a scheme, there is no way that the Treasury can ever run out of dollars. So long as the Treasury is selling more bonds to borrow more to increase its spending, there is no way that the Fed can run out of Treasuries to buy either.

Where does the purchasing power of the dollar come from?

In theory, people might refuse to accept the Fed’s credit paper. But in practice there’s a critical reason people haven’t yet, and why they aren’t close to refusing it even now at the $28 trillion mark. What is it?

Producers of all kinds of goods provide a ferocious and relentless bid for the dollar.

Nearly every producer—from farmers and miners, to manufacturers, to shippers, to distributors, and retailers—has borrowed to finance their productive assets. This means they owe dollars. They must grow enough wheat, mine enough ore, manufacture enough plastic parts, carry enough containers of goods, and sell enough stuff to make enough dollars of profit (revenue minus expenses) to service their debts. Failure to service one’s debts results in foreclosure.

So producers are frantically dumping their goods to get what price they can fetch. They are pushing prices down (though ever-increasing mandatory useless ingredients can slow this trend, and Covid-related disruptions to the supply chain can temporarily distort it).

Most people think of the value of a currency in terms of its purchasing power. Purchasing power is strong, thanks to the struggles of the indebted producers. And every time the interest rate drops (it has been dropping for 40 years), productive businesses are incentivized to borrow more to increase productive capacity. Unfortunately, so are their competitors. None of them can get ahead. The net result is falling unit margins.

Whatever the name for this dynamic is, hyperinflation is not it.

Many readers have a choice not to hold a money dollar balance (that’s why they’re reading articles like this one). They can, if they wish, hold gold( i.e. money). But indebted producers are not in a position to incur the price risk. The bigger your debts, and especially the bigger your debt service payments, the riskier it is to hold gold or anything else other than dollars.

If you think about it, it should not be surprising that the dollar regime is stable (or at least pseudo-stable). Its flaws have existed for a long time, yet it keeps on keeping on.

The Irony of Wendy’s Honey Butter Chicken Biscuits at $1.99

It’s an exquisite dilemma, and a delicious irony. The producers have been progressively lured to go deeper and deeper into debt—and thereby finance more and more capacity—by lower and lower interest rates. Whomever did not want to borrow at 10%, surely was tempted at 9%. And if not at 9%, then at 8%, etc.

Their rising debts must be serviced by selling more and more goods at lower and lower margins. Margins fall, because their competitors also borrow to produce and sell more goods. Falling interest is thereby a powerful downforce on prices.

To people who think of the value of the dollar as the inverse of consumer prices, it appears there is indeed little problem with the dollar at all!

Yet the quantity of dollars not only keeps rising, but rises at a faster and faster rate. Mainstream theory says this should cause skyrocketing prices. And so many economists have made bold predictions of severe inflation or even hyperinflation. Their chorus is especially loud today.

However, we note current TV ads for Wendy’s Honey Butter Chicken Biscuits. $1.99. Not even counting the cost of the flour and butter, and chicken, how much labor goes into making, distributing, preparing, and serving that biscuit?

Or look at cars. There is currently a very real disruption to the supply of chips that go into them, but even so manufacturers keep offering 0% interest on financing for six long years.

Purchasing power is strong, indeed. However, government debt is on an unsustainable trajectory. What cannot be sustained, will not be. So how will it end?

The true meaning of Inflation and its destructive effects

We use the term inflation in a specific way. We do not mean an increase in the quantity of dollars, nor the presumed effect, which is an increase in prices. We mean the dishonesty of calling it “borrowing” when you lack the means and intent to repay. This is a monetary fraud. It is not a problem of aggregate statistics, but of economic soundness (and of course morality).

Anyone who lends to a fraudster will not be repaid. The only question is when the default occurs. Until that point, the fraudster’s paper may change hands in a thousand, thousand different transactions.

There is no magic number, no threshold at which the debt transforms from “it’s not a problem” to “it’s a problem”. There is no particular quantity of debt that predicts the crisis. Nor any particular ratio of debt to GDP.

So where do we look?

Savers are free to hold gold. But where’s the urgency? The producers of all the things they would purchase are borrowing more to produce more to lower the cost of said purchases. With the purchasing power of the currency not falling (or even rising), where is the signal that says “dump all your dollars, this is IT”?

In other words, “gold is not going up,” say most people, “why should I buy it now?”

Of course, every saver should own some gold. Not because producers won’t be dumping more and more merchandise on the dollar bid price. i.e. not because of falling purchasing power. But because giving your surplus income to the government to consume in a welfare scheme is an eventual forfeit to your savings.

Anyways, even if the people did dump all their dollars, that would push down the value of the dollar but it would not address the problem that the debt is already unpayable. Whether gold is $200, $2,000, or $200,000 the debt problem continues to expand. Whether oil is $20, $60, $600, or $6,000, the debt problem continues to expand. The problem keeps growing in magnitude.

There is no way to reset the debt, but there is a solution, and it includes gold

We’ve diagnosed the problem as unsustainable debt produced by the irredeemable dollar system. If this is the correct diagnosis, then an effective solution must address it.

What if debtors could replace their dollar-denominated debt, with gold-denominated debt? Unlike dollar-denominated debts which are paid in dollars which are themselves debt-backed instruments, gold-denominated debt is extinguished when paid in gold. The money is returned to the savers who lent it.

When savers hold dollars, which by nature and definition must be somebody’s liability, they are creditors. They cannot have dollars and at the same time be paid off. There is no such thing as a magnetic monopole, a North without a South. A dollar without a debt and debtor on the other side of the trade. Gold does not suffer from this fatal flaw. One can own a gold coin without anyone owing anything.

Productive companies need a way to get out of debt, the economy needs a way to extinguish debt, and the taxpayers need the government to get out of debt. A market for savers to redeem outstanding paper bonds in exchange for new gold bonds will accomplish these objectives.

It must be a market for the free exchange of paper bonds for gold bonds. It cannot be forced. It wouldn’t work for the Treasury or the Fed to declare that the price of gold will henceforth be fixed at $2,000 or $20,000.

People should have the choice, uncoerced, to trade a paper bond for a gold bond. We will see how strong the preference is for gold vs uncertain-dollars to be paid in the future. This preference will be expressed as a discount. That is, a debtor can get out of a dollar of debt for less than a dollar of gold financing.

Monetary Metals has issued the first gold bond in 87 years, with many more coming. If you’re interested in receiving more information, please fill out the form on this page (Note: gold bonds are available to accredited investors only). The company is on a mission to remonetize gold, and let it perform the one function for which there is no substitute. To extinguish debt.

Tags: Basic Reports,Featured,Gold Exchange Report,newsletter