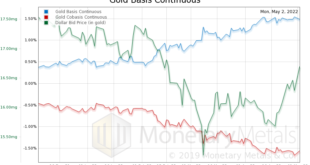

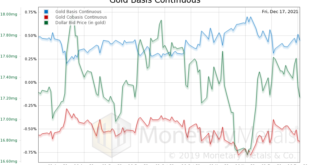

The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month. However, it’s been behaving differently than gold behind the scenes. Let’s look at the gold and silver basis charts to see. Gold Fundamentals – Gold Basis Analysis The gold basis (i.e. abundance to the market) was humming along around 0.5%. Then, as the price began to rise, it rose...

Read More »Oil, the Ruble and Gold Walk into a Bar…Part III

Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else? What A Gold Standard Isn’t Can we all recognize the simple fact that every government price-fixing scheme, ever, has failed? For example, banana republics have declared their pesos to be worth $1. But when the market decides to redeem pesos for dollars 1-to-1, the...

Read More »Oil, the Ruble, and Gold Walk into a Bar…

[unable to retrieve full-text content]Part I – Unpacking the narrative of how Russia is going to change the global monetary system. There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause...

Read More »Human Action in the Silver Market

Sorry, I've looked everywhere but I can't find the page you're looking for. If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page: Search Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dweiner+human+action+silver+market ...

Read More »This is Not The Silver Breakout You’re Looking For!

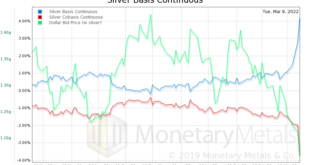

To listen to the audio version of this article click here. Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices. Oh well. Our consolation is that they most likely are not calling for lower silver prices based on the same indicator we observe. The basis. Here is the chart. Silver Price Basis Chart...

Read More »Inflation and Gold: What Gives?

Listen to the audio version of this article here! In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the: “…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.” Since then, Ireland has bought gold for the first time in over a decade. And predictably, most voices in the gold...

Read More »What’s In Your Loan?

To listen to the audio version of this article click here Opposing Monetary Directions “Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars. “What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!”...

Read More »Perversity Thy Name is Dollar

[unable to retrieve full-text content]Breaking Down the Dollar Monetary System If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar.

Read More »Rising Fundamentals of Gold and Silver

[unable to retrieve full-text content] Prices move up and down, in the restless churn of our irredeemable monetary system. There are several schools of thought whose theories attempt to describe, if not predict, the next price move.

Read More »Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold. What Happened to Gold After the Gold Standard? It...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org