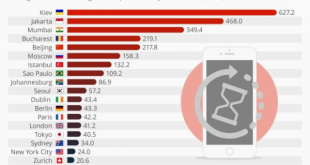

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone 6 in under three working days. In Kiev, by contrast, it would take 13...

Read More »“We want to be more Swiss again”

Mr. Gottstein, we're meeting the morning after Stan Wawrinka beat Novak Djokovic in the US Open. How long did you watch last night? Truthfully? I put the kids to bed, and I was only planning to watch the first set. But I stayed up for the whole thing, and when I looked up at the clock, it was 2:46 am. A fantastic match. Wawrinka is a perfect example of Swiss values in the world – just like Roger Federer, but in his own unique way. Nevertheless, my alarm went off at six this...

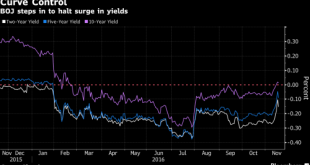

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »1+1=3? The Synergy of Analog and Digital Banking

Mr. Abele, few industries today operate to such a degree at the juncture between analog and digital as the financial sector. On one hand, digitalization has caught up to the banks, while on the other hand, the financial business functions through personal relationships, discretion and tailored consultation. How can you resolve this conflict? That's the wrong question, in my view. Digital and analog are not binaries, but are more along the lines of the synergy equation: 1+1=3. New...

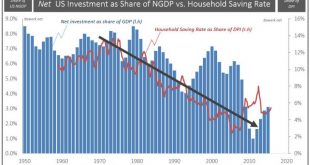

Read More »Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

We have seen several explanations for the financial crisis and its lingering effects depressing our global economy in its aftermath. Some are plain stupid, such as greed for some reason suddenly overwhelmed people working within finance, as if people in finance were not greedy before 2007. Others try to explain it through “liberalisation” which is almost just as nonsensical as government regulators never liberalised...

Read More »China’s Internet Giants Play Leapfrog in Online Finance

Online sales juggernaut Amazon has a toe in the Internet finance business, processing payments and offering loans to the site’s merchants. What about its Chinese counterpart, Alibaba? It does those things, too. It also facilitates peer-to-peer lending, sells mutual funds and insurance policies, and has formed a private bank to lend to consumers. Who’s leading the Internet revolution now? From a modest start in processing online payments, Alibaba, online media and entertainment firm...

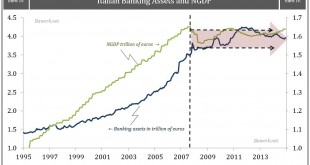

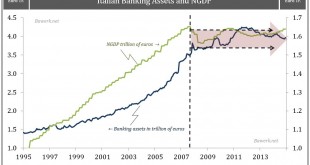

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org