The following is an excerpt from David Enrich's nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at Citigroup, kicking government investigations into interest-rate-rigging into a...

Read More »To The Asian ‘Dollar’, And Then What?

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

Read More »Where There’s Smoke…

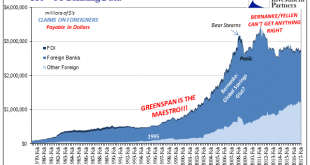

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »We Need To Define The ‘Shadows’, And All Parts of Them; or, ‘Rising Dollar’ Kills Another Recovery Narrative

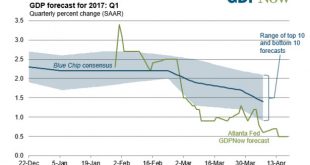

JP Morgan’s CEO Jamie Dimon caused a stir yesterday with his 45-page annual letter to shareholders. The phrase that gained him so much widespread attention was, “there is something wrong with the US.” Dimon mentioned secular stagnation and correctly surmised it was the right idea if for the wrong reasons. He then gave his own which included a litany of globalist agenda items, including not enough access to mortgages. I...

Read More »Credit Suisse Offices Raided In Multiple Tax Probes: Gold Bars, Paintings, Jewelry Seized

Credit Suisse has confirmed that the Swiss bank, some of its employees and hundreds of account holders are the subjects of a major tax evasion probe launched in UK, France, Australia, Germany and the Netherlands, setting back Swiss attempts to clean up its image as a haven for tax evaders. According to Bloomberg, Dutch investigators seized jewellery, paintings and even gold bars as part of a sweeping investigation into...

Read More »Credit Suisse Offices Raided In Multiple Tax Probes: Gold Bars, Paintings, Jewelry Seized

Credit Suisse has confirmed that the Swiss bank, some of its employees and hundreds of account holders are the subjects of a major tax evasion probe launched in UK, France, Australia, Germany and the Netherlands, setting back Swiss attempts to clean up its image as a haven for tax evaders. According to Bloomberg, Dutch investigators seized jewellery, paintings and even gold bars as part of a sweeping investigation into tax evasion and money laundering in the Netherlands. They added that the...

Read More »“Most of the financial institutions left the region. We stayed.”

As a child, he left communist-era Prague for capitalist Jakarta and lived through the massive effects of the Asian crisis. Helman Sitohang has worked for Credit Suisse for nearly 20 years. As CEO for the Asia Pacific region, he knows that his customers attach great importance to loyalty. Manuel...

Read More »Money, Banking, and Dreams

In another excellent post on Moneyness, J P Koning likens the monetary system to the plot in the movie Inception, featuring a dream piled on a dream piled on a dream piled on a dream. Koning explains that [l]ike Inception, our monetary system is a layer upon a layer upon a layer. Anyone who withdraws cash at an ATM is ‘kicking’ back into the underlying central bank layer from the banking layer; depositing cash is like sedating oneself back into the overlying banking layer. Monetary...

Read More »Not Recession, Systemic Rupture – Again

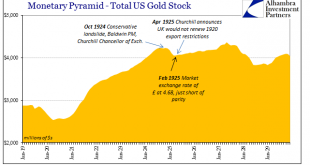

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Not Recession, Systemic Rupture – Again

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org