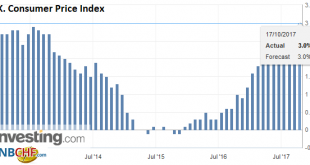

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »BoJ Briefs Reuters: We’ll Let 10-Year Yield Rise Above Zero Percent Target Around 1Q 2018

It looks like BoJ Governor, Haruhiko Kuroda’s, minions are getting out and about to brief the financial news services that the biggest stimulator of all the central banks might reduce stimulus earlier than expected. The recipient of the unofficial briefings by BoJ officials is Reuters, which has this to say. The Bank of Japan is dropping subtle, yet intentional, hints that it could edge away from crisis-mode stimulus earlier than expected, through a future hike in its yield target,...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »Mysterious Bitcoin Dip-Buyer Identified

Amid the cataclymsic collapse of Bitcoin late on Friday night, the crypto currency suddenly saw a large buyer step in as prices plummeted below $6000. We now have an idea who that buyer of last resort was... As a result of a giant publicity effort from its proponents, BCH saw mass investment as it heads towards a potentially contentious hard fork set for just after 7 p.m. GMT today. The failure of SegWit2x, coupled with endorsement from the soon-to-be-defunct Bitcoin...

Read More »The Big Reversal: Inflation and Higher Interest Rates Are Coming Our Way

This interaction will spark a runaway feedback loop that will smack asset valuations back to pre-bubble, pre-pyramid scheme levels. According to the conventional economic forecast, interest rates will stay near-zero essentially forever due to slow growth. And since growth is slow, inflation will also remain neutral. This forecast is little more than an extension of the trends of the past 30+ years: a secular decline in...

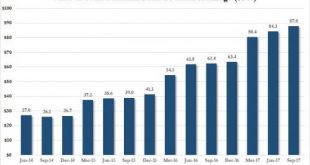

Read More »The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented “coordinated growth spurt”, and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using “money”...

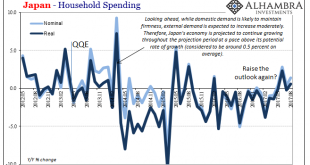

Read More »Japan Is Booming, Except It’s Not

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Central Bank Chiefs and Currencies

Summary: Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election. The market is fickle. It has jumped from one candidate to another as the most likely Fed Chair. Until his belated and mild criticism of the President dealing with race issues,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org