The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

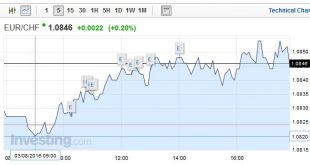

Swiss Franc Click to enlarge. FX Rates European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE’s Italian bank index is up 1.4% to extend its recovery into a fifth session. Bond markets are broadly...

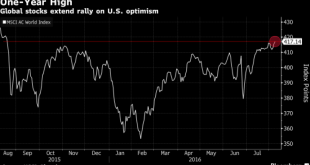

Read More »Great Graphic: Bullish Emerging Market Equity Index

Summary: Liquidity rather than intrinsic value seems to be driving EM assets. MSCI EM equity index looks constructive technically. The chart pattern suggests scope for around 13% gains from here. Scratch an investor, and you will find two models. One is a fair value model, perhaps based on free-cash-flow or earnings expectations, or breakup value. The other is based on liquidity. We suspect that the latter...

Read More »Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his...

Read More »S&P To Open At New Record High As Commodities Rise, China Trade Disappoints

The meltup continues with the S&P500 set to open at new all time highs as futures rise 0.2% overnight, with European, Asian stocks higher, as job data pushed MSCI Asia Pacific Index towards highest close since Aug. 2015. Germany, U.K. economic data seen positive, with dollar, oil rising, and gold declining. Global equities advanced with commodities and emerging markets on speculation the U.S. economy is strong enough to sustain growth while only triggering a gradual increase in interest...

Read More »666: The Number Of Rate Cuts Since Lehman

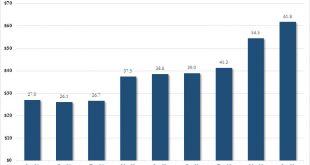

BofA’s Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, “global central banks have now cut rates 666 times since Lehman.” One would think this attempt by central banks to push everyone into risk assets, certainly the Swiss National Bank which as we showed yesterday has increased its US equity holdings by 50% in the first half of 2016 … …...

Read More »FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

Swiss Franc The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak – reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week’s sight deposits. Click to enlarge. Bank of England The Bank of England owns today, though tomorrow will be about the US...

Read More »BoE cuts rates, expands asset purchases. To what end?

In spite of the Bank of England’s latest monetary stimulus, ambitious fiscal package may be needed to deal with steep drop in growth foreseen for next year On 4 August, the Bank of England (BoE) managed to beat market expectations by announcing a policy package that included a 25 bp rate cut (to 0.25%), a Term Funding Scheme (TFS) “to reinforce the pass-through” of the rate cut, a GBP60 bn increase in the bank’s purchases of government bonds, as well as up to GBP10 bn in corporate bonds...

Read More »Carney Gets Ahead of Market Expectations; Sterling Slumps, Gilts Soar

Summary: BOE cuts rates and expands QE. Door is open to more easing. Sterling stabilizes after selling off 2 cents. Sterling has slumped two cents in the wake of the Bank of England’s announcement. It cut the base rate 25 bp and announced a resumption of its asset purchase program. It will buy GBP60 bln of Gilts and added corporate bonds to its purchase plan, which will be completed over the next six...

Read More »FX Daily, August 03: Consolidation Featured

Swiss Franc Click to enlarge. FX Rates The US dollar is consolidating yesterday’s losses. The greenback’s upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week’s RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week. The asset markets are more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org